Transferring Aeroplan Points

Many of us collect travel points -- dreaming of a future vacation. But what happens to those points if you die? Two Vancouver-area women found out that transferring their husbands' points wasn't easy.

Janet Hill's husband Robert passed away last summer. He had collected Aeroplan and American Airlines points for a decade. Janet asked to have the points transferred to her name

"I got a very nice letter back from American Airlines with condolences and saying no problem we can change this over with a $50 administration fee which I thought was quite fair," explained Janet.

With Aeroplan it was a different matter.

Aeroplan's Death Transfer says that "reflecting its desire to express compassion" Aeroplan charges survivors a penny per point plus a $30 administration fee -- plus taxes.

For Janet that would be $500 dollars to transfer about 40 thousand points

"I thought that this was somewhat ludicrous considering that we had already paid for these points through travel and purchases," said Janet.

Janet is not alone

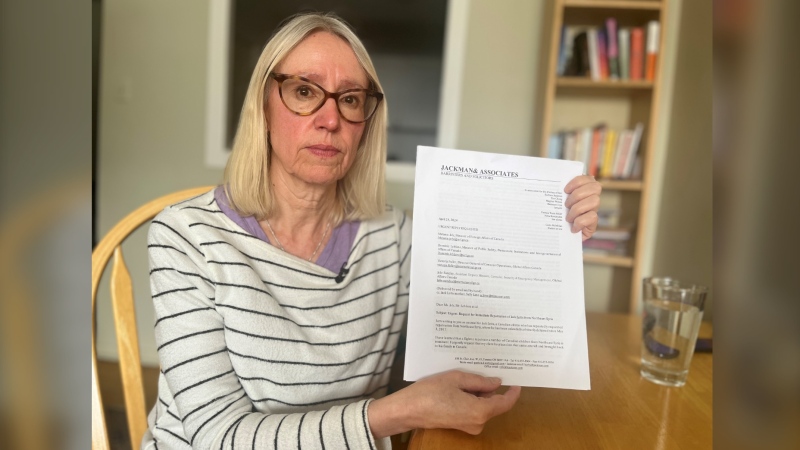

Betty Elliot is also a widow. Aeroplan wanted her to pay $2,000 to transfer her husband's

200,000 points collected on a joint Visa card.

"They said well, sorry, you don't get them unless you pay," Betty explained.

Most of the spending was on Betty's card, but the points were in her husband's name.

"They had me in tears, they had me in absolute tears," she said.

In her case Aeroplan has made an exception because there might have been a misunderstanding and is transferring the points at no charge.

As for Janet -- Aeroplan is not making an exception.

In an e-mail to CTV news, an Aeroplan representative says "if a beneficiary is allowed to claim the mileage in a deceased members account, rather than having that mileage expire, the company must find other ways to offset that cost to the business and to ensure that active members are not penalized. Aeroplan is a business and, as such, needs to demonstrate profitability."

"If they don't want to do points then don't do them. That's my word to them," responded Janet.

"You are trying to encourage people to fly but you really don't want them to, not to use the points."

Janet's decided to donate her points -- which Aeroplan allows -- for no charge.

"I refuse to pay them $500. It's not the fact of the money now it's a point of principle. Then I will donate the points to charity at least someone can get the use out of them," she said

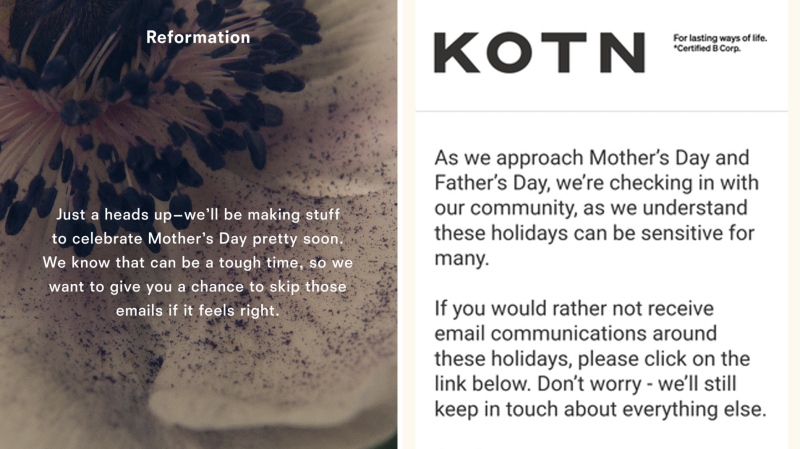

Having points expire allows many reward programs to offer larger rewards to its other members. With that in mind, make sure you are up to date on the rules of any program you're involved in so your points stay current. And remember -- they can change the rules at any time.

Help with Credit Card Debt

If you overspent during the holidays here's some advice for how to tackle that credit card debt.

Most of us pay between 18 and 20 per cent interest on the money we owe on our credit cards. And our habits -- like only paying the minimum amount each month -- can dig us deeper into debt.

For example, if you have a balance of $ 5,000 and are paying 20 per cent interest, you could make a minimum payment of just $100 dollars. If you do -- it will take you 107 months, almost nine years -- to pay it off. And you'll have paid $5,700 in interest on top of the original five thousand.

But if you took that same $5,000 and paid $200 dollars every month, you'd have that debt wiped off in 33 months and only paid $1,600 in interest-- a savings of $4,100.

To get relief from those high credit card interest rates you could consider getting a consolidation loan or transferring your balance to a low or zero interest credit card. Be warned many people end up doubling their debt because they've borrowed money for one debt but just keep on spending.

With the zero interest credit cards -- keep in mind the zero interest only applies to what you transfer in -- not to any new spending.

You could also try to negotiate with your credit card company to reduce your interest rate. Asking for a lower rate is only effective if you consistently make timely payments -- have a balance less than 30 per cent of your limit -- and have had your rate raised several times.

It might be easier to just spend less. You can't continue to spend like you have or the debt won't be paid off. To spend less -- focus on what you have - you've obviously spent the money on something you wanted or needed - so enjoy it. Spending less is like quitting smoking -- first month or two is the hardest -- after that you adjust to that lifestyle.

With a report by CTV British Columbia's Chris Olsen.