With a husband laid off and a young child, an Ontario family needed money fast.

But an online loan offer from a supposedly Vancouver company just about cost them big time.

Cindy Brooks' family was having financial troubles. Her husband was laid off in November and they have a four-year-old daughter.

"We were looking for something to try to get us caught up until he did get back to work," she explains.

Cindy went online to look for a loan. What she found was Northwest Pacific Funding. It had a slick website and a prestigious address in downtown Vancouver. She applied and was almost instantly approved.

"I was quite excited because we were approved for a loan and thought our financial problems were over and that's where it all began," Cindy says.

She twigged something was wrong when a company representative instructed her to wire $500 "to secure her loan" for $5,000.

"That's when I became a little suspicious of it. I didn't feel I should have to send someone money to get a loan. If I need money obviously I don't have money," she reasoned.

Cindy contacted the Better Business Bureau. Linda Pasacreta says they've had a 153 complaints about Northwest Pacific Funding since early March.

"They are not getting their loan and another part of it that is even nastier is that is ...they are asking for a wired transfer of money. That is cash. So out of your pocket. You can't prove they have paid it and you cant get that back," Pasacreta warns.

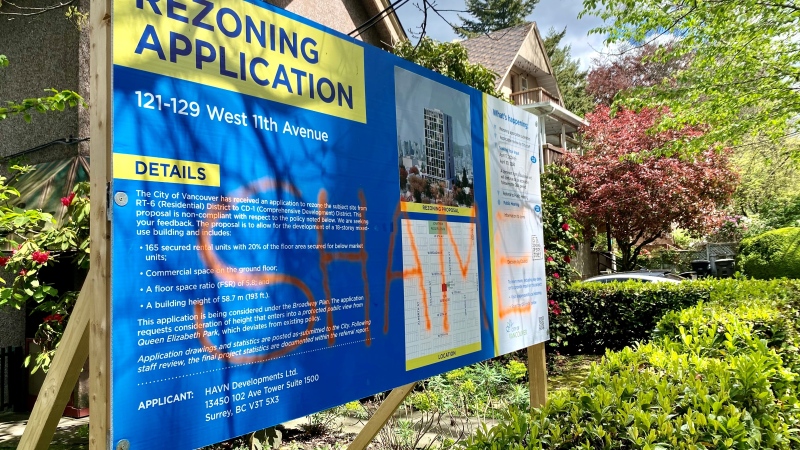

It is illegal in British Columbia to demand fees in advance for loans. We went to the address given on the company's website -- Suite 1001 in the SunLife building in Vancouver. On the tenth floor, suite numbers only go to 1000 -- there is no suite 1001.

"They are not there. The address doesn't exist. I mean the whole look at this looks to be a scam because they have given an address that doesn't exist," says Pasacreta.

We called the 1-800 number and got a recorded message which said it was temporarily unavailable. Our emailed requests for an interview were not answered either.

Cindy is glad she trusted her gut feeling that something was wrong. "They have a great website. They look like they'd be a real company but it's not," she concludes.

Financially, they've managed without the loan: her husband has just returned to work, Cindy's working more, and the family has cut its expenses to help make ends meet.

"If we would have paid out that $500 that would have been our grocery money our rent it would have hurt us a lot, a lot," she says.

If you're laid off and having trouble with your bills, don't wait until you've missed some payments talk to your bank right away or see a credit counselor -- or both. They may be able to re-schedule your debt or find other cost savings.

With a report from CTV British Columbia's Chris Olsen