Richmond, B.C., 'tax protester' gets 30-month sentence, $120K in fines, CRA says

A sign outside the Canada Revenue Agency is seen Monday May 10, 2021 in Ottawa. THE CANADIAN PRESS/Adrian Wyld

A sign outside the Canada Revenue Agency is seen Monday May 10, 2021 in Ottawa. THE CANADIAN PRESS/Adrian Wyld

A B.C. man who evaded more than $120,000 worth of taxes more than a decade ago has been sentenced to 30 months in prison, according to the Canada Revenue Agency.

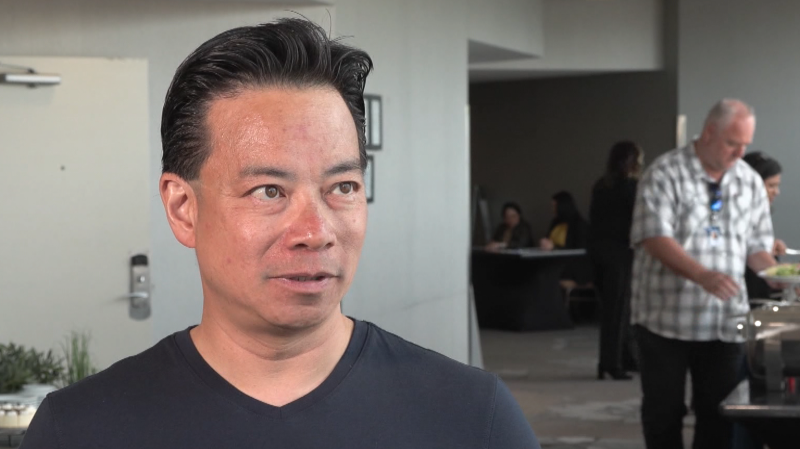

Richmond resident Eric Ho, also known as Eric Siu-Kei Ho and Pat Lee, was first charged with failing to report taxable income and counselling others to commit fraud in excess of $5,000 back in 2012, the CRA said in a news release Friday.

Ho failed to attend court for his first scheduled appearance on March 5, 2012, and a warrant was issued for his arrest. The CRA said he "surrendered himself to custody" on Aug. 11 of this year, more than a decade later.

The charges against Ho stem from his failure to report taxable income of $582,641 for the 2004 through 2008 tax years, according to the CRA. The agency said he evaded $122,367 in taxes as a result.

"Mr. Ho was an 'educator' with the Paradigm Education Group (Paradigm), a fraudulent scheme that counselled people across Canada to evade taxes," the CRA said in its release.

"From 2002 to 2010, Mr. Ho taught interested individuals, known as 'students,' the Paradigm theory, which is based on the faulty premise that if an individual declares themselves as a 'natural person' they do not become a taxpayer under the Income Tax Act."

Ho received income from his work with Paradigm, including from selling Paradigm DVDs, CDs and books, the CRA said.

On Oct. 6, he pleaded guilty to two of the charges against him. He was sentenced on Thursday.

In addition to the 30 months he must spend behind bars, Ho was fined 100 per cent of the amount of taxes he evaded, according to the CRA.

The agency described Ho and Paradigm as "tax protesters," a term it uses for people who use specious legal justifications to claim to be exempt from taxation.

"For those involved in tax protester schemes, the CRA will reassess income tax, charge interest and impose penalties," the CRA said. "A court can also impose a fine between 50 and 200 per cent of the tax evaded, and a jail term of up to five years for tax evasion, and up to 14 years for tax fraud."

Between April 1, 2017 and March 31, 2022, a total of 15 tax protesters were convicted across Canada, according to the CRA. Courts imposed more than $1.9 million in fines against them, in total, and sentenced them to a combined 29.75 years in prison.

"In addition to the court imposed fines and/or jail sentences, convicted taxpayers have to pay the full amount of tax owing, plus related interest and any penalties assessed by the CRA," the agency said.

CTVNews.ca Top Stories

'Most of the city is evacuating': Gridlock on Alberta highway after evacuation order in Fort McMurray

Four Fort McMurray neighbourhoods were ordered to evacuate on Tuesday as a wildfire gets closer to the city.

Sask. police seize 1.5M pieces of evidence, lay 60 more charges in child exploitation case

Saskatchewan RCMP have revealed that a historic sexual assault investigation has led to the discovery of alleged crimes against children dating back to 2005.

'Inappropriate' behaviour shuts down Dublin to New York City portal

Less than a week after two public sculptures featuring a livestream between Dublin, Ireland, and New York City debuted, 'inappropriate behaviour' in real-time interactions between people in the two cities has prompted a temporary shutdown.

Oilers starting Calvin Pickard in goal for Game 4 vs. Canucks

The Edmonton Oilers will start Calvin Pickard in net Tuesday for Game 4 of their playoff series with the Vancouver Canucks.

Biden administration moving ahead on US$1 billion arms package for Israel, AP sources say

The Biden administration has told key lawmakers it is sending a new package of more than US$1 billion in arms and ammunition to Israel, two congressional aides said Tuesday.

King Charles III unveils his first official portrait since his coronation

King Charles III has unveiled the first portrait of the monarch completed since he assumed the throne, a vivid image that depicts him in the bright red uniform of the Welsh Guards against a background of similar hues.

Full List Are these Canada's best restaurants? Annual top 100 list revealed

The annual list of Canada's top restaurants in the country was just released and here are the places that made the 2024 cut.

Alberta announces the 4 health agencies that will replace AHS later this year

The province has released more information on its plan to break up Alberta Health Services and replace it with four sector-based health agencies.

Maximum payout for LifeLabs class-action drops from $150 estimate to $7.86

Canadian LifeLabs customers who filed an application for a class-action settlement began receiving their payments this week, though at a much lower amount than initially expected.