'Development project gone terribly wrong': B.C. court awards $5.1M to buyers of doomed subdivision sites

A forest service road is seen on Sumas Mountain near the property the plaintiffs purchased. (Photo: Fraser Valley Regional District)

A forest service road is seen on Sumas Mountain near the property the plaintiffs purchased. (Photo: Fraser Valley Regional District)

A B.C. Supreme Court judge has awarded a couple and their property investment company more than $5 million in damages for what he describes as "a real estate development project gone terribly wrong."

Justice F. Matthew Kirchner issued his 140-page decision in the case on Monday, finding defendants Yunal Kumar Nath, Jozsef Horvath and their companies jointly and severally liable for all of the $5,164,950 owed to Weihe Wang, Guilian Tian and Weihe Investments Ltd.

A third party, Ying Ping Guo, was also found liable for several million dollars in damages, but Kirchner concluded that Nath, Horvath and their companies were obligated to indemnify Guo for "the full amount of his liability to the plaintiffs."

The litigants

Each of the numerous claims addressed in Kirchner's decision stems from the parties' acquisition of and attempts to develop a pair of roughly 150-acre properties, one southwest of Prince George and the other at the top of Sumas Mountain in Abbotsford.

The parties' testimony on the purchases and the development efforts often contradicted itself and that of other participants, according to the decision, which found both the plaintiffs and the defendants lacked credibility and reliability as witnesses.

The judge arrived at his version of events based on the testimony of certain third-party witnesses whom he deemed credible, as well as documentary evidence and cautious use of the plaintiffs' and defendants' testimony.

The plaintiffs, Wang and Tian, are spouses who immigrated to Canada from China in 2005. Wang was the owner of a "very successful" pharmaceutical in China until his retirement, and spends only one to two months in Canada each year, according to the decision. His wife has remained in Canada with their children – who are now all adults – and has been a Canadian citizen since 2010.

Though she described herself as a "housewife," Tian "has also been primarily responsible for Weihe’s investment activities," including purchases of 22 pre-sale condos in B.C., "as well as commercial and stand-alone residential properties in the province," the decision reads. Wang also has real estate investments in China, and the family has invested in properties in Alberta and Ontario, as well.

Despite their wealth of experience in real estate investment, the couple had never attempted to act as developers until their work with Nath, Horvath and Guo, according to Kirchner's decision.

Guo was the initial contact point between the plaintiffs and the other defendants. He and his wife Yue Chun Xi were "close friends" of Wang and Tian before the ill-fated property deals that led to the litigation.

"In May 2016, Mr. Guo introduced Mr. Wang to the opportunity to invest in the Prince George and Sumas Mountain properties," the decision reads. "This would ultimately prove fatal to their 20-year friendship."

Though there was dispute about who approached whom regarding the investment, Kirchner concluded that Guo approached Wang, and that he did so after meeting with Nath and Horvath to discuss their interest in bringing on an investor to acquire and develop the two properties.

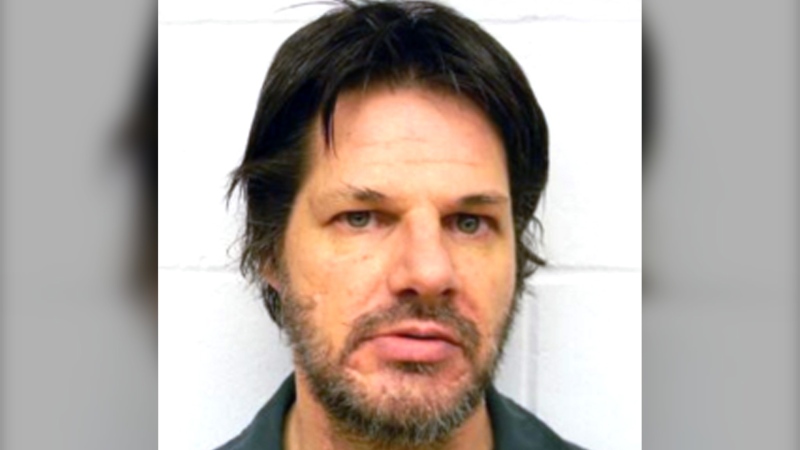

Horvath is a building contractor who met Guo in 2013 while renting a property in Pitt Meadows that Guo was managing on behalf of the owner, who lived in China. That owner hired Horvath to work on a construction project on the property in 2015, which Guo managed on the owner's behalf. The following year, Horvath approached Guo about the investment proposal for the Prince George and Sumas Mountain properties, according to the decision.

The decision does not explain how Horvath and Guo knew Nath, who was also a contractor. It does note that Nath had "a relative who worked in some level of government," and that this connection was suggested as a way to get the zoning for the Sumas Mountain property changed to allow denser development.

Nath did not participate in the court proceedings. He had a stroke "some years ago" and had "no money and no ability to participate in the trial," according to the decision.

Acquiring the properties

Kirchner concluded that Horvath approached Guo looking for help finding an investor to finance the acquisition of the two properties.

Guo, Nath and Horvath met in Langley in April or May 2016 "to discuss how they would manage the development of the properties" and the possibility of getting Wang to invest, according to the decision.

Guo contacted Wang to tell him about the opportunity to invest in the two properties. He portrayed the properties as a good investment with the potential to return as much as $50 million in profit after subdividing and developing them.

The idea, according to the decision, was to subdivide the Prince George property into one-acre lots and the Sumas Mountain property into half-acre lots.

As many as 150 lots were proposed for the Prince George property, with as many as 300 envisioned for Sumas Mountain, though Kirchner concluded that Guo had made clear to Wang that those figures were not guaranteed, but subject to government approvals.

"I accept that Mr. Guo did not represent any certainty that the properties could be subdivided as suggested," the decision reads. "However … I am satisfied that it was misrepresented to Mr. Wang that there were favourable circumstances to achieve these subdivisions when in fact there was no basis for that representation."

The four parties – Guo, Wang, Horvath and Nath – met for lunch in Abbotsford on May 15, 2016, to discuss the potential investment. According to the decision, Wang "was anxious to see the Prince George property," and decided to pay for a charter flight to visit the site that afternoon.

The four flew to Prince George and back on short notice and viewed the property which was "covered with trees" and could only be viewed from the perimeter, according to the decision. They toured the Sumas Mountain property the following day.

That night, Wang and Tian hosted Guo, Horvath and Nath for dinner at the Grand Villa Casino in Burnaby, and verbally agreed on a plan to purchase the properties for development. The decision indicates the plaintiffs planned to pay $1.5 million for the Prince George property and $3.15 million for the Sumas Mountain property, plus the cost of developing the two properties, which would be conducted by Horvath and Nath and supervised by Guo.

Two days later, on May 18, 2016, Wang and Tian met with Guo, Horvath and Nath at a lawyer's office in Abbotsford, provided deposits and signed documents to acquire the properties.

The defendants' secret profits

"Unbeknownst to the plaintiffs, in the weeks leading up to the May 16, 2016, dinner, Mr. Horvath and Mr. Nath secured for themselves the right to buy the Prince George and Sumas Mountain properties for substantially less than the purchase price given to Mr. Wang and Ms. Tian," the decision reads.

"Thus, by May 16, 2016, when the parties toasted their new investment relationship, Mr. Horvath and Mr. Nath stood to share (and soon after did share) a secret profit of $1,450,000 by flipping two properties to the plaintiffs."

According to Kirchner, Nath and Horvath had travelled to Prince George on May 12, 2016, to look at the property, and on May 16 – the same day Wang and Tian agreed they would buy it for $1.5 million – Nath entered a contract to purchase it through his company Developro Construction Ltd. for $550,000.

An appraisal submitted by the plaintiffs as part of the court case suggested that the actual value of the Prince George property in May 2016 was just $375,000, the decision notes.

Developro assigned its rights to purchase the property to a numbered company controlled by Nath shortly before Wang and Tian signed the documents initiating their purchase. That numbered company would later be sold to Wang and Tian's company, Weihe, as part of the land transaction, according to the decision.

Similarly, on May 10, 2016, Horvath – through his own numbered company – took assignment of a planned sale of the Sumas Mountain property that was already in progress.

"The assignment document states that the assignment fee is $3.15 million, but Mr. Horvath agreed in his evidence that he was only required to pay $2.65 million for the assignment," the decision reads.

"I infer this was done in case Mr. Horvath had to disclose the assignment to the plaintiffs, who had agreed to buy the property for that price. This would help conceal the fact that Mr. Horvath and Mr. Nath would be earning a $450,000 profit by flipping the assignment to the plaintiffs."

According to the decision, when Wang and Tian met with Guo, Nath and Horvath at the Abbotsford lawyer's office, they did not have a lawyer of their own present.

The lawyer who prepared the documents told the court he advised the couple to seek independent legal advice before proceeding with the transaction, which was conducted without Chinese translations of the documents, despite Wang speaking no English and Tian having limited English ability.

Kirchner concluded that Wang and Tian understood the advice to get their own representation and chose not to, but the couple was unaware that the lawyer they were speaking to was representing Nath and Horvath, who were now the actual sellers in the transaction.

The judge also found that Guo – who served as a translator during the meeting – contributed to Wang and Tian's confusion over the lawyer's role in the process.

"Ms. Tian and Mr. Wang were not aware that Mr. Nath and Mr. Horvath had acquired any rights or interest in the properties," the decision reads. "They thought they were buying the properties from a third party."

The decision also notes that Guo only became aware of Nath and Horvath's acquisition of the properties at the Abbotsford lawyer meeting.

"Despite coming into this knowledge, Mr. Guo did not question the transaction or disclose Mr. Nath’s and Mr. Horvath’s interest to Ms. Tian and Mr. Wang," the decision reads.

"However, I accept that Mr. Guo did not know that Mr. Nath and Mr. Horvath were making a secret profit by flipping the properties. Rather, I accept Mr. Guo’s evidence that he believed Mr. Nath and Mr. Horvath’s involvement related to their efforts to secure the properties for Weihe to buy. I find this largely because Mr. Guo received no benefit from the property flips. If he knew Mr. Nath and Mr. Horvath were making a profit from the flips, he likely would have inquired into this."

Fiduciary duty and conspiracy

Kirchner concluded that Nath and Horvath had a fiduciary duty to disclose their interests in the two properties to Wang and Tian.

This legal obligation came about automatically because the defendants had entered a partnership with the plaintiffs for the development of the property, according to the judge, who found Nath and Horvath liable for the $1,450,000 in secret profits they earned from the sale.

Likewise, Kirchner found Nath and Horvath liable to the plaintiffs for the $175,000 overpayment Nath made when acquiring the Prince George property, relative to its appraised value.

"This loss did not arise directly from Mr. Nath and Mr. Horvath’s failure to disclose their interest in the property," the decision reads. "However, had they complied with their fiduciary obligation and disclosed their interest in the properties, I find the plaintiffs would not have bought the properties and would not have suffered this $175,000 loss."

The plaintiffs also alleged that Nath, Horvath and Guo had engaged in a conspiracy to make the secret profits from the sale.

Kirchner concluded with "no hesitation" that Nath and Horvath had conspired, but the judge declined to make the same finding about Guo, concluding instead that Guo had neither breached a fiduciary duty toward the plaintiffs nor been a part of the conspiracy.

While Guo did have a fiduciary duty to the plaintiffs as part of their partnership for developing the land, Kircher found that duty required him only to "prudently and carefully manage Weihe’s investment of project development funds," not to ensure the plaintiffs were getting the best possible price when initially acquiring the properties.

"While Mr. Wang and Ms. Tian had no experience in real estate development, they had extensive experience in buying and selling real estate – considerably more than Mr. Guo," the decision reads.

"They knew that prudence dictated getting an appraisal of property before making a significant investment in it. Ms. Tian routinely did so for any property purchase she made in excess of $1 million. Despite this, they did not get an appraisal of either property … The plaintiffs knew better than to invest $4.65 million in real estate without knowing if an appraisal had been done and they were not relying on Mr. Guo to opine on the value of the land. They knew he had no such expertise."

Fraudulent and negligent misrepresentations

Kirchner did find Guo liable for a small portion of the overpayment Wang and Tian made when acquiring the properties, concluding that Guo made negligent misrepresentations to the couple about Horvath's level of skill and expertise as a land developer.

The judge found that Guo "took no steps to independently assess whether Mr. Horvath was qualified or capable of managing the developments," but vouched for Horvath anyway.

This was one of several misrepresentations that Kirchner concluded Wang and Tian relied on when deciding whether to purchase the properties. If Guo had not touted Horvath's expertise, the couple would not have completed the purchases, according to the decision.

Because Guo's misrepresentation was negligent, rather than fraudulent, Kirchner assessed whether the losses the plaintiffs suffered as a result of their purchase – specifically, the $1.45 million in secret profits that Horvath and Nath earned from the sale and the $175,000 overpayment relative to the value of the Prince George property – were foreseeable.

"In my view, it was foreseeable at the time of the negligent misrepresentation that the plaintiffs may not be paying market value for the properties since no appraisal had been done," the decision reads.

"However, it is my view that the mechanism by the plaintiffs suffered the $1.45 million loss at the hands of Messrs. Nath and Horvath earning a secret profit through flipping the properties is so extraordinary that this type of loss was not reasonably foreseeable at the time of Mr. Guo’s negligent misrepresentation. I find this loss is too remote to attract liability on Mr. Guo’s part."

Thus, while not liable for the secret profits Horvath and Nath earned from the sale, Guo was liable for the $175,000 overpayment. However, Kirchner concluded that Wang and Tian were "contributorily negligent" because they failed to conduct an appraisal before agreeing to make the purchase.

He reduced Guo's liability by 50 per cent, to $87,500, as a result.

The judge also considered several other alleged misrepresentations made by Nath and Horvath and – in some cases – passed along by Guo. He concluded that Nath and Horvath had engaged in fraudulent misrepresentation, rather than negligent misrepresentation, by presenting the envisioned dense subdivisions on the two properties as achievable.

"There was simply no factual basis on which to suggest there were good (or any) prospects to achieve approval for one-acre or half-acre-lot subdivisions on either property," the decision reads. "These representations were designed to and in fact did create a false optimism for the potential profits that might be earned by developing these properties."

These fraudulent misrepresentations further contributed to Horvath and Nath's liability for the plaintiffs' losses, and – because they were fraudulent rather than negligent – cannot be offset by the plaintiffs' contributory negligence, according to the decision.

Misappropriation of construction funds

While work would eventually be started on development of the Prince George property after the plaintiffs' acquisition of it, such work was "hopelessly mismanaged by Mr. Nath and Mr. Horvath," the decision reads. It also notes that even if the project had been properly managed, it likely wouldn't have been profitable.

"Neither the Prince George project nor the Sumas Mountain project was ever financially viable or even achievable as planned," Kirchner's decision reads.

"Even if the Prince George project had completed, it would have lost money. The Sumas Mountain project would likely have never broken ground since the plan would have required a variance to the Official Community Plan. Further, the necessary services for a subdivision on the Sumas Mountain property were simply not there."

Under the terms of their agreement for development of the properties, Wang and Tian agreed to fund construction costs – estimated at roughly $5 million – and made regular payments to Horvath's construction company to fund work on the Prince George site.

A forensic accountant's report submitted by the plaintiffs concluded that most of the $2,862,500 that Wang and Tian advanced the company for the project was appropriated for other things, according to the decision.

"The amount of cash withdrawn is nothing short of staggering," the decision reads.

"Where expenditures can be traced, (the accountant) finds that Weihe money was spent at casinos, car dealerships, jewelry stores, restaurants, clothing stores, and the like. However, most of the expenditures are untraceable because money was taken out in cash."

In all, Kirchner concluded, Nath and Horvath spent about $812,536 on the Prince George project, while the remaining $2,049,964 was misappropriated.

No homes were actually constructed on the Prince George site, and the judge concluded that the work done – mainly tree clearing and road construction, which was not completed – had not created any value or benefit to the plaintiffs.

Ultimately, Kirchner found Nath and Horvath jointly and severally liable for the full $2,862,500, plus $307,500 that Wang and Tian agreed to pay an unpaid contractor to settle a related lawsuit and $82,000 the couple paid Horvath's company for a lidar survey of the Sumas Mountain site that was never completed.

The judge reached this conclusion on several grounds, including breach of contract, breach of trust, breach of fiduciary duty and conspiracy.

He also found Guo jointly and severally liable for $2,649,500 of the project funds – a total that excludes two payments he advised Tian not to make, and which she made anyway – as well as for the $307,500 settlement and the $82,000 lidar survey that never happened.

"Mr. Guo’s liability is in breach of contract and breach of fiduciary duty based on his complete failure to supervise the project in accordance with his managerial role under the project development agreements," the decision reads.

Guo's third-party claim

While Kirchner found Guo liable for millions of dollars in damages payable to Wang, Tian and their company, the judge determined that Horvath and Nath are liable to Guo for all amounts he owes to the plaintiffs.

"Messrs. Nath and Horvath made misrepresentations about the investment opportunity to Mr. Guo with the intent of convincing Mr. Guo that investing in the properties was a good idea," the decision reads.

"This was necessary so that Mr. Guo would make a persuasive case to Mr. Wang for the investment. Thus, I find Messrs. Nath and Horvath are liable to Mr. Guo for the damages he must pay in relation to the purchase price of the properties."

Regarding the amounts Guo was found to owe the plaintiffs for the construction funds, the judge ruled that Horvath and Nath had "deliberately excluded" Guo from his management role in the project and concealed their misappropriations from him.

"While Mr. Guo bears substantial responsibility for allowing this to happen and for failing to assert himself in the supervising role he had committed to, this does not excuse Mr. Nath and Mr. Horvath from liability under Mr. Guo’s third party claim," the decision reads.

Other claims and damage awards

In all, Kirchner awarded the plaintiffs a total of $5,164,950, plus court costs and pre-judgment interest amounts that are still to be determined.

Nath and Horvath owe all of that total jointly and severally, but the decision also included some amounts owed separately by Horvath's wife Katalin.

The damages Nath and Horvath were ordered to pay include:

- $1,450,000 for their secret profits

- $175,000 for the overpayment on the Prince George property

- $2,862,500 for the project development funds

- $82,000 for the non-existent lidar survey

- $307,500 for the contractor settlement

- $187,950 in interest the plaintiffs paid on money borrowed to finance the property acquisitions

- $100,000 in punitive damages

Guo's liability – which is distinct from Nath and Horvath's total, but will end up being part of it – totaled $3,314,450, broken down as follows.

- $87,500 for the overpayment on the Prince George property

- $2,649,500 for the project development funds

- $82,000 for the non-existent lidar survey

- $307,500 for the contractor settlement

- $187,950 in interest the plaintiffs paid on money borrowed to finance the property acquisitions

The judge did not order any punitive damages against Guo.

Katalin Horvath was ordered to pay $35,500 of the secret profits amount based on her "knowing receipt" of the ill-gotten gains, according to the decision. She must also pay $225,000 for knowing receipt of proceeds from the misappropriated project development funds.

That total represents her half of a down-payment the Horvaths made on a home in Surrey, which has since been sold. The amount she owes will be offset by half the proceeds of the sale, which should reduce the amount she still owes to "the range of $41,500," according to the decision.

The damages Katalin Horvath owes are part of the overall total owed by her husband, but her liability is not joint.

The plaintiffs' additional claims against Guo's wife and the Horvaths' son were dismissed.

CTVNews.ca Top Stories

More than 115 cases of eye damage reported in Ontario after solar eclipse

More than 115 people who viewed the solar eclipse in Ontario earlier this month experienced eye damage after the event, according to eye doctors in the province.

Toxic testing standoff: Family leaves house over air quality

A Sherwood Park family says their new house is uninhabitable. The McNaughton's say they were forced to leave the house after living there for only a week because contaminants inside made it difficult to breathe.

Decoy bear used to catch man who illegally killed a grizzly, B.C. conservation officers say

A man has been handed a lengthy hunting ban and fined thousands of dollars for illegally killing a grizzly bear, B.C. conservation officers say.

B.C. seeks ban on public drug use, dialing back decriminalization

The B.C. NDP has asked the federal government to recriminalize public drug use, marking a major shift in the province's approach to addressing the deadly overdose crisis.

OPP responds to apparent video of officer supporting anti-Trudeau government protestors

The Ontario Provincial Police (OPP) says it's investigating an interaction between a uniformed officer and anti-Trudeau government protestors after a video circulated on social media.

An emergency slide falls off a Delta Air Lines plane, forcing pilots to return to JFK in New York

An emergency slide fell off a Delta Air Lines jetliner shortly after takeoff Friday from New York, and pilots who felt a vibration in the plane circled back to land safely at JFK Airport.

Sophie Gregoire Trudeau on navigating post-political life, co-parenting and freedom

Sophie Gregoire Trudeau says there is 'still so much love' between her and Prime Minister Justin Trudeau, as they navigate their post-separation relationship co-parenting their three children.

Last letters of pioneering climber who died on Everest reveal dark side of mountaineering

George Mallory is renowned for being one of the first British mountaineers to attempt to scale the dizzying heights of Mount Everest during the 1920s. Nearly a century later, newly digitized letters shed light on Mallory’s hopes and fears about ascending Everest.

Loud boom in Hamilton caused by propane tank, police say

A loud explosion was heard across Hamilton on Friday after a propane tank was accidentally destroyed and detonated at a local scrap metal yard, police say.