B.C.’s harmonized sales tax became history on Monday, but some businesses seem to be having trouble with the transition.

The return of the provincial sales tax this week was supposed to be paired with the re-implementation of some familiar tax exemptions, on items like groceries, restaurant meals, and healthy activities like gym memberships and ski passes.

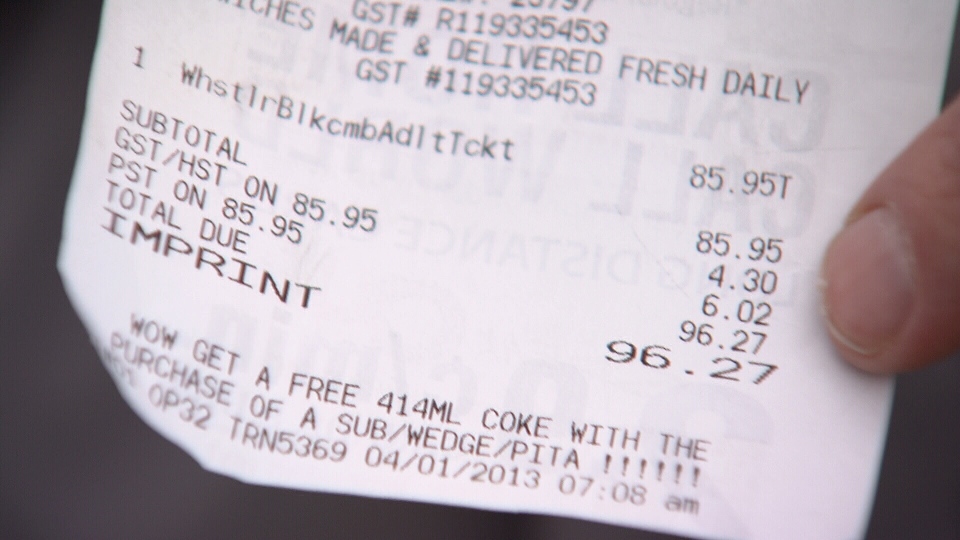

But Sean Madill found an unexpected surprise on his receipt after picking up a Whistler lift ticket from a 7-Eleven in New Westminster: a $6.02 charge for PST.

“I showed them the receipt where [the PST] was still there and they insisted no, that was right,” Madill said.

“They sell a lot of tickets for Whistler-Blackcomb, and you wonder where that money’s going to end up going.”

The convenience store’s corporate office admitted the PST was charged in error, and promised to quickly correct the apparent programming problem.

The company issued a statement saying it also “would be happy to reimburse guests who were incorrectly charged PST on ski passes at any 7-Eleven store upon receipt.”

And they’re not the only ones still working out the kinks. Roughly 20,000 businesses across B.C. still haven’t registered for the PST, though the province said it will be auditing those who don’t comply soon.

CTV News checked six Vancouver businesses Tuesday to see if they had managed to properly re-implement the old tax; two had it figured out, two were still charging HST, and there was some confusion at the others. One clerk charged PST, but promptly corrected the mistake.

Consumers who are improperly charged more than $10 in PST can get a rebate from the provincial government from filling out a form. Those charged for HST must go through the federal government. Any charges under $10 must be resolved with the business owners.

For more information on which goods and services are exempt from the PST, click here.

With a report from CTV British Columbia’s Scott Roberts