Ranking: These Metro Vancouver cities saw biggest real estate price dips due to rising interest rates

Pitt Meadows and Maple Ridge are seen from the air. (Pete Cline / CTV News Vancouver)

Pitt Meadows and Maple Ridge are seen from the air. (Pete Cline / CTV News Vancouver)

A just-released report on rising interest rates is giving would-be home buyers and sellers an idea of the impact already being seen in the Vancouver area, and the results vary by city.

Brokers with HouseSigma say the those involved in the local real estate market are seeing price dips, longer listing periods and some homes not selling at all.

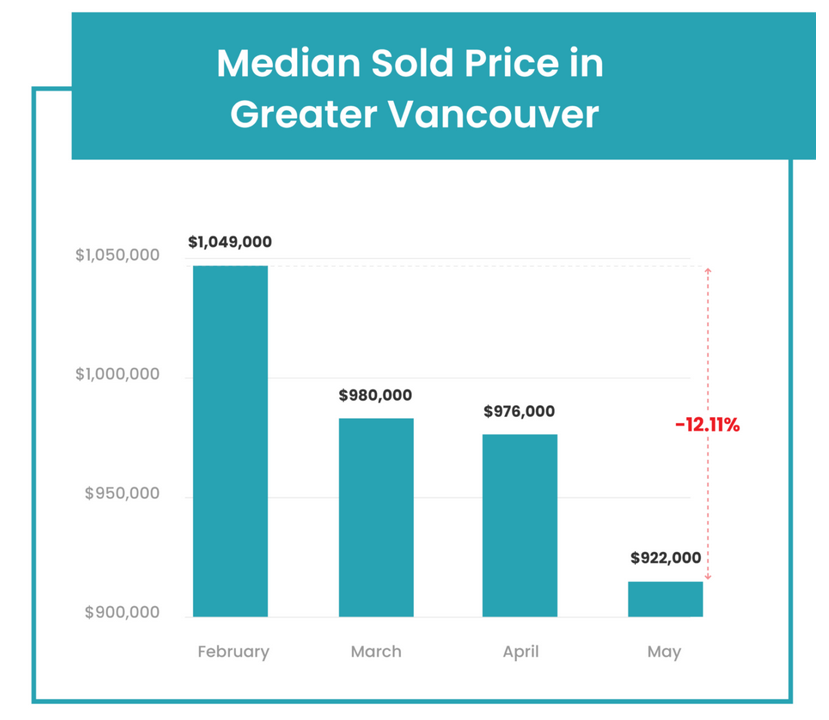

In a report Thursday, the company said the median sale price in the Vancouver area overall dipped to $922,000 in May.

That's a 12.11 per cent decrease from what sellers were getting for their homes back in February ($1,049,000).

HouseSigma blames the Bank of Canada's overnight lending rate, which was recently increased by 0.5 per cent, up to 1.5 per cent.

It's the third hike this year, following similar moves in March and April. Those behind the report tried to track the impact in the country's hottest housing market, and found that, although some buyers had already locked in a lower rate at the beginning of the year, the data suggests changes are underway.

Looking at the median sold price in the region overall, it was close to the $1.05-million mark before the rate hikes began.

In March, that median dropped to $980,000, and by April it was $976,000, followed by the dip again in May.

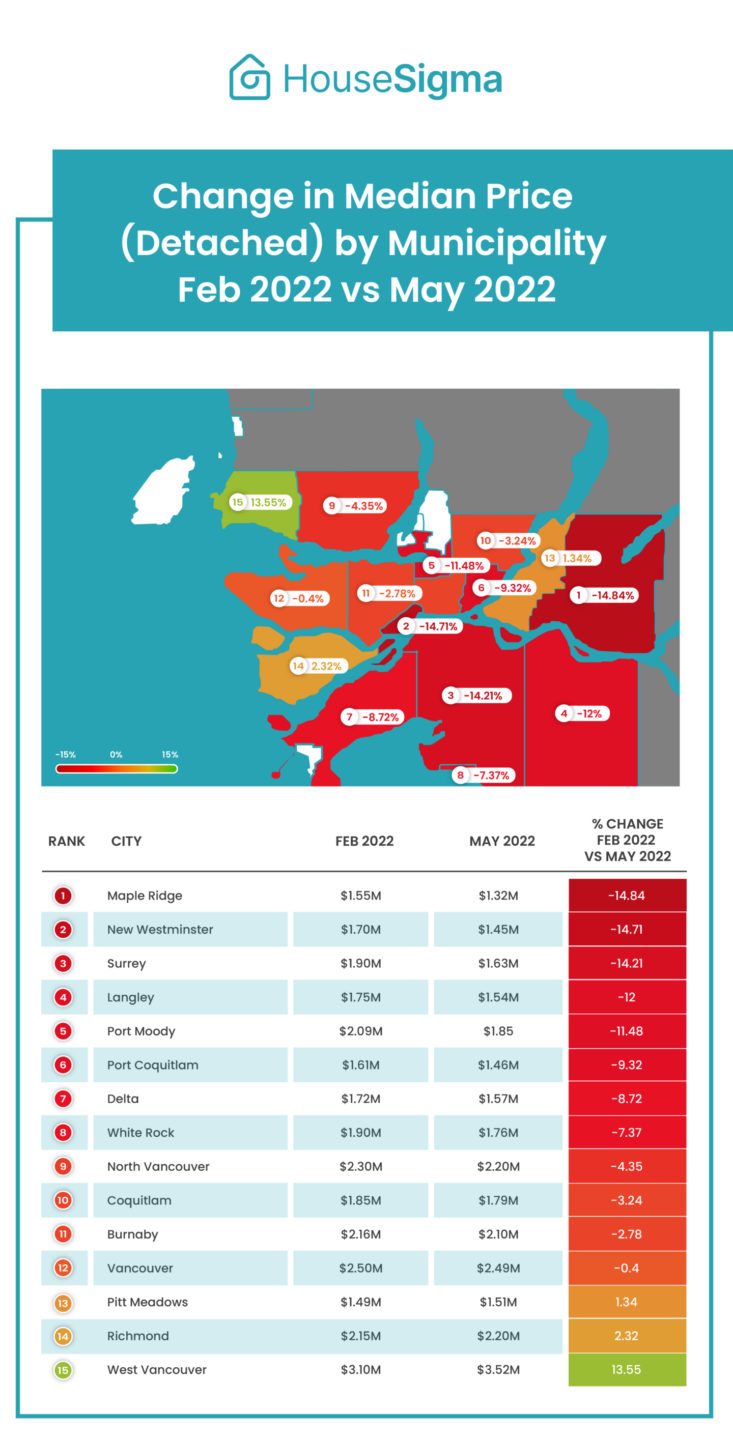

NOT ALL CITIES IMPACTED EQUALLY

According to the June 2 report, some communities saw more of a decrease than others. While the average for the region is a 12.11 per cent decrease, sellers of detached homes in Maple Ridge got nearly 15 per cent less for their houses in May than in February.

New Westminster, too, saw a shift in favour of buyers with a 14.71 per cent change.

Also impacted more than the average were sellers in Surrey, while those in Langley were close to the average.

Port Moody sellers too saw a double-digit decrease, though below average.

"We're now starting to see the full effect of rising interest rates on buyers and sellers' habits," HouseSigma broker Hao Li said in a news release about the report.

"These double digit dips in detached home averages in areas like Surrey and Maple Ridge highlight the pullback that's happening in B.C.'s market."

But the data also suggested it's still good to be a seller in one area: West Vancouver.

In that community, the median sale price was actually up quite a bit from February. Buyers paid a median of $3.52 million, up 13.55 per cent from what they paid in February.

See a larger version of the embedded graphic on HouseSigma's blog.

HOMES NOT SELLING AT ALL

In addition to what homes are selling for, the report looked at whether they're selling at all.

Terminated listings, meaning listings that essentially timed out – they haven't sold during a specified time and have been pulled down – were up a whopping 121 per cent from February.

According to HouseSigma, 2,331 homes fell into this category back then. By March, 3,095 listings were terminated. In April: 3,590. Another 5,141 listings were terminated in May.

Li said there are a few reasons for this, one of which is sellers deciding the offers they got weren't good enough. They can then choose to pull it down and re-list the property to attract a new set of potential buyers.

Sometimes, too, sellers will remove the property from the market because it's sat for a while, thinking maybe they'll try again when conditions change or at a different time of year.

WHAT IT MEANS

According to Li, this suggests a sharp turn from the height of the pandemic when buyers scrambled to find options, "raising prices at a pace we've never seen before."

Now, it looks like buyers don't feel that rush, and are thinking that they may get a deal or find a better option if they wait, Li said.

"Since the Bank of Canada started raising rates, buyers have steadily taken a more 'wait-and-see' approach to buying a home, and sellers have had to adjust their sale price expectations," Li said.

CTVNews.ca Top Stories

LIVE B.C. seeks ban on using drugs in 'all public spaces,' shifting approach to decriminalization

The B.C. government is moving to have drug use banned in 'all public spaces,' marking a major shift in the province's approach to decriminalization.

Air traveller complaints to Canadian Transportation Agency hit new high

The Canadian Transportation Agency has hit a record high of more than 71,000 complaints in a backlog. The quasi-judicial regulator and tribunal tasked with settling disputes between customers and the airlines says the backlog is growing because the number of incoming complaints keeps increasing.

Orca calf that was trapped in B.C. lagoon for weeks swims free

An orca whale calf that has been stranded in a B.C. lagoon for weeks after her pregnant mother died swam out on her own early Friday morning.

Sophie Gregoire Trudeau on navigating post-political life, co-parenting and freedom

Sophie Gregoire Trudeau says there is 'still so much love' between her and Prime Minister Justin Trudeau, as they navigate their post-separation relationship co-parenting their three children.

More than 115 cases of eye damage reported in Ontario after solar eclipse

More than 115 people who viewed the solar eclipse in Ontario earlier this month experienced eye damage after the event, according to eye doctors in the province.

U.S. flight attendant indicted in attempt to record teen girl in airplane bathroom

An American Airlines flight attendant was indicted Thursday after authorities said he tried to secretly record video of a 14-year-old girl using an airplane bathroom last September.

76ers All-Star centre Joel Embiid says he has Bell's palsy

Philadelphia 76ers All-Star centre Joel Embiid has been diagnosed with Bell’s palsy, a form of facial paralysis he says has affected him since before the play-in tournament.

AFN chief says Air Canada offered a 15% discount after her headdress was mishandled

After the Assembly of First Nations' national chief complained to Air Canada about how staffers treated her and her ceremonial headdress on a flight this week, she says the airline responded by offering a 15 per cent discount on her next flight.

Trump's lawyers try to discredit testimony of prosecution's first witness in hush money trial

Donald Trump's defence team attacked the credibility Friday of the prosecution's first witness in his hush money case, seeking to discredit testimony detailing a scheme between Trump and a tabloid to bury negative stories to protect the Republican's 2016 presidential campaign.