A real estate forum in Victoria heard from two ex-premiers on Tuesday -- Mike Harcourt and Brad Wall -- who said British Columbia's government needs to do more to cool sky-high urban housing prices than just increase taxes.

In the February budget, the NDP created a new speculation tax targeting homes bought by foreigners and speculators who don't currently pay taxes in a bid to stabilize B.C.'s hot housing market. It also increased the property transfer tax and school tax on homes worth more than $3 million.

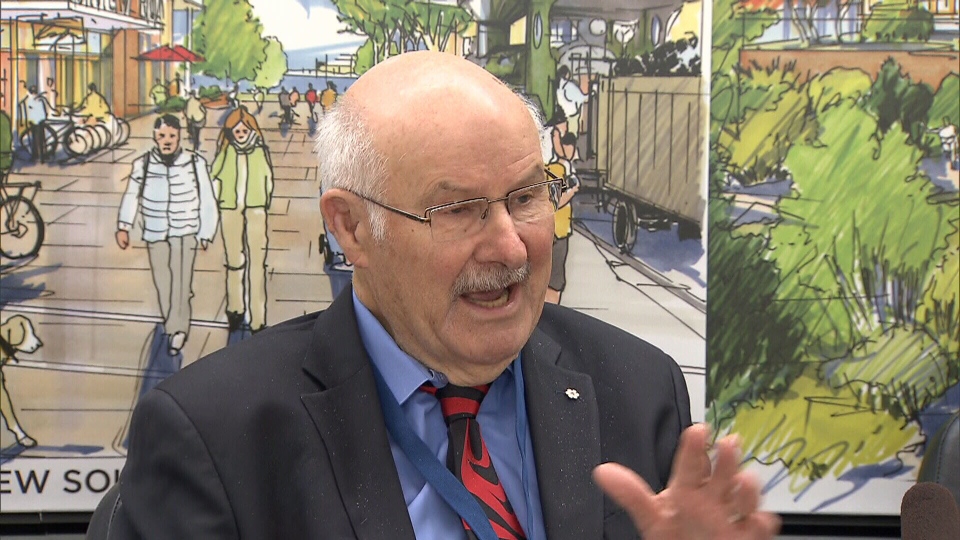

But Harcourt, who served as the province's NDP premier from 1991 to 1996 and Vancouver's mayor from 1980 to 1986, says the double whammy of increased school and housing taxes is a "bad idea."

"To then add a school tax on [top of] expensive housing is already piling on what I think is unfair," said Harcourt on Tuesday. "Some form of speculation tax, I don't have a problem with. But I think this needs the famous second look."

Harcourt suggested a mere 0.25 per cent increase on the income tax of the wealthiest two per cent would be enough to cover "all the funds that are coming out of this school tax. So, there are other ways we could do it that are fairer."

He also said the "age of (the) single family house is over," and neighbourhoods should no longer be zoned as such. Homes close to schools and transit corridors should also be zoned for town houses and other high-density residences with two to three bedrooms.

Former Saskatchewan premier Brad Wall said the speculation tax might also give the impression that B.C. isn't open to investment.

"I've got folks at home -- lots of people in Swift Current Saskatchewan -- who have property in some of the targeted areas of the [B.C.] speculation tax, and they... don't necessarily feel very welcome anymore."

The discussion on housing, held at the sixth annual Kenneth W. and Patricia Mariash Global Issues Dialogue, was sponsored by a Victoria-based real estate development company, Focus Equities.

Developer Kenneth Mariash said in a press release that eliminating delays in zoning and construction permits would reduce prices faster than speculation taxes by dramatically increasing housing supply.

"The speculation tax is shutting down sales, presales and stalling the market.... Buyers are disappearing. The government policy is intended to make everyone’s house 25 per cent lower in price, so a $400,000 home will then be worth $300,000 or less," he added.

The Horgan government made changes in March to its speculation tax following criticisms the policy was hurting owners of rural cabins and vacation homes. The tax was tweaked to more directly target empty homes in urban areas. Homes valued at less than $400,000 also won't have to pay.

With files from Bhinder Sajan