Permanent residents subject to foreign buyers tax because they used China-based company to purchase B.C. building

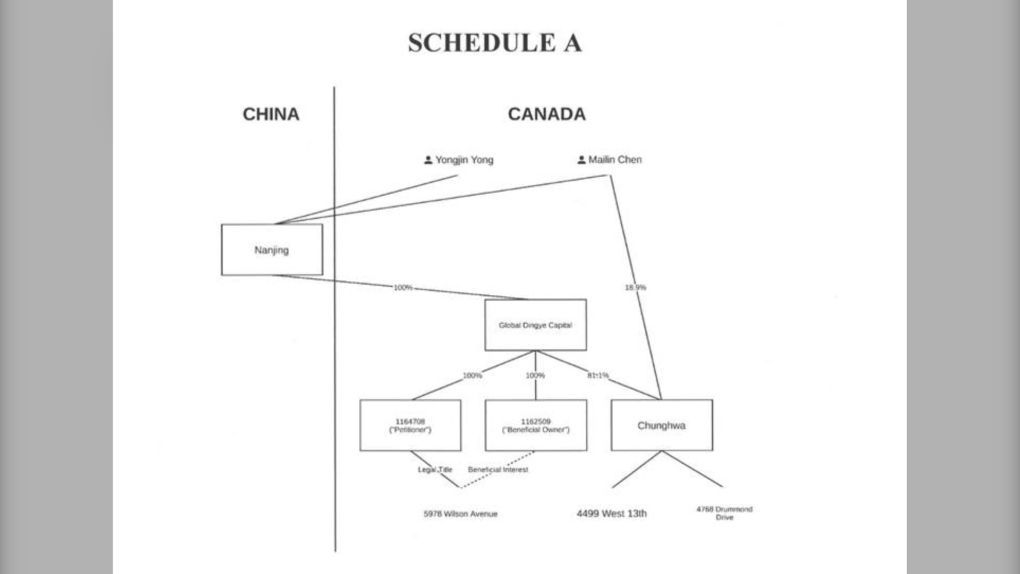

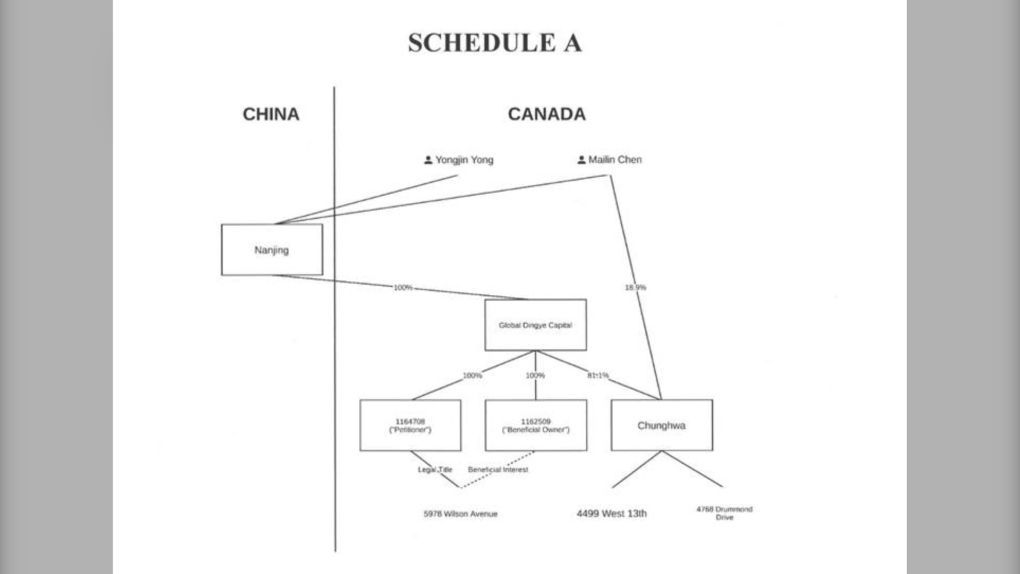

A diagram included as an appendix to Wilson's decision outlines the companies' ownership structure.

A diagram included as an appendix to Wilson's decision outlines the companies' ownership structure.

The provincial government was correct to impose its foreign buyers tax on a pair of permanent residents who paid $30 million to acquire a Burnaby apartment building in 2018, the B.C. Supreme Court has ruled.

Permanent residents of Canada are typically exempt from paying the tax, which was first introduced for Metro Vancouver properties in 2016 and has since been expanded to other areas of the province.

What made this case different was the complicated ownership structure behind the purchase, which included a company incorporated in China.

In a decision issued and posted online earlier this week, Justice Steven Wilson notes that the case is related to two others brought by a different company controlled by the same B.C. residents, which deal with "largely the same issue."

A decision in those two cases has not yet been issued.

COMPLEX OWNERSHIP STRUCTURE

All three cases involve companies owned by Mailin Chen and Yongjin Yong, who have both been permanent residents of Canada since 2009, according to the decision.

A diagram included as an appendix to Wilson's decision outlines the companies' ownership structure, which the judge also summarizes in writing.

Chen owns the majority of shares in a company called Nanjing Dingye Investment Real Estate Group Co. Ltd., which is incorporated in China. Yong holds the remainder of the shares in that company.

Nanjing is the sole shareholder of a B.C. company called Global Dingye Capital Ltd. That company, in turn, is the sole shareholder of two numbered B.C. companies involved in the purchase of 5978 Wilson Ave., a four-storey Burnaby apartment building with 38 units.

One of the numbered companies, 1164708 B.C. Ltd., purchased the building and holds it in trust for the other, 1162509 B.C. Ltd., referred to throughout the decision as the "beneficial owner."

1164708 B.C. Ltd. brought the case to court, and is referred to in the decision as the "petitioner."

A diagram included as an appendix to Wilson's decision outlines the companies' ownership structure.

A diagram included as an appendix to Wilson's decision outlines the companies' ownership structure.

Global – the named B.C. company owned by Nanjing – also owns 81.1 per cent of another B.C. company called Chunghwa Investment (Canada) Co. Ltd., with the remaining 18.9 per cent of Chunghwa owned by Chen directly.

Chunghwa is the owner of the properties at the centre of the two related cases: a single-family home on the corner of West 13th Avenue and Sasamat Street in Vancouver and a nine-bedroom, 10-bathroom mansion on Drummond Drive in the West Point Grey neighbourhood that was worth more than $14 million as of July 1, 2022, according to BC Assessment.

DEFINITION OF 'CONTROL' CHALLENGED

In the case decided by Wilson, the petitioner argued that B.C.'s Ministry of Finance had incorrectly interpreted the definition of "controlled" in the foreign buyers tax legislation.

"There can only be one person or entity that exercises ultimate control, and that person in this case is Mr. Chen," Wilson's decision reads, summarizing the argument.

"Because Mr. Chen controls the majority of the shares in Nanjing, which controls Global, which in turn controls the petitioner, no additional (property transfer tax) should be payable."

In response, the Attorney General of B.C. argued that it was the petitioner that was misunderstanding the statute.

"There can be simultaneous control of a corporation by different persons or entities and, since Nanjing was incorporated in China, Global and its subsidiaries, including the petitioner, are all foreign corporations," the decision reads, summarizing the province's argument.

In considering these arguments, Wilson referred to the provincial legislation, as well as the federal Income Tax Act, from which the B.C. law draws its definition of control.

The judge concluded that the petitioner's assertion that only one person or entity can exercise ultimate control relied on a single section of the federal law, which is expanded and elaborated on by other sections.

Taking the federal statute's definition of control in its entirety supports the province's position, and was clearly the intention of the provincial legislature when it wrote the B.C. law, Wilson found.

The decision notes that "a plain reading" of both laws "would lead to the inescapable conclusion that Nanjing was a foreign corporation and that Global and the petitioner are therefore also foreign corporations."

"Moreover, the mere fact that one can envisage situations where the question of control might be the subject of some debate does not render the legislation ambiguous," the decision continues.

"Even though I accept the petitioner's submission that it was not the legislature's intention to subject people such as Mr. Chen to the additional (property transfer tax), it is important to recognize that it is not Mr. Chen who is liable to pay the tax in this case. Rather, the tax is payable by the petitioner."

Wilson dismissed the case and awarded court costs to the Attorney General. The decision leaves the petitioner on the hook for a foreign buyers tax of $6 million.

CTVNews.ca Top Stories

Prime Minister Trudeau meets Donald Trump at Mar-a-Lago

Prime Minister Justin Trudeau landed in West Palm Beach, Fla., on Friday evening to meet with U.S.-president elect Donald Trump at Mar-a-Lago, sources confirm to CTV News.

'Mayday! Mayday! Mayday!': Details emerge in Boeing 737 incident at Montreal airport

New details suggest that there were communication issues between the pilots of a charter flight and the control tower at Montreal's Mirabel airport when a Boeing 737 made an emergency landing on Wednesday.

Hit man offered $100,000 to kill Montreal crime reporter covering his trial

Political leaders and press freedom groups on Friday were left shell-shocked after Montreal news outlet La Presse revealed that a hit man had offered $100,000 to have one of its crime reporters assassinated.

Questrade lays off undisclosed number of employees

Questrade Financial Group Inc. says it has laid off an undisclosed number of employees to better fit its business strategy.

Cucumbers sold in Ontario, other provinces recalled over possible salmonella contamination

A U.S. company is recalling cucumbers sold in Ontario and other Canadian provinces due to possible salmonella contamination.

Billboard apologizes to Taylor Swift for video snafu

Billboard put together a video of some of Swift's achievements and used a clip from Kanye West's music video for the song 'Famous.'

Musk joins Trump and family for Thanksgiving at Mar-a-Lago

Elon Musk had a seat at the family table for Thanksgiving dinner at Mar-a-Lago, joining President-elect Donald Trump, Melania Trump and their 18-year-old son.

John Herdman resigns as head coach of Toronto FC

John Herdman, embroiled in the drone-spying scandal that has dogged Canada Soccer, has resigned as coach of Toronto FC.

Weekend weather: Parts of Canada could see up to 50 centimetres of snow, wind chills of -40

Winter is less than a month away, but parts of Canada are already projected to see winter-like weather.