A local car dealership is under fire over the way it’s done business with dozens of people trading in used vehicles.

Up to 40 customers at Destination Chrysler in North Vancouver traded in their vehicles for new ones but weeks, even months later, they were still paying on their old loans and were stuck with two car payments instead of one.

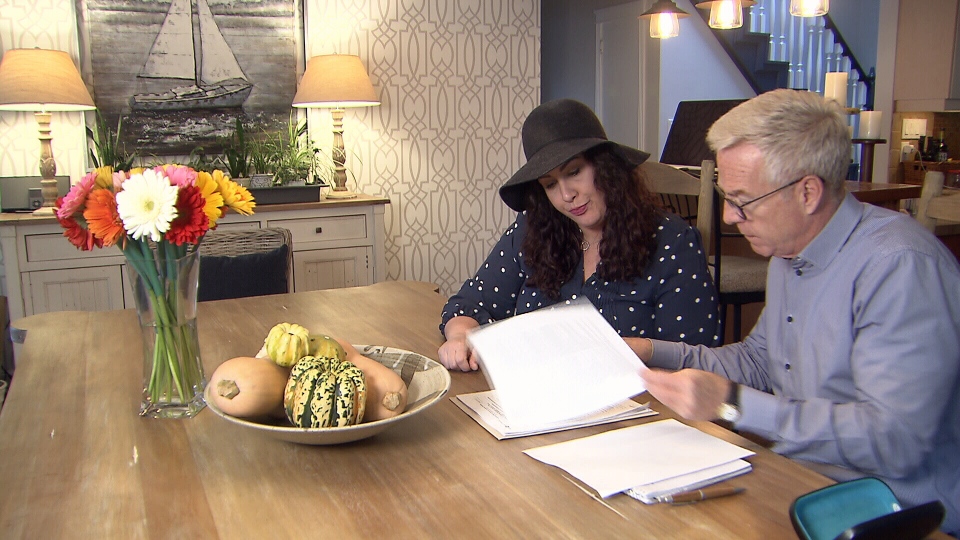

Jessica Hoffman was one of those customers. She traded in her 2012 RAV-4 in June to purchase a new Jeep. As part of the purchase contract, the dealership agreed to pay off the loan on her RAV-4.

But for four months she had to pay two car loans. One for her new Jeep and the payment on her old loan. And as the months ticked by her account was drawn down an extra $1,300.

Hoffman says she tried numerous times to get the dealer to pay off her old loan but ran into problems.

"I was getting the run around by five people. Talk to this person. Talk to this person. This person will call you back. Nobody called me back for two weeks at a time," she said.

Paul Hargreaves had a similar problem after purchasing a new truck from Destination Chrysler.

"You know the original truck payment came out, that was my trade in and then this truck payment came out all on the same date," he explained.

The two car payments left him short to pay off other bills that were due.

"Things fell through the cracks and lien payouts got missed," said Adam Sinclair, Destination Chrysler GM, "It wasn't malicious or intentional."

Destination Chrysler confirmed it had delays in getting their trade-ins paid off and that up to 40 customers may have been impacted.

“The entire team dropped the ball,” said Sinclair, “We let them down, so we hired up.

Sinclair blames the issue on centralized accounting and staff cuts during the busy summer months. He says dealership has now taken care of business and has compensated customers like Hoffman and Hargreaves.

However, the Vehicle Sales Authority of B.C has concerns about this type of business practice.

“Four weeks is too long [to pay off a loan],” said Doug Longhurst, VSA spokesperson, "A reasonable period of time, which is in business, is two to five days, something like that."

In cases like this it’s not uncommon for the VSA to go in and audit the dealer to make sure there aren't any other lingering problems.

Complaints about trade-in loans are not common but the Vehicle Sales Authority has taken action before. Earlier this year the VSA took action against a car dealership that was found over estimating how much was owed on trade-ins and pocketing the difference. That dealer agreed to pay everyone back.

Don’t let it happen to you. It’s important to know how much you owe, specify in the contract the exact day that the dealer must pay off the trade-in loan, or you can even arrange your own financing.