The Canada Revenue Agency is deploying dozens of auditors to B.C. in an effort to catch tax evaders, but critics argue the province is still missing the mark on the affordable housing issue.

B.C. NDP housing critic David Eby said the real problem is not foreign buyers, but rather how some people report low incomes, yet buy homes worth millions.

“There’s been a lot of discussion about data in the real estate market. Who’s buying properties, where are they from?” Eby said at a news conference Friday. “I think a lot of that is a huge distraction from the core issue, which is not international people in our housing market, but international money in our housing market.”

One home in Point Grey sold for over $30 million and the majority owner listed their occupation as "student." New data shows this is a trend across Metro Vancouver, and Eby said the provincial government should cross-reference income statistics with housing sale information.

“The focus should be quite straightforward: are you paying your worldwide taxes in British Columbia or not? And if you're not, then you should have to pay extra in order to pay for the public services that make this real estate so valuable,” Eby said.

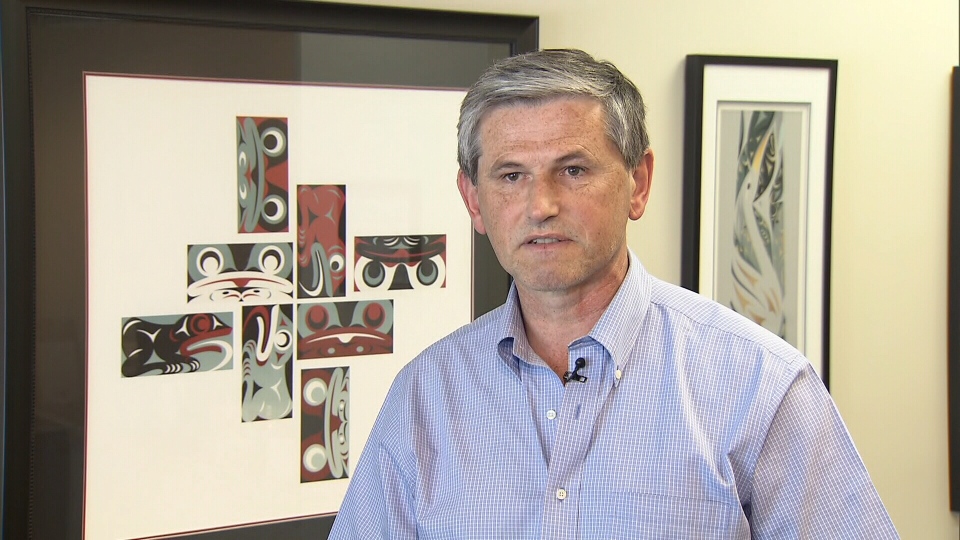

Liberal MLA Andrew Wilkinson said the NDP’s plan has a major flaw.

“People who decide to downsize and move to a different house will have to justify where they’re getting their money from and they’ll have to pay a $40, $50, $60,000 tax bill unless they can show on their income tax returns where they got money from. If they’re living off their savings like many seniors, that's just not possible,” he said.

The NDP said using information about age and retirement from tax forms would make it easy to identify and exempt seniors. Wilkinson said the opposition’s plan would be a “nightmare” to administer and called their plan “completely crazy.”

With a report from CTV Vancouver’s Bhinder Sajan