B.C. fraudster who lured investors with promise to help homeless fined by securities regulator

Canadian cash is shown. (Shutterstock.com)

Canadian cash is shown. (Shutterstock.com)

A Vancouver woman whose company duped investors by promising big returns on real-estate deals that would house the homeless has been ordered to pay nearly $626,000 after the British Columbia Securities Commission deemed the operation a Ponzi scheme.

The commission found Cherie Evangeline White committed fraud, obstructed justice and illegally sold more than $1 million worth of shares in her company, KingdomInvestments2015 Inc., formerly known as KingdomRealty Inc. and Kingdom Investments Inc.

The company, which White controlled as the owner and chief executive, promised investors financial returns of between 10 and 30 per cent by "fixing and flipping" residential properties at a profit.

Many investors were lured by the prospect of helping to house people facing barriers such as addictions and homelessness, while others were attracted by White's profession of "shared spiritual values" and her "calculated use of faith-related" logos and language, according to the commission.

Instead, White and her company used investor funds to repay earlier investors, which the commission's tribunal determined was "consistent with a Ponzi scheme."

Other investor funds went to repaying a personal loan from White's stepfather, the panel found.

White created a false sense of urgency among investors, "going so far as to accompany one investor to their financial institution in order to facilitate payment … despite attempts by staff at such institution to warn such investor," the three-member panel wrote in its decision on Friday.

All told, White's investors incurred $776,000 in losses as a result of the fraud and the illegal distribution of more than $1.18 million in shares in her company.

She also obstructed justice when she failed to provide documents and information demanded by securities commission staff during a compelled interview, the tribunal ruled.

White and her company "did not co-operate fully in the enforcement process, have shown little to no remorse for their actions or the damages caused by them, and have failed to demonstrate any understanding of their misconduct or its impact," according to the ruling.

In addition to the $625,771 in penalties and reimbursements the commission ordered White to pay, she was also permanently banned from participating in B.C.'s investment market, except as an investor.

Kingdom was likewise permanently prohibited from trading its shares or engaging in any promotional activity.

CTVNews.ca Top Stories

Air Canada walks back new seat selection policy change after backlash

Air Canada has paused a new seat selection fee for travellers booked on the lowest fares just days after implementing it.

Province boots mayor and council in small northern Ont. town out of office

An ongoing municipal strike, court battles and revolt by half of council has prompted the province to oust the mayor and council in Black River-Matheson.

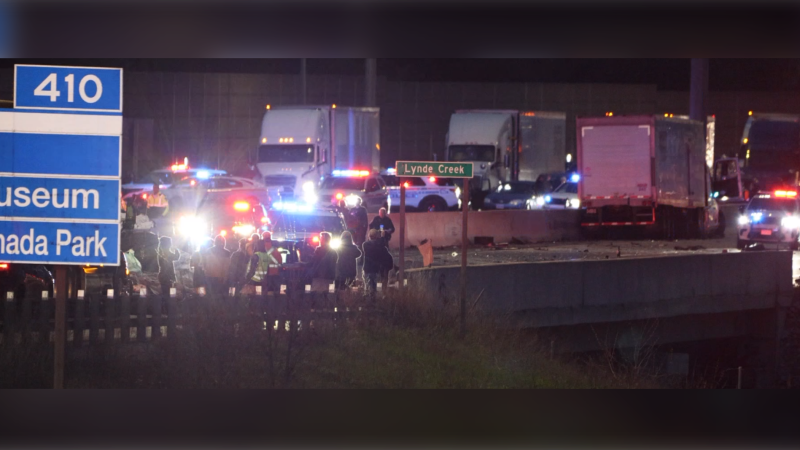

3 law officers serving warrant are killed, 5 wounded in shootout at North Carolina home, police say

Three officers on a U.S. Marshals Task Force serving a warrant for a felon wanted for possessing a firearm were killed and five other officers were wounded in a shootout Monday at a North Carolina home, police said.

'Shocked and concerned': Calgary principal charged with possession of child pornography

A Calgary elementary school principal has been charged with possession of child pornography, authorities announced Monday.

Health authority confirms cockroaches at B.C. hospital, insists they 'do not bite'

The Vancouver Island Health Authority is downplaying what staff describe as a cockroach infestation in a medical unit of Saanich Peninsula Hospital.

Toronto police arrest 12 people, lay 102 charges in major credit card fraud scheme

Toronto police say 12 people are facing a combined 102 charges in connection with an investigation into a major credit fraud scheme.

Winner of US$1.3 billion Powerball jackpot is an immigrant from Laos who has cancer

One of the winners of a historic US$1.3 billion Powerball jackpot last month is an immigrant from Laos who has had cancer for eight years and had his latest chemotherapy treatment last week.

Britney and Jamie Spears settlement avoids long, potentially ugly and revealing trial

Britney Spears and her father Jamie Spears will avoid what could have been a long, ugly and revealing trial with a settlement of the lingering issues in the court conservatorship that controlled her life and financial decisions for nearly 14 years.

WATCH 'Double whammy': What happens if you don't file your taxes by the deadline

The clock is ticking ahead of the deadline to file a 2023 income tax return. A personal finance expert explains why you should get them done -- even if you owe more than you can pay.