Older drivers are paying hundreds more in annual ICBC premiums than they should to subsidize "younger, riskier" motorists, according to a new report from the right-leaning Fraser Institute.

Report author John Chant said there's evidence crash rates vary wildly between different age groups, yet B.C.'s public insurer charges drivers the same basic rate whether they're young or old.

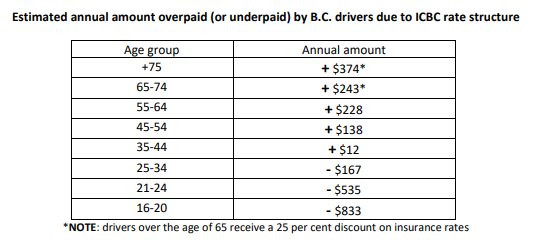

As a result, the Fraser Institute estimates drivers who are 55-64 overpay by $228 annually, while drivers 16-20 underpay by a whopping $833.

"Everyone over 35 subsidizes young drivers," Chant told CTV News. "The difference in accidents for very young drivers relative to older drivers is so great, that it’s not fair for the older drivers to have to bear the burden."

Drivers who are 75 and up overpay by $374, according to his report, and those 21-24 underpay by an estimated $535.

If ICBC were to begin charging premiums based on age, Chant acknowledged there would be young people who are careful behind the wheel getting penalized.

"I think that's better than having a whole class of people being subsidized by drivers at large," he added.

The Fraser Institute's figures come as the provincial government prepares to introduce major changes to ICBC premiums in the interest of "making rates more fair." The new system, which is set to take effect next year, will give drivers deeper discounts for having a clean record, and bigger penalties for at-fault crashes.

The current basic insurance discount for inexperienced drivers will also be reduced, and there will be a new add-on for learning drivers ranging from $130-$230 per year, depending on where they live.

"Our government and ICBC are changing our 30-year-old insurance system to ensure that all drivers pay rates that more accurately reflect the risk they represent on the road," Attorney General David Eby said in an email statement.

The changes are also revenue neutral, according to the province.

Chant said he supports those changes, but that more is needed to make the system truly fair.

"I think they're a good start," Chant said. "The increase in rates for people who have poor driving records, I think, is very important. Really what I'm talking about is some more work that could be done on top of that."

According to his report, ICBC's premiums are also being affected by the Crown corporation's duties that aren’t related to insurance, including driver testing, licensing and fine collection.

Those add an estimated $50 annually to every driver's insurance, the Fraser Institute said.

With files from CTV Vancouver's Nafeesa Karim