Economic uncertainty means most of us are trying to trim our spending. But making an actual budget can seem intimidating.

Many people say it's hard to know where to cut back and that's because people can only usually identify where about three-quarters of their money is going.

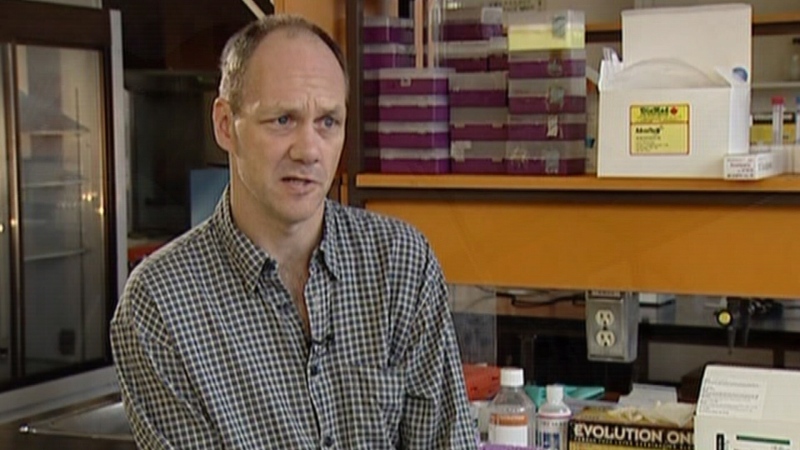

"It's that $20 a day habit where they are not sure where the money is being spent, they don't keep receipts but its gone by the end of the day," said Scott Hannah of the B.C. Credit Counselling Society.

But when you are preparing a budget, finding out where the money is going is not step one.

Setting a goal for why you are making changes in the first place is step one.

"It's what those finances represent: security, education for your kids, retirement, buying a home or just paying down debt," suggested Hannah.

It can even represent something fun like a trip -- even a small one.

Mark Race is trying to save for a vacation by just cutting back on dining out, and that daily coffee-to-go.

"Nothing significant right away but also we're not taking significant trips: that's where we're going to start," he pledged during a recent visit to Granville Market.

It sounds small but that could add up to $2,500 or more in a year, going a long way to pay for a trip. Look for every opportunity to save $5 here, $10 there.

And while you may not be thinking of retirement just yet, those already there will tell you a budget helped them get there.

Diane Atkinson says the secret is to know where every penny comes from and where every penny goes. To keep track when money was especially tight, Diane kept a little book to keep track.

"We'd write it all down all our expenses and add it up," she explained. "And if it was too much because we weren't getting that much of a paycheque, we'd have to go over the list again and cut down on something, cut something out, wait until the following month and we did that for quite a number of years."

Now retired, Diane and her husband Don enjoy a comfortable life and can take the time to smell the roses -- without worrying about where the money is coming from.

A viewer named Marie sent CTV an email which really brings home some money lessons we've forgotten over the years. She says her dad taught her that interest is to be earned, not paid.

Don't buy anything you can't afford to pay for by your next paycheque. And always put some money aside for a rainy day; you never know when an unexpected expense may arise.

With a report from CTV British Columbia's Chris Olsen.