"Social media influencers" are being named alongside lottery scammers and online dating fraudsters on the Better Business Bureau's annual rundown of the year's top scams.

That's because some influencers – people described as having a "significant online presence" – choose to profit through phony product endorsements and secret sponsorships, according to the consumer protection group.

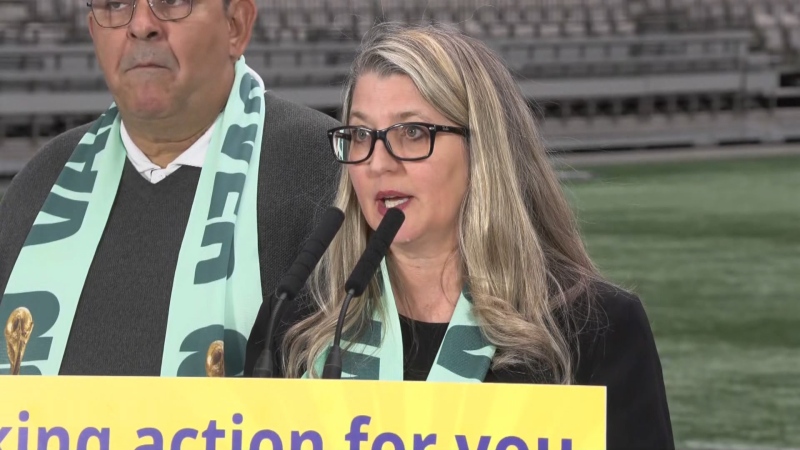

"Consumers are often enticed to purchase a product or a service based on reviews by social media influencers," said Danielle Primrose, president of the Better Business Bureau of B.C.

"Unfortunately, these reviews may not be genuine, and the influencer may have been paid by the company to be used as a marketing tool."

The Competition Bureau, which helps the BBB with its annual scam list, said when influencers' sponsorship deals aren't transparent, their followers can easily be duped.

And if the social media users are ever caught, there can be consequences for them as well – including trouble with the law.

"When these influencers talk, people buy," Asst. Deputy Commissioner Victor Hammill said. "By not revealing their business interests and claiming to have had authentic experiences and opinions, these influencers are misleading consumers and could be subject to action by law enforcement."

Though it's unclear how much Canadians lost falling for insincere endorsements last year, the BBB believes the practice is concerning enough to warrant a spot on 2016's top scams list.

Most of the list is made up of the usual suspects, including lottery scammers who promise to transfer a hefty jackpot in exchange for a "tax" or "insurance fee," and identity thieves who steal personal information then use it to secure credit cards, bank loans and even property rentals.

One other new addition is a form of investment fraud known as the binary option scam, which accounted for $7.5 million in losses last year.

Binary options amount to a 50/50 bet on whether a given stock will appreciate or depreciate in value over a specified period of time. Not only are they unregulated in Canada, the BBB warns that some of the bets are rigged from the get-go.

"You've heard about Ponzi schemes, you've heard about pyramid schemes, but the B.C. Securities Commission wanted us to highlight this growing investment fraud," Primrose said.

"Understand high risk is really involved when you enter into these kind of things.”

This year's list also includes a twist on last year's top scam, which involved fraudsters pretending to represent the Canada Revenue Agency.

Victims were called at all hours of the day or night and threatened with fines or even jail time if they didn't pay phony tax bills immediately.

Primrose said there was a dip in reports of CRA scams last fall following a crackdown at a call centre in India, but a new ploy emerged later in the year that re-victimized past targets.

"Victims have actually been re-contacted with an offer to get their money back if they pay a fee," she said. "We want to make sure that people know the CRA does not make threatening phone calls, nor do they ask or request personal information via email or over the phone."

According to the Better Business Bureau, Canadians lost more money to scammers in 2016 than the previous two years, totaling more than $90 million. That’s about 50 per cent more than they lost in 2015.

What's worse, the non-profit organization estimates that figure only represents about five per cent of the real total, because the vast majority of victims never report what happened.

Anyone who falls prey to a scammer is encouraged to report it to authorities, and to the BBB using its online Scam Tracker.

The full list of 2016's top scams includes:

- Employment scams ($5.3 million reported)

- Online dating scams ($17 million reported)

- Identity fraud ($11 million reported)

- Advance fee loans ($1.1 million reported)

- Online purchase scams ($8.6 million reported)

- Wire fraud, or “spearphishing” ($13 million reported)

- Binary option scams ($7.5 million reported)

- Fake lottery winnings ($3 million reported)

- Canada Revenue Agency scam ($4.3 million reported)

- Fake online endorsements (Unknown)