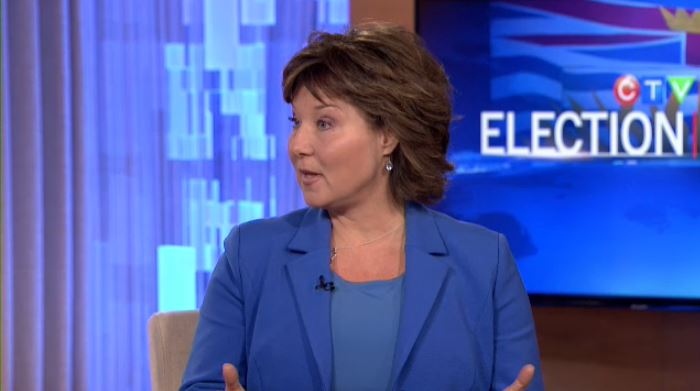

VANCOUVER -- Liberal leader Christy Clark is defending a little-known tax rebate program meant to attract international business to British Columbia that allowed TD Bank to claim a $2.8-million refund.

Her government had challenged the company's claim for a refund in court because TD filed its paperwork a day late. The Court of Appeal ruled last month that B.C. must reconsider the bank's request for a time extension to claim the refund.

Clark said on Friday the International Business Activity Act, first launched under a Social Credit government in 1988, has created more revenue than it has cost and it's aimed at luring companies to B.C.

"The evidence tells us it's helping create jobs in British Columbia," she said. "The evidence tells us that it's been a good investment. We need to grow those programs ... that are aimed at attracting head offices from around the world to Vancouver."

She said the jobs are high-paying and are often in financial services or the legal industry.

The program came under scrutiny this week after a story was published by the New York Times saying it created fewer than 300 jobs while giving $140 million in refunds since 2008.

However, the Liberal party said a study by the government found the program created 1,140 jobs between 2004 and 2007.

The NDP said in a statement that residents deserve answers about a program that allows unnamed corporations to receive an unknown amount of taxpayer money with no discernible benefits for B.C.

NDP candidate David Eby called for the auditor general to investigate the program, calling it a "shady corporate giveaway scheme."

"Every day, it's getting harder and more expensive to live in B.C., and the only people getting ahead are Christy Clark and her rich friends," said Eby in a statement. "British Columbians deserve to know how much of their hard-earned tax dollars Christy Clark has secretly handed to rich donors."

Clark pointed out that the program existed while the NDP was in power in the 1990s.

The NDP alleged that the program grew under the B.C. Liberals in 2004 and 2010, allowing for larger tax breaks and expanding the types of corporations and financial activities eligible.