A real estate developer building a condo complex east of Vancouver is hoping to help low-income buyers get into the market by offering ownership with zero down payment.

Townline Homes says it is introducing its “historic affordability plan” in Port Moody in response to “the ever increasing financial challenges for the average British Columbian to access home ownership in a central, amenity rich, transit oriented, and family safe neighbourhood.”

The company says it can achieve the plan by selling the high-rise units for eight per cent less than the current appraised market value, and having that eight per cent discount be recognized by the Canada Mortgage and Housing Corporation as the down payment for the mortgage.

For example, on a $280,000 condo, the affordability program would discount $22,400 to be used as an eight-per-cent “virtual down payment” – making the actual purchase price $257,000, which would be 100 per cent financed by a book.

That eight-per-cent discount would not need to be repaid, and would not be considered a second mortgage.

However, there are restrictions on purchasers.

New homeowners must stay in their property for at least two years after the closing date before they are allowed to sell, and the condo must be their primary residence.

Qualified buyers must have a combined family income of less than $65,850 for a one-bedroom or one bedroom plus den unit, or $92,430 for a two-bedroom unit. Income must be proven by supplying a recent T4 slip.

The developer says B.C. Housing has already green-lit the concept. However, CMHC says it is still reviewing the development proposal.

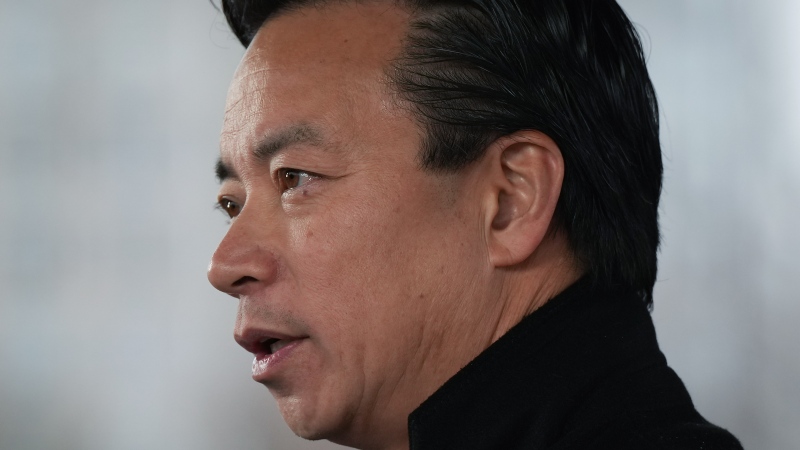

While the agency normally requires at least a five per cent cash down payment on a home purchase to qualify for insurance, Lisa Ono said the CMHC could make an exception under its Flexibilities for Affordable Housing program.

Under the program, the agency accepts a broader range of down payment sources that are “alternatives to cash from borrowers,” including sweat equity, grants, borrowed down payments or rent-to-own payments.

“This is not the same thing as requiring no down payment,” Ono said in a statement sent to CTV Vancouver.