Scorpion venom research company did not commit misconduct, B.C. regulator rules

The B.C. Securities Commission logo in an undated file photo.

The B.C. Securities Commission logo in an undated file photo.

A Vancouver-based health sciences company that was attempting to develop synthetic scorpion venom withheld relevant information from investors, but that omission did not necessarily have an impact on the company's stock price, B.C.'s financial regulator has ruled.

A panel of the B.C. Securities Commission dismissed the allegations against PreveCeutical Medical Inc. and its CEO Stephen Van Deventer in a decision issued this week.

The commission's executive director had accused PreveCeutical and Van Deventer of misconduct stemming from a news release the company issued in 2018. In the release, the company said it had raised approximately $6.5 million through a private placement, but it did not share that approximately $3.2 million of the total had already been paid or would be paid to consultants.

Panels of the BCSC have found these types of omissions to be misconduct in the past, such as when a blockchain company failed to disclose it would be paying most of the $5.4 million it had raised to consultants.

In this case, however, the panel found that PreveCeutical's omission, while misleading, did not necessarily constitute a "material" omission that would have a significant effect on the company's market value.

"The executive director must prove on a balance of probabilities not simply that investors were misled, but also that the impact would have been sufficiently serious from the point of view of reasonable investors that the effect on market price would have been significant," the panel explains in its decision.

The panel concluded that this was "an open question" in the case of PreveCeutical's news release, in part because the company had previously disclosed publicly that only about 10 per cent of its available funds were being spent on research and development.

Reasonable investors would have felt they weren't given all of the necessary facts in the news release, the panel found, but that doesn't necessarily mean there would be a significant effect on share prices.

"Although the executive director has come close, the evidence introduced before us has not established on a balance of probabilities that the omission which has been proven was material in the sense required by the relevant provisions of the (Securities) Act," the decision reads.

For this reason, the panel dismissed the allegations against PreveCeutical and Van Deventer.

CTVNews.ca Top Stories

Serial sexual offender linked to unsolved 1970s homicides of four Calgary girls, women

An investigation into unsolved historical homicides from the 1970s has linked the deaths of two girls and two young women in and around Calgary to a now-deceased serial offender.

Woman with liver failure rejected for a transplant after medical review highlights alcohol use

For nearly three months, Amanda Huska has been in an Ontario hospital, part of it on life support, because of severe liver failure. Her history of alcohol use is getting in the way of her only potential treatment: a liver transplant.

$500K-worth of elvers seized at Toronto airport

Fishery and border service officers seized more than 100 kilograms of unauthorized elvers at the Toronto Pearson International Airport on Wednesday.

Toronto eliminated from PWHL playoffs

Toronto has been eliminated from the PWHL playoffs.

Information commissioner faces $700K funding shortfall, says system is 'overwhelmed'

Canada's information commissioner says her office is facing a $700,000 funding shortfall that could impact its ability to investigate complaints about government transparency and accountability.

B.C. man 'attacked suddenly' by adult grizzly near Alberta boundary: RCMP

A B.C. man is recovering from multiple injuries after he was "attacked suddenly" by an adult grizzly bear near Elkford Thursday afternoon.

Backlash over NFL player Harrison Butker's commencement speech has reached a new level

The NFL is distancing itself from controversial comments by Kansas City Chiefs kicker Harrison Butker during a recent commencement address.

Dabney Coleman, actor who specialized in curmudgeons, dies at 92

Dabney Coleman, the mustachioed character actor who specialized in smarmy villains like the chauvinist boss in '9 to 5' and the nasty TV director in 'Tootsie,' has died. He was 92.

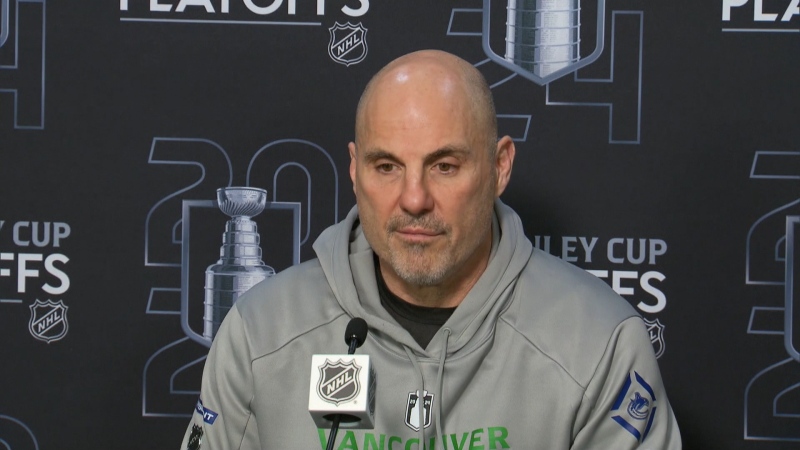

Craig Berube named as next head coach of Toronto Maple Leafs

The Toronto Maple Leafs have named Craig Berube as their new head coach.