American debt settlement companies are preying on vulnerable British Columbians, and watchdog agencies are warning consumers to stay away or risk being put in an even worse financial position.

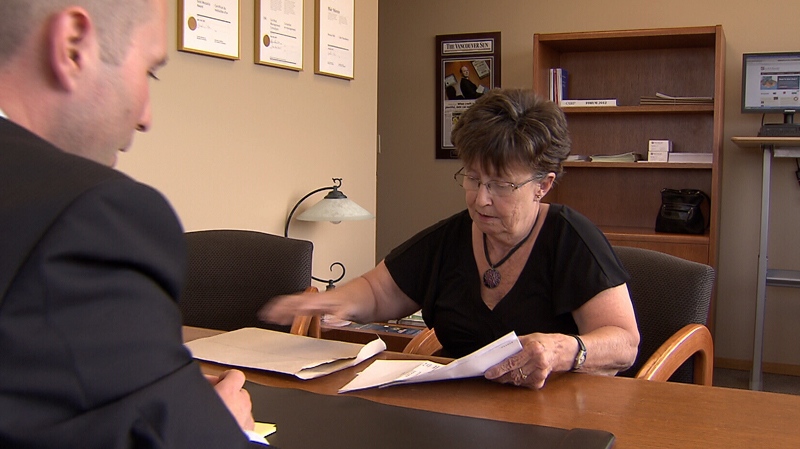

Langleysenior Suzanne Barker was called out of the blue last January by a debt settlement company called Synergy Debt Group that offered help. After suffering financial hardships for almost two decades she thought it was a lifeline.

"I felt like it was an answer to a prayer,” she told CTV’s Steele on Your Side. “I was so excited and so I signed up for it right away."

Her financial troubles began when the 66-year-old got sick in 1994 and had to quit her job. She had trouble living on her $880 dollar a month disability cheque and began using her MasterCard to make ends meet.

"I just kind of became desperate. I don't want to leave my debt for my kids and I felt really ashamed that I had gotten into that situation,” she said.

Barker owed MasterCard $10,000 and could only afford the minimum monthly payment. At that rate, it would take her 73 years to pay it off.

She set up a payment plan to Synergy Debt Group. After making five monthly payments of $233 to the debt company she received a call from MasterCard asking why she wasn’t paying her bills.

Barker said Synergy admitted that MasterCard had not agreed to its debt repayment plan, and none of the money she was sending had actually gone to her credit card but went to fees instead.

"I think they're preying on people at their most vulnerable,” she said.

Barker paid Synergy $1,200 and received $645 back, while the rest went to “fees.” The company did not respond to multiple interview requests from CTV News.

On its website, Synergy Debt Group promises to free “consumers caught in the minimum monthly payment trap,” to become debt free. It calls itself “an alternative to bankruptcy and the damages that come with it.”

Barker has now declared bankruptcy and says she just wants the process to end.

“I don't want credit. I won’t be applying for credit. I live on what I get and that's what I have to do,” she said.”

Sands & Associates bankruptcy trustee Blair Mantin, who is now settling Barker’s case, has no time for debt settlement companies like Synergy who make unrealistic claims, and promises they don't keep.

"It’s just a matter of time until each province eventually shuts them down,” he said. “But it's remarkable that B.C. doesn't seem to be doing anything, where Manitoba and Alberta have really acted to protect consumers."

The Better Business Bureau accuses Synergy of "misleading sales practices,” and warns consumers to beware.

"This is to potentially reduce your debt. There are no guarantees, so it could be putting you into a worse financial position and it could be ultimately harming your own credit reputation,” said Mark Fernandez.

B.C. intends to regulate these debt settlement companies the way other provinces do. In an email to CTV News, the Ministry of Justice said: “In order to better protect consumers and families living in poverty, the B.C. government will provide legislative changes to regulate businesses that provide debt consolidation services and regulate advance fees paid.”

Consumer Protection BC is consulting with a debt collection industry advisory group right now to determine how consumers can be better protected. Its findings will help the province decide how to rewrite the legislation.

The agency says it saw a 1,000 per cent spike in calls about debt settlement companies from last year alone.

The U.S. government now prohibits for-profit debt settlement companies from charging their clients fees before providing them with a service, such as negotiating a debt settlement for a consumer.

The Credit Counselling Society of B.C. also offers free credit counselling and money management advice to British Columbians. Learn more by clicking here.

Consumer Protection BC offers information on its website to assist consumers in making informed decisions when it comes to debt management options.

It identifies five questions for consumers who are considering a debt repayment option to consider before making a decision:

- Does the company offer to negotiate reduction in the total debt amount excluding interest?

- When are fees required to be paid to the company?

- When are payments made to the creditor?

- Is there a potential to increase the amount of debt over time during the debt repayment plan?

- What is expressly guaranteed to you and what is only indicative or set as an objective?