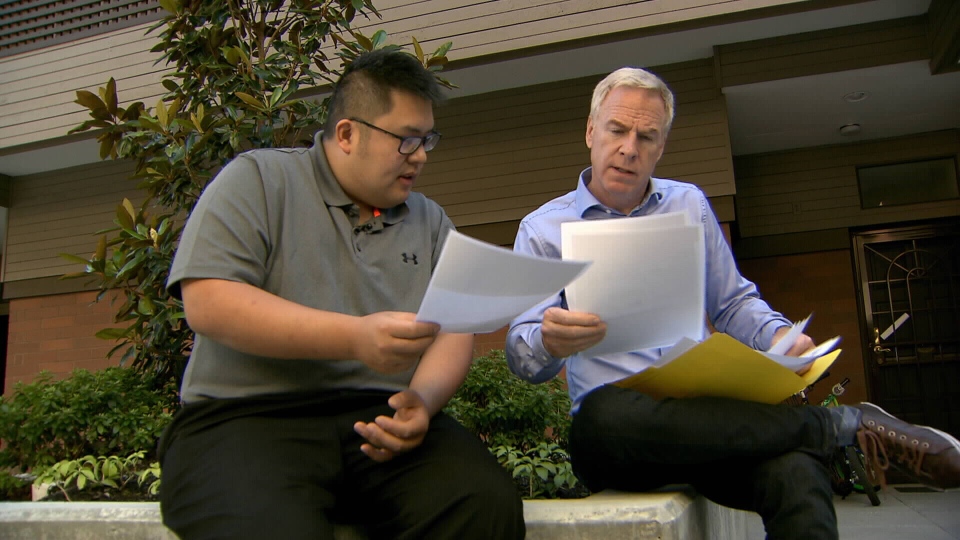

A Vancouver man is speaking out after he got caught up in a cheque cashing scam and thought his bank had procedures in place to protect him.

Trevor Chan received a message on LinkedIn in 2014 from what he thought was a legitimate Japanese company. He was asked to collect money from the company’s clients in Canada and then transfer the funds to Japan. The company had a website, and Chan was even mailed a contract with a stamped seal.

Chan then received a cheque that appeared to be from Manulife Financial for $37,654 from a so-called client. Chan deposited the cheque into his TD bank account, and it cleared after a seven day holding period.

After TD released the funds, Chan felt confident in wiring $33,000 to Japan and holding back $4,500 as a retainer fee and payment for more collections that he was told would follow. A few weeks later, Chan received a call from TD Bank and was told that the cheque had been “altered” and was fraudulent. He was told he was responsible for paying the bank back the full amount. Chan says that TD should have done more to determine if the cheque was real before it was cleared.

"I relied on TD Bank to take care of that for me. Because they're the professionals because they can tell if anything's legitimate or a scam," he said.

In a statement to CTV News, TD says “Clearing a cheque is the process for moving funds from one financial institution to another, not for verifying the authenticity of the cheque.” TD also said that a cheque can come back as fraudulent at any time, and if a cheque is returned for “any reason” the customer is still responsible for the amount.

Bruce Cran from the Consumers’ Association of Canada says he’s seen similar cheque scams before but never one so elaborate or large.

“He has my sympathy,” he said. “I also believe it comes in the ‘too good to be true’ rule. The old saying, if it looks too good to be true, that’s the case. Leave it alone.”

TD also said in its statement that they’re “sympathetic” to Chan’s situation but that “it’s important for customers to be aware, know who they are doing business with.”

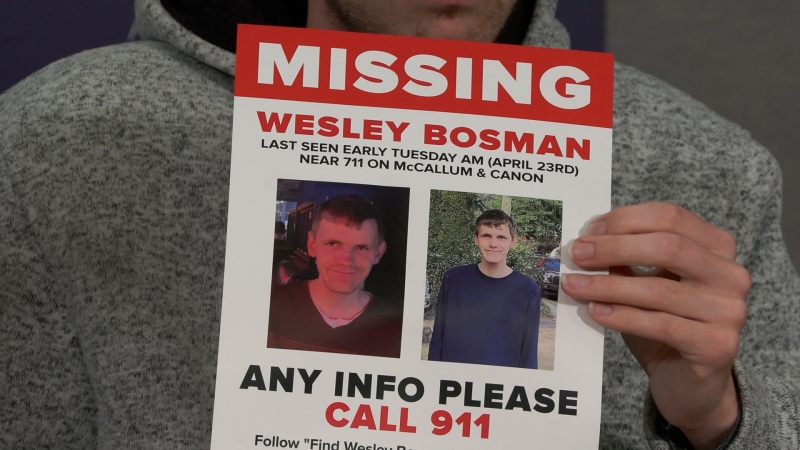

Manulife says they’re still investigating as to whether the cheque was legitimate and actually cleared the account and what the circumstances were regarding the fraud. An email to the so-called company in Japan bounced-back. Their website is also down, and their phone number was not in service.

Chan says he’s speaking out to warn others to do more research if they get wrapped up in a similar scheme.

“I won’t be able to apply for a mortgage or apply for a car loan because of this,” said Chan. “It’s on my credit report now.” The debt has now been sent to collections.