Here's how much you'd need to earn per year to buy an average home in Vancouver

The exterior of a garden-level townhouse listed in Vancouver for $1,229,000 is shown. (Realtor.ca / Westside Realty)

The exterior of a garden-level townhouse listed in Vancouver for $1,229,000 is shown. (Realtor.ca / Westside Realty)

It's no surprise to most would-be homeowners: anyone looking to buy a home in two major British Columbia cities must have a six-figure income.

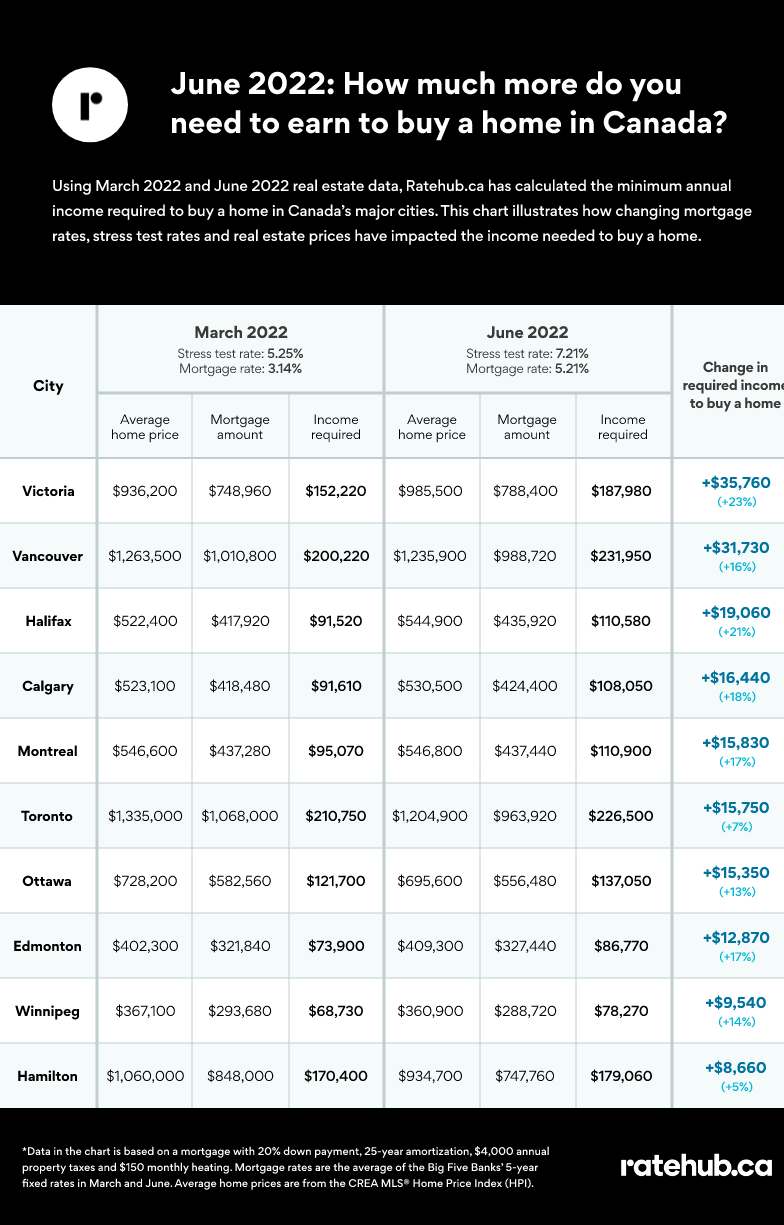

A just-published report from mortgage rate comparison site RateHub.ca suggests those hoping to buy an average home in Vancouver need to earn about $231,950 to meet the requirements to obtain a mortgage.

That calculation includes the average home price in the Vancouver area of $1,235,900 – the highest average in the country.

It takes into account a mortgage "stress test" rate and uses the mortgage rate of 5.21 per cent for June 2022. RateHub estimated a mortgage of $988,720, and factored that into the income requirement, and tacked on $4,000 in annual property taxes and $150 for monthly heating.

The income required is based on a 20 per cent down payment. Being able to put more or less down would impact that final number.

Vancouver's required income is high when compared to most of the country, but it's also high compared to the amount needed earlier this year.

The same calculation in March, when the average home price was actually higher, resulted in a required income of $200,220. Just three months later, buyers needed $31,730 more to afford the average, according to the study.

RateHub said the goal of its calculations was to show how much the changing stress test and mortgage rates (5.25 and 3.14 per cent in March) impacted housing affordability.

In Vancouver, buyers now need an income 16 per cent higher, according to the research.

In Victoria, buyers need 23 per cent more than they did back in March.

The provincial capital now has an average home price of $985,500, meaning those looking to buy would have to bring home $187,980 a year to afford that home.

With an increase from the end of Q1 to the end of Q2 of $35,760, Victoria saw the steepest impact by dollar amount and by price, based on this data.

In fact, of all Canadian cities included in the monthly report, only homes in Winnipeg and Edmonton were affordable to those making five-figure salaries.

According to RateHub, buyers in Edmonton need an income of at least $86,770 to buy the average home, and in Winnipeg, families need to be bringing in $78,270.

The average home prices in those cities are $409,300 and $360,900, respectively.

Incomes in other Canadian cities examined last month vary from $108,050 in Calgary up to $179,060 in Hamilton, Ont. See more in the chart below.

Other than Vancouver, Toronto is the only city in which homebuyers need to earn more than $200,000. According to RateHub, the income required in the country's most populous city is $226,500 to buy a home at the average price of $1,204,900.

CTVNews.ca Top Stories

Canadian team told Trump's tariffs unavoidable in short term in surprise Mar-a-Lago meeting

During a surprise dinner at Mar-a-Lago, representatives of the federal government were told U.S. tariffs from the incoming Donald Trump administration cannot be avoided in the immediate term, two government sources tell CTV News.

Toronto man accused of posing as surgeon, performing cosmetic procedures on several women

A 29-year-old Toronto man has been charged after allegedly posing as a surgeon and providing cosmetic procedures on several women.

W5 Investigates 'I never took part in beheadings': Canadian ISIS sniper has warning about future of terror group

An admitted Canadian ISIS sniper held in one of northeast Syria’s highest-security prisons has issued a stark warning about the potential resurgence of the terror group.

Trump threatens 100% tariff on the BRIC bloc of nations if they act to undermine U.S. dollar

U.S. president-elect Donald Trump on Saturday threatened 100 per cent tariffs against a bloc of nine nations if they act to undermine the U.S. dollar.

Poilievre suggests Trudeau is too weak to engage with Trump, Ford won't go there

While federal Conservative Leader Pierre Poilievre has taken aim at Prime Minister Justin Trudeau this week, calling him too 'weak' to engage with U.S. president-elect Donald Trump, Ontario Premier Doug Ford declined to echo the characterization in an exclusive Canadian broadcast interview set to air this Sunday on CTV's Question Period.

Bruce the tiny Vancouver parrot lands internet fame with abstract art

Mononymous painter Bruce has carved a lucrative niche on social media with his abstract artworks, crafted entirely from the colourful juices of fruits.

Why this Toronto man ran so a giant stickman could dance

Colleagues would ask Duncan McCabe if he was training for a marathon, but, really, the 32-year-old accountant was committing multiple hours of his week, for 10 months, to stylistically run on the same few streets in Toronto's west end with absolutely no race in mind. It was all for the sake of creating a seconds-long animation of a dancing stickman for Strava.

Former Ont. teacher charged with sexually assaulting a teen nearly 50 years ago

A senior from Clearview Township faces charges in connection with an investigation into a sexual assault involving a teen nearly 50 years ago.

It's time for a good movie this holiday season, here's what's new in theatres

This holiday season has a special edition at the theatres with movies "that everyone has been waiting for," says a movie expert from Ottawa.