Maryann Malzone's daughter loves to dance. So when she wrote a check for Julia to take classes at a local dance studio, Maryann considered it money well spent.

That is, until the studio went bankrupt after only two classes, leaving Maryann out the $980 she had already paid in tuition.

"Just out of nowhere, they closed the doors,'' she said.

The studio where Maryann's daughter danced now sits empty. So does a storefront closed by retail giant Linens 'N Things. It's roof that even large national retailers file for bankruptcy protection.

Kim Kleman, the editor of Consumer Reports magazine, says there are several ways you can protect yourself in these shaky financial times. First, pay with a credit card - especially when leaving a deposit.

"If the business goes under before you get what you paid for, you can dispute the charge with the card issuer," said Kleman

You generally have less recourse if you paid with cash, a check, or a debit card.

Another precaution to take. Spend gift cards as soon as you can, even if there's no reason to suspect the retailer is having financial difficulties.

"If someone you're doing business with goes belly-up, all isn't lost,'' said Kleman.

If a retailer goes bankrupt, you may still be covered by the manufacturer, and if the manufacturer goes under, you still may have rights at the store where you bought the product or service."

After losing nearly a thousand dollars, Malzone has changed the way she pays.

"I try and put as much as I possibly can on my credit card."

Good advice .

Consumer Reports says if you're owed money by a company that's gone under, you can file as a priority creditor with the bankruptcy court. You may not recover much during bankruptcy proceedings, but it can be worth a try.

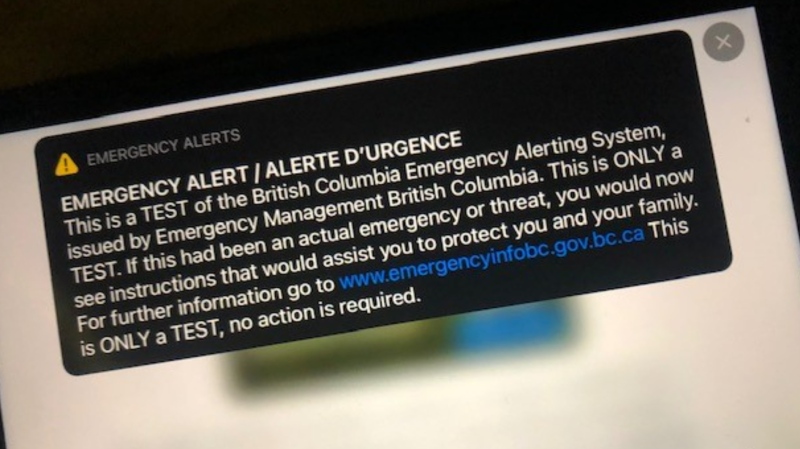

Check online for the name of the court where the company filed, or ask The B.C. Business Practices and Consumer Protection Authorityfor advice.

With a report by CTV British Columbia's Chris Olsen.