Tax notices have been sent to homeowners on Vancouver's West Side, but the problem is they're not real.

The forms received by some owners are designed to look like those sent by the province, but they're not coming from the government.

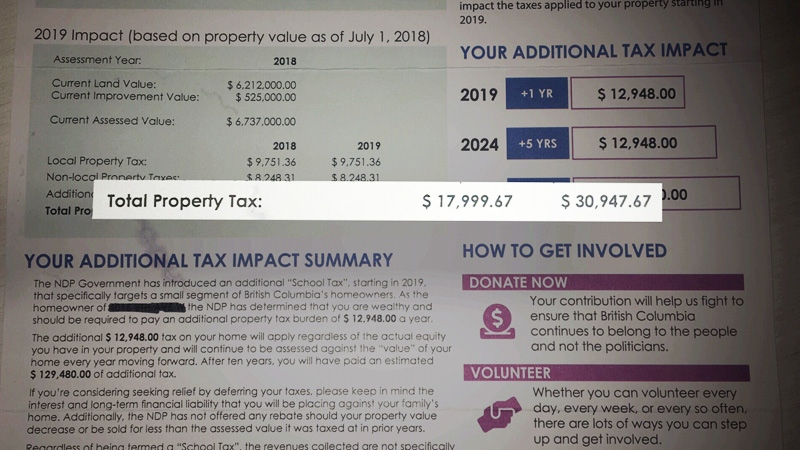

A group called Step Up Now crunched the numbers for residents of Point Grey who will be impacted by a controversial new school tax, then put forms in the mail.

The forms show the owner's latest property tax assessment, what they paid in taxes this year and what to expect next year due to the tax.

The increase was part of the NDP's 2018 budget, and impacts those with multimillion-dollar homes starting in 2019. The owners of a house worth $3 million to $4 million will see a property tax increase of 0.2 per cent. Taxes on houses worth more will be increased by 0.4 per cent.

Critics have said that the tax may appear small, because its value is less than one per cent, but its impact will be significant.

For homeowner Stephen Wiseman, he'll be paying an extra $13,000 on his $6.7-million house in the new year.

"I was pretty shocked to see this in print… I don't have the money to pay this tax," he told CTV News.

"The number on the BC Assessment sheet – like many of my neighbours, I want that to come down. We need those numbers to come down."

The group behind the notices did not provide a comment to CTV, but Wiseman said many members aren't affected by the school tax, just opposed to it.

"All of a sudden with these tax rates, doctors, lawyers, accountants, other professionals are really wondering where they're going to come up with the money to stay in their own house," he said.

"It really does cause a lot of division within the community."

While some -- including those 55 and older, retirees and parents of children – can defer the tax, Wiseman doesn't fit the criteria. He says he may have to sell his home, but is worried a foreign buyer would scoop it up and build something bigger, changing the neighbourhood.

The tax is not based on whether an owner's family uses the public or private school system, but is meant to help fund education for all B.C. residents.

Beedie School of Business finance professor Andrey Pavlov said another reason it's substantial is that it will be the same every year, unlike taxes tied to income or sale of an asset.

"This is a tax that is due completely on the value of the asset, so it's an asset tax that is due regardless of whether you make money or not," Pavlov said.

It's a move that has sparked protests in areas, including Point Grey, where some residents suggested David Eby be recalled.

The MLA said earlier this year that he was elected in part because of his commitment to deal with the housing crisis that has affected the community.

Eby was not able to provide a comment on Tuesday, but the Ministry of Finance provided a statement on the fake notices.

"This is inappropriate, misleading and could result in harm to homeowners. We will take appropriate measures with the organization," the ministry said.

"The letters being distributed are not official provincial government documents and have no legal effect to impose tax liability on property owners."

The ministry asks homeowners who've received a fake assessment to either disregard it or report it to BC Assessment. Real notices will be mailed in January.

With a report from CTV Vancouver's Allison Hurst