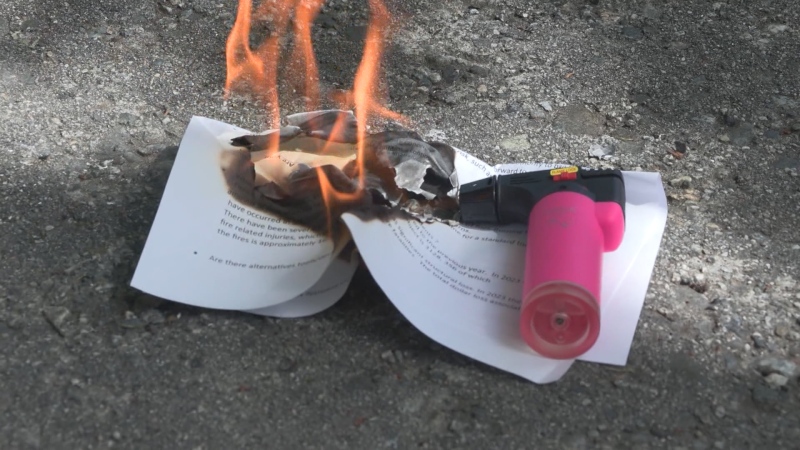

The private information of dozens of British Columbians was unearthed from a dumpster in downtown Vancouver and turned over to CTV News over the weekend.

Documents containing names, addresses, tax information, business transactions, and social insurance numbers from several firms in a Howe Street office building were visible by someone having a cigarette in the alley.

Many of the documents -- marked with phrases such as "personal and confidential" -- come from the office of Peter R.G. Roberts, a well-known accountant.

"Oh my gosh," said one of Roberts' clients, David Weinberg, whose name was on several files.

"I'll have him either return this to me or assure me that he will be changing his privacy practices going forward to assure that not just this but all of his clients' documents are properly shredded."

When reached by phone, Roberts said that he put a bag full of the documents in the dumpster on Saturday.

He said he doesn't own a shredder and believed the documents would be safe because the dumpster is secured by a padlock.

But to Vancouver's large and innovative homeless population, a lock isn't much of a safeguard.

"Guys will bend ... the lids or use rocks to pry them open," said one binner to CTV News.

"I watched a guy cut a lock off a bin with bolt cutters and he took 35 cents out of the bin, but the lock cost $19.95," he said.

Another binner said he has found personal documents in dumpsters all over the place.

"I thought, 'It was so personal, I wondered why it was put there,'" he said.

Two years ago, a CTV viewer shot a video from an apartment balcony showing hundreds of personal documents scattered in an alley. The papers included people's names, birthdates, addresses and phone numbers.

Most of the documents appeared to be from a law firm that handles ICBC personal injury claims. The firm, Simpson, Thomas and Associates, said it had no idea how the documents ended up there.

And several months earlier, B.C.'s privacy commissioner was called in to investigate after a courier company had a vehicle containing hundreds of confidential medical documents stolen.

The B.C. Crime Prevention Association says that companies and organizations are legally required to protect customers' personal information.

"Businesses need to know it's not something they should know, it's a legislated requirement that they know," said Valerie MacLean the executive director of the BCCPA. "They have to protect their clients and employees information."

The penalties for breaking the law on protecting privacy can be stiff: individuals face a maximum $10,000 fine, and companies can be fined as much as $100,000.

Among the documents found this weekend are:

- Federal T1 tax return forms from 2003 to 2008, including names, financial details, addresses, and social insurance numbers

- Federal T1013E forms, which contain names, addresses, social insurance numbers, and telephone numbers

- Property sales, which include names, addresses, prices paid for the property, and balance owing to solicitors in the deal

- Consent forms, which include names, addresses and phone numbers

- Statements of investment income, which include financial details.

- Draft statement of account, including names, addresses, and a detailed breakdown of expenses

Many of the documents appeared to be drafts or copies for records, and as such did not contain signatures. A few of the pages were hand-shredded, but for the most part the documents were intact.

One of the pages was a letter from Roberts addressed to the Institute of Chartered Accountants of B.C., which describes itself on its website as a group that fosters public confidence in the profession of chartered accountants.

Customers can protect themselves by:

- Asking what safeguards are in place to protect your personal information.

- Asking to see the company's privacy policy

- Filing a complaint with the B.C. privacy commissioner.

With reports from CTV British Columbia's David Kincaid and Jina You

| CLARIFICATION/APOLOGY |

|---|

|

We would like to clarify the identity of the Vancouver accountant at the centre of this story. The accountant is Peter R. G. Roberts, with an office on Howe Street in downtown Vancouver. The original report incorrectly referenced and included a picture of Mr. Peter W. Roberts, FCA, CPA (Illinois), ICD.D. Mr. Peter W. Roberts is no longer in public practice and had no involvement in this story. Mr. Peter W. Roberts retired as CFO of Sierra Wireless in March, 2004 and is a member of the CICA's Risk Management and Governance Board. He completed his final term as President of the Institute of Chartered Accountants of B.C. in June, 2007. He currently serves on various public company corporate boards. |