Ranking: These Metro Vancouver cities saw biggest real estate price dips due to rising interest rates

Pitt Meadows and Maple Ridge are seen from the air. (Pete Cline / CTV News Vancouver)

Pitt Meadows and Maple Ridge are seen from the air. (Pete Cline / CTV News Vancouver)

A just-released report on rising interest rates is giving would-be home buyers and sellers an idea of the impact already being seen in the Vancouver area, and the results vary by city.

Brokers with HouseSigma say the those involved in the local real estate market are seeing price dips, longer listing periods and some homes not selling at all.

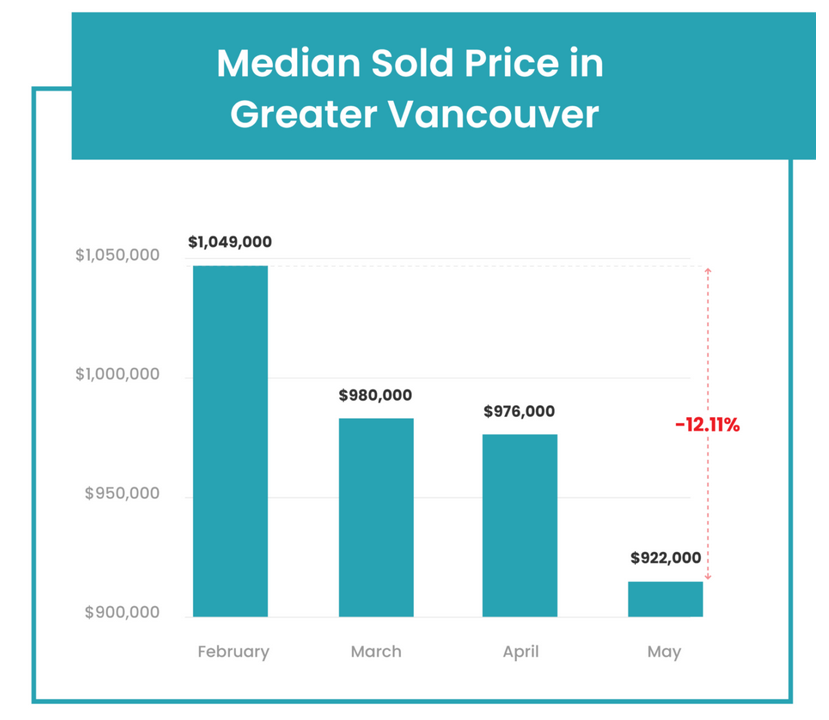

In a report Thursday, the company said the median sale price in the Vancouver area overall dipped to $922,000 in May.

That's a 12.11 per cent decrease from what sellers were getting for their homes back in February ($1,049,000).

HouseSigma blames the Bank of Canada's overnight lending rate, which was recently increased by 0.5 per cent, up to 1.5 per cent.

It's the third hike this year, following similar moves in March and April. Those behind the report tried to track the impact in the country's hottest housing market, and found that, although some buyers had already locked in a lower rate at the beginning of the year, the data suggests changes are underway.

Looking at the median sold price in the region overall, it was close to the $1.05-million mark before the rate hikes began.

In March, that median dropped to $980,000, and by April it was $976,000, followed by the dip again in May.

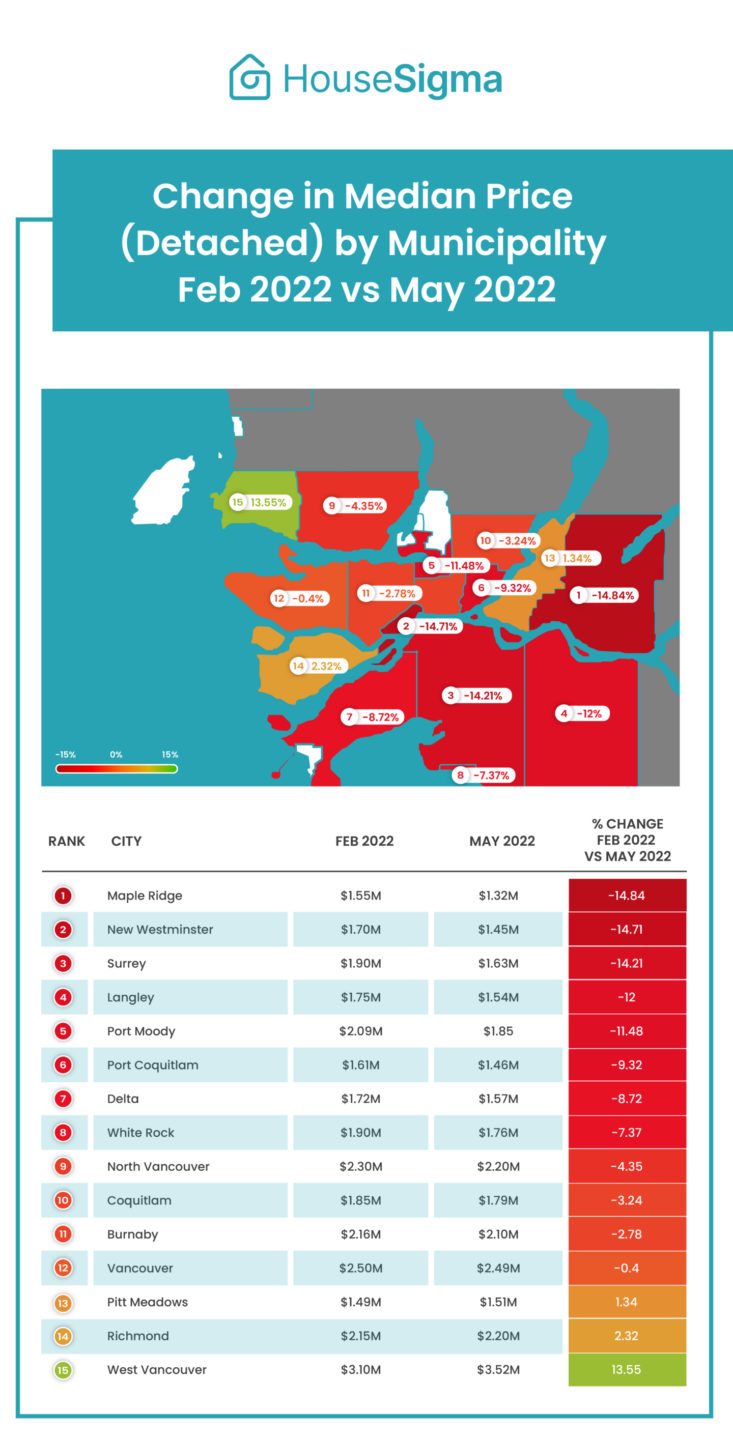

NOT ALL CITIES IMPACTED EQUALLY

According to the June 2 report, some communities saw more of a decrease than others. While the average for the region is a 12.11 per cent decrease, sellers of detached homes in Maple Ridge got nearly 15 per cent less for their houses in May than in February.

New Westminster, too, saw a shift in favour of buyers with a 14.71 per cent change.

Also impacted more than the average were sellers in Surrey, while those in Langley were close to the average.

Port Moody sellers too saw a double-digit decrease, though below average.

"We're now starting to see the full effect of rising interest rates on buyers and sellers' habits," HouseSigma broker Hao Li said in a news release about the report.

"These double digit dips in detached home averages in areas like Surrey and Maple Ridge highlight the pullback that's happening in B.C.'s market."

But the data also suggested it's still good to be a seller in one area: West Vancouver.

In that community, the median sale price was actually up quite a bit from February. Buyers paid a median of $3.52 million, up 13.55 per cent from what they paid in February.

See a larger version of the embedded graphic on HouseSigma's blog.

HOMES NOT SELLING AT ALL

In addition to what homes are selling for, the report looked at whether they're selling at all.

Terminated listings, meaning listings that essentially timed out – they haven't sold during a specified time and have been pulled down – were up a whopping 121 per cent from February.

According to HouseSigma, 2,331 homes fell into this category back then. By March, 3,095 listings were terminated. In April: 3,590. Another 5,141 listings were terminated in May.

Li said there are a few reasons for this, one of which is sellers deciding the offers they got weren't good enough. They can then choose to pull it down and re-list the property to attract a new set of potential buyers.

Sometimes, too, sellers will remove the property from the market because it's sat for a while, thinking maybe they'll try again when conditions change or at a different time of year.

WHAT IT MEANS

According to Li, this suggests a sharp turn from the height of the pandemic when buyers scrambled to find options, "raising prices at a pace we've never seen before."

Now, it looks like buyers don't feel that rush, and are thinking that they may get a deal or find a better option if they wait, Li said.

"Since the Bank of Canada started raising rates, buyers have steadily taken a more 'wait-and-see' approach to buying a home, and sellers have had to adjust their sale price expectations," Li said.

CTVNews.ca Top Stories

From outer space? Sask. farmers baffled after discovering strange wreckage in field

A family of fifth generation farmers from Ituna, Sask. are trying to find answers after discovering several strange objects lying on their land.

Broadcaster and commentator Rex Murphy dead at 77: National Post

The National Post is reporting that Rex Murphy, the pundit and columnist who hosted a national call-in radio show for decades, has died.

Pearson gold heist suspect arrested after flying into Toronto from India

Another suspect is in custody in connection with the gold heist at Toronto Pearson International Airport last year, police say.

Millions of cyberattacks per hour as B.C. government investigates multiple breaches

Careful attention to government statements and legislation is required to get a handle on the level of risk British Columbians’ information is under, as investigators probe multiple breaches under a continued barrage of attacks.

Ontario family receives massive hospital bill as part of LTC law, refuses to pay

A southwestern Ontario woman has received an $8,400 bill from a hospital in Windsor, Ont., after she refused to put her mother in a nursing home she hated -- and she says she has no intention of paying it.

Debate on abortion rights erupts on Parliament Hill, Poilievre vows he won't legislate

A Conservative government led by Pierre Poilievre would not legislate on, nor use the notwithstanding clause, on abortion, his office says, as anti-abortion protesters gather on Parliament Hill.

Justin and Hailey Bieber are expecting their first child together

Hailey and Justin Bieber are going to be parents. The couple announced the news on Thursday on Instagram, both sharing a video that showcases Hailey Bieber's growing belly.

Here are the ultraprocessed foods you most need to avoid, according to a 30-year study

Studies have shown that ultraprocessed foods can have a detrimental impact on health. But 30 years of research show they don’t all have the same impact.

New 'Lord of the Rings' film coming in 2026

The Oscar-winning team behind the nearly US$6 billion blockbuster 'Lord of the Rings' and 'The Hobbit' trilogies is reuniting to produce two new films.