Fraser Valley real estate: Buyer's market? Seller's market? Or just confusing?

Extremely challenging — that’s how some Fraser Valley realtors are summing up last year’s housing market, which saw the lowest annual sales in a decade.

“Definitely, we had a lower inventory compared to the previous two years,” said Fraser Valley Real Estate Board chair Narinder Bains.

According to the FVRB, the region ended the year with 14,713 sales, a decline of four per cent over 2022 and 23 per cent below the 10-year average. New listings in the Fraser Valley were also at a 10-year low, at 29,610, eight per cent below the 10-year average.

It also took a little longer for properties to sell. A detached home was on the market an average of 28 days in 2023. That’s six days longer than the previous year. Townhouses, condos and homes with acreage also spent more time for sale, according to numbers from the FVRB.

“There’s a lot of pent up demand, a lot of demand out there. But unfortunately, with the interest rate where it is right now, it’s very hard for people to get approval,” said Bains.

The Bank of Canada hiked interest rates to five per cent last year, leading to a drop in property sales.

“Nobody wakes up in the morning and says, 'I can buy a home for $1.5 million.' They wake up and say, 'I can afford a $3,700 or $4,000 payment',” explained Andrew Bracewell of Royal LePage Little Oak Realty.

“So if the cost of money changes abruptly, then the cost of what that individual can buy changes abruptly,” he said.

Bracewell said the latter half of 2023, “experienced numbers similar to what we saw post financial crisis in 2009 when it comes to volume of transactions."

According to a news release from BC Assessment, most Fraser Valley homes saw their property values diminish. The sharpest decrease was 13 per cent in Hope, where the average home had an assessed value of $611,000 as of July, 2023.

But that doesn’t mean it will stay that way.

The FVRB said with the Bank of Canada expected to lower interest rates before mid-year, demand will increase.

“Chances are with interest rates coming down, demand will go up and also possibly see increase in pricing with that,” Bains said.

Meanwhile, some realtors say no matter what happens with the market, the biggest obstacle in 2024 will continue to be a lack of inventory.

“Because there’s a lack of inventory, a nice property comes on the market, whether it’s a condo, townhouse, or house, you still hear stories, even today, of selling in one day and multiple offers. And that’s because there’s just not enough supply to meet the demand,” Bracewell said.

Asked if he felt it was currently a buyer's market or a seller's market, Bracewell said that right now, it’s just a market that’s “confusing”.

CTVNews.ca Top Stories

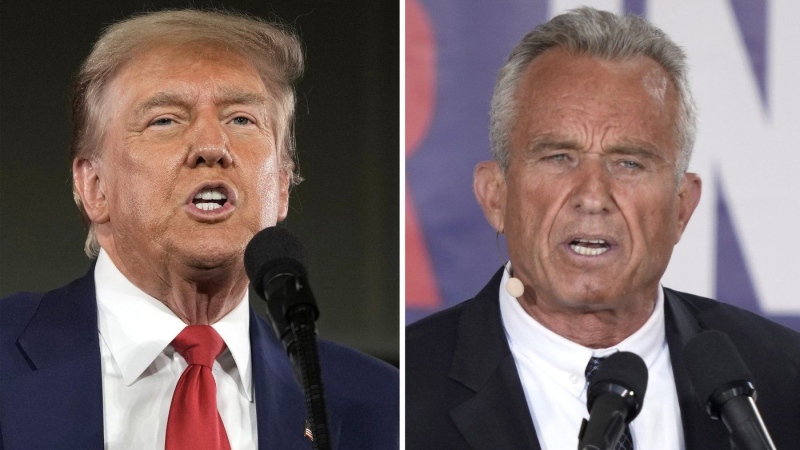

Trump confronts repeated boos during raucous Libertarian convention speech

Donald Trump was booed repeatedly while addressing Saturday night’s Libertarian Party National Convention.

This type of screen time has the worst effect on kids: experts

According to some experts, there is one type of screen time that is continuously excessive, and it's having a severe effect on our children.

Family of toddler found dead at small-town Ont. daycare no closer to answers after year of investigation

A year has passed since two-year-old Vienna Irwin was found on the property of a home-based daycare in small-town Ontario, but her family says they are no closer to answers of what happened that day.

Grayson Murray, two-time PGA Tour winner, dead at 30

Two-time PGA Tour winner Grayson Murray died Saturday morning at age 30, one day after he withdrew from the Charles Schwab Cup Challenge at Colonial.

Humboldt Broncos crash victims and families react to decision to deport truck driver

The family of one of the victims of the Humboldt Broncos bus crash in 2018 says they are 'thankful' for a decision by a Calgary immigration board to deport the driver of the truck involved.

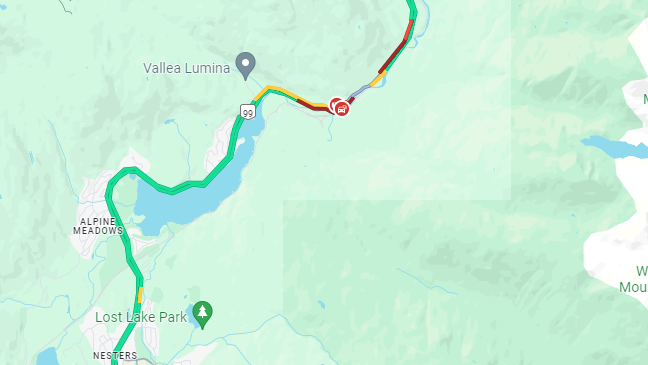

Fatal plane crash reported near Squamish, B.C.

The Transportation Safety Board of Canada has confirmed it is working with local Mounties and the BC Coroners Service after a plane crash near Squamish, B.C. Friday night.

'God forgives but we don’t': Loud outburst from stabbing victim’s family during sentencing hearing

An emotional outburst in a London, Ont. courtroom Friday disrupted the sentencing hearing of a woman who pleaded guilty for her part in the death of 29-year-old Mohammed Abdallah.

Three dead after vehicle plunged down a 100-foot embankment in Shediac, N.B.

Three people have died after a vehicle veered off the road in Shediac N.B., Friday morning.

Appeal denied for Edmonton soldier accused of trying to kill her 3 children

An Edmonton woman found guilty of trying to kill her three children has been denied an appeal.