On Canada Day, British Columbians will likely be paying the highest gas prices in the country, thanks to a new provincial carbon tax that adds almost 2.5 cents to a litre of fuel and has turned service stations into the province's latest political battle ground.

Motorists are doing more than filling up at their local gas stations. They're fuming about gas politics.

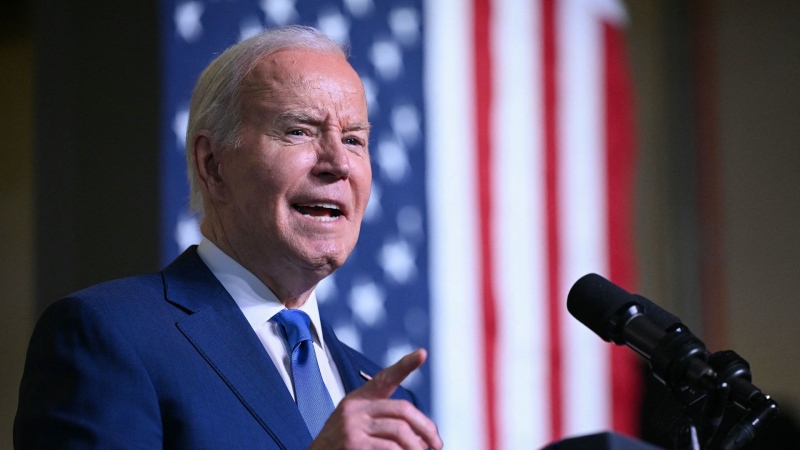

Premier Gordon Campbell admits his government has a selling job to do on its new green tax, the first escalating consumer tax on carbon in Canada.

"The government should look at themselves first before they look at tackling little guys like me,'' said Trish O'Brien as she filled up her fuel efficient Suzuki Aerio. "I do what I can. I recycle everything that's not nailed down. I drive a small car and take the bus when I can, and I walk.''

O'Brien said she wants to see consumer incentives to go green from the government before being hit with taxes.

The Liberal government's carbon tax , introduced in last February's budget and effective July 1, will be phased in over five years to give consumers and businesses time to adjust and begin to understand there is a cost associated with generating harmful greenhouse gases.

The carbon tax starts at a rate based on $10 per tonne of carbon emissions and rises $5 a year to $30 per tonne by 2012. The tax works out to an extra 2.4 cents a litre on gasoline, rising to 7.24 cents per litre by 2012.

The carbon tax on diesel and home heating oil will start at 2.7 cents per litre and increase to 8.2 cents per litre over the five-year period.

The tax is being billed as revenue neutral, meaning the government will not use money generated from the tax to fill its coffers. The revenue, estimated to hit $1.8 billion over three years, will be returned to taxpayers through personal income tax and business tax cuts.

British Columbians already pay a 3.5-cent-per-litre gasoline tax to help fund transportation projects.

With gas prices already at $1.46.9 per litre in Victoria and on the rise, consumers already are aware that fuel is a commodity that shouldn't be wasted, said O'Brien.

"I drive a little dinky car,'' she said. "Yes, OK, I'm doing some damage, but it's not a fleet of limousines and it's not cross-country flights.''

Campbell said the government is about to launch a public campaign touting its Climate Action Plan, including the carbon tax.

The B.C. premier, who calls global warming a threat to life of earth, wants to cut greenhouse gas emissions in the province by one-third by 2020. He said his plan is the most aggressive green agenda in North America.

British Columbia is already on the way to that goal, he said.

The plan includes entrenching greenhouse gas reduction targets in law and targets all sectors of the B.C. economy. Campbell said it aims to educate British Columbians on the need to fight global warming and ensure they adapt to the realities of climate change.

Last week households in B.C. began receiving a $100 Climate Action Dividend, a one-time cheque for every residents of the province aimed at funding environmental change at home.

"It is aimed at making sure that everyone is part of the solution and everyone has the opportunity to make their own choices,'' he said. "There's lots there (in the plan) that people can use to reduce their carbon footprint to save themselves literally hundreds and hundreds of dollars and for British Columbia to be out front, building an economy that is actually going to be at the leading edge of economic growth in the future.''

But at the pump, the government message doesn't appear to be getting through.

"I think it's b.s.,'' said Margaret Moon of Victoria. "If they wanted to fight climate change they should have done it a long time ago.''

She said she's not convinced that fossil fuel use is entirely responsible for global warming, citing past ice ages, and she considers the $100 government cheque a form of hush money.

"That's kind of like giving a baby candy to keep us quite for a while,'' said Moon.

Opposition New Democrat Leader Carole James opposes the Liberal carbon tax even though her party supports taxing carbon. Campbell's plan is a government tax grab that punishes consumers while allowing big industry to continue polluting, she said.

The issue has made for some strange bedfellows.

The federal Conservatives, B.C.'s fledgling Conservative party, rural politicians from northern communities, and the right-leaning Canadian Taxpayers' Federation have all joined the NDP chorus against the carbon tax.

But their opposition hasn't prevented the provincial NDP from asking British Columbians to donate their $100 to the party.

"Join me and donate your $100 tax rebate to the B.C. NDP,'' said a letter from the . "You'll be helping Carole James stop Gordon Campbell and start making real progress on climate change.''

Political scientist Dennis Pilon said the Liberals have a lot of ground to make up to with voters on the carbon tax.

The introduction of the tax suffered from too little debate and a lack of understanding of what the average Joe might think about paying more for a tank of gas, he said.

"As long as it was just the pundits and the experts, there seemed to be a broad consensus. In fact, the parties seemed to agree,'' said Pilon. "I'm sure that the Liberals thought they had really squared the circle on this policy. It seems to be there's been far too much consensus and not enough showcasing of a genuine debate here.''