When the economy falters -- businesses go bankrupt. Bankruptcies are up almost 10 percent so far this year. So what can you do to lower your risk of being caught in the financial fallout?

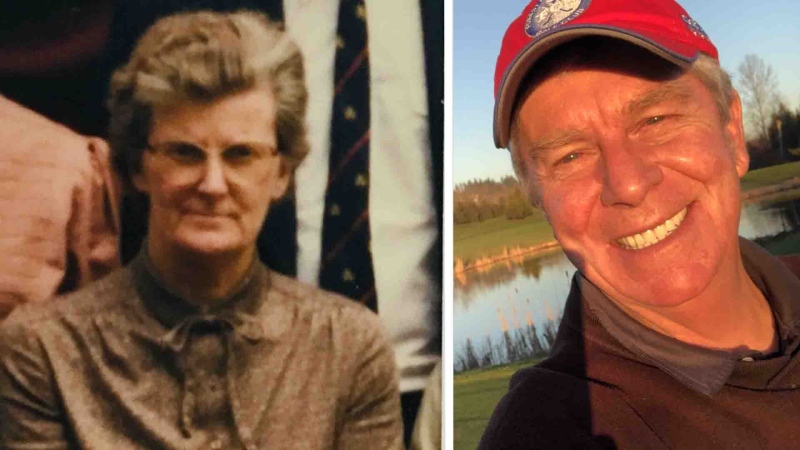

Kim Hamburg lost thousands of dollars when a contractor she hired to renovate her home went bankrupt.

"It's just depressing you know you work so hard for it," she says.

Maryann Malzone lost hundreds of dollars when the school she'd paid for her daughter's dance lessons went broke. "Just out of nowhere, they closed the doors. [The sign said] out of business!' she remembers.

"So, did they know it was coming? Probably. Were they still accepting money from people for a service they couldn't provide? Yeah," she concludes.

From small business to major retailers it seems any company can face bankruptcy during an economic downturn. And some analysts think the worst may not be over.

"I still see in the next year or two some major issues," explains Harold Saunders, a trustee in bankruptcy. Business at Campbell Saunders has been brisk lately. So how can you protect yourself?

"The main thing is be careful. In tough times if you are buying products and giving deposits be careful," recommends Saunders.

For example, Saunders says be wary of shops that want you to pay a 50 per cent deposit for custom orders. He suggests considering a floor model you can have delivered right away.

If you do order a product in and the company goes bankrupt or into receivership then you better get in touch with the receiver or trustee right away.

But if you've paid by credit card there might be a quicker option.

"If the business goes under before you get what you paid for, you can dispute the charge with the card issuer," suggests Kim Kleman of Consumer Reports.

If you paid with cash, a cheque, or a debit card you have fewer options. Another precaution to take - spend gift cards as soon as you can, even if there's no reason to suspect the retailer is having financial difficulties.

Kim Hamburg says her experience has shown her the importance of a thorough paper trail --with receipts and cancelled cheques.

What ever it is, if they ask you for cash I guess you just don't do it now," she concludes.

When it comes to warranties, if the retailer closes its doors, you may still have coverage from the manufacturer. If the manufacturer goes broke, you still may have rights at the store where you bought the item.

You can find out more from the Office of the Superintendent of Bankruptcy Canada.

With a report from CTV British Columbia's Chris Olsen