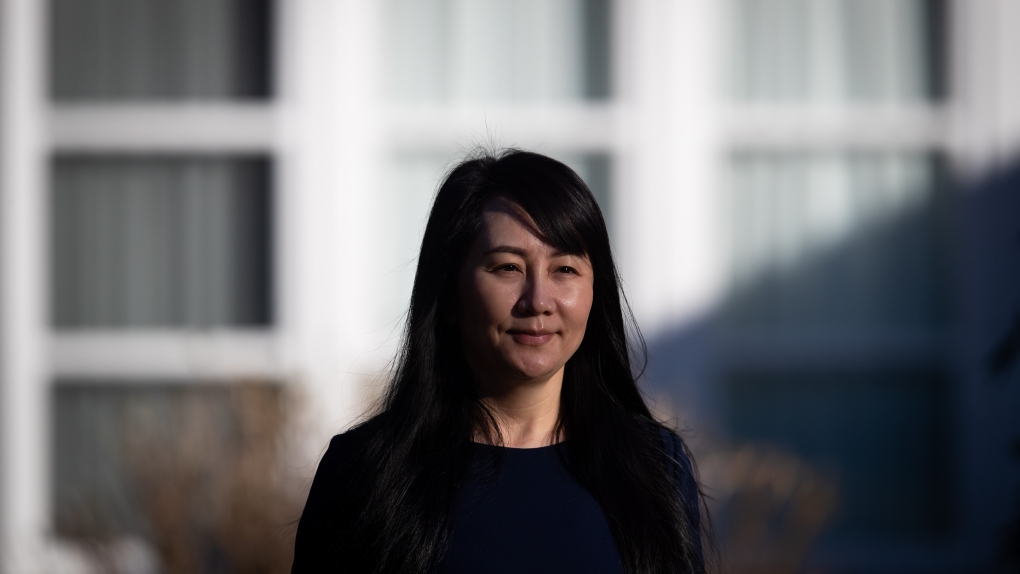

VANCOUVER -- A lawyer for Huawei's chief financial officer says there's no evidence that international bank HSBC suffered an increased risk of loan loss as a result of Meng Wanzhou's alleged actions.

Frank Addario made the comment as he asked a B.C. Supreme Court judge to admit new evidence in Meng's extradition case.

“There was never any risk the bank could incur a loss,” Addario said, before receiving pushback from both the judge and a lawyer for Canada's attorney general.

Meng was arrested at Vancouver's airport in 2018 at the request of the United States to face fraud charges that both she and Huawei deny.

She is accused of misrepresenting Huawei's control over technology company Skycom in a 2013 presentation to HSBC, putting the bank at risk of violating U.S. sanctions against Iran.

On Monday, the B.C. Supreme Court entered the second in seven weeks of argument in Meng's case, which culminates in an actual extradition or committal hearing in May.

The evidence her team wants to introduce is an affidavit from an accountant that details credit facilities and loans issued between 2013 and 2017.

Court documents from Meng's team outlining the proposed evidence say that HSBC executed the first loan one week before Meng's presentation, so they argue the bank could not have been influenced by it. The next two loans were issued to Huawei subsidiaries, and her lawyers say that suggests they were too far removed from the sanction violation risks.

HSBC was not a lender in the final syndicated loan.

Associate Chief Justice Heather Holmes challenged Addario's assessment of why the loans were mentioned by the United States in the record of the case in the first place.

The United States appears to rely on a casual link that is “framed broadly” rather than alleging that a particular loan was sought on the basis of a particular representation that turned out to be false, putting that loan at risk, Holmes said.

“It's much broader, which is a banking relationship that was continued because of the alleged misrepresentation and therefore all loans made within that banking relationship were at risk,” Holmes said.

Addario responded that he did not believe that the specifics of how the loans might be at risk had been “settled.”

Holmes also suggested that fraud law recognizes inherent risk in any loan, even when it is repaid.

A lawyer representing Canada's attorney general described the proposed evidence as “irrelevant” and urged the judge to reject it.

Robert Frater argued the evidence shows the bank didn't lose money on the loans, but doesn't speak to risk.

“The evidence I would submit is capable of showing Huawei is not a deadbeat and the banks are doing just fine,” Frater said.

“Do either of those facts help you with any issue that would be relevant to committal? We say they don't.”

Arguments over fraud law should be argued at the extradition hearing, but excluding the proposed evidence wouldn't weaken Meng's argument at that stage anyway, Frater said.

Deprivation involves a risk of economic loss and the requesting state does not have to prove actual loss, he said.

The “most alarming” part of Addario's submission was it was the last “scheduled” application to introduce new evidence, rather than the last application, period, he said.

“In our submission it has no merit, it's time to move on to committal,” Frater said.

The court adjourned until Wednesday, when arguments will begin in a crucial leg of the case.

The conduct of Canadian police and border officers will face the court's scrutiny as Meng's team begins arguments that her charter rights were violated during her questioning and arrest at Vancouver's airport.

They allege Meng was subjected to an abuse of process and proceedings should be stayed, while officers have testified they acted appropriately.

This report by The Canadian Press was first published March 15, 2021.