Growing number of unpaid medical bills at Metro Vancouver hospitals

Metro Vancouver hospitals are facing an increase in non-residents receiving emergency care and skipping out on the bill, CTV News has learned.

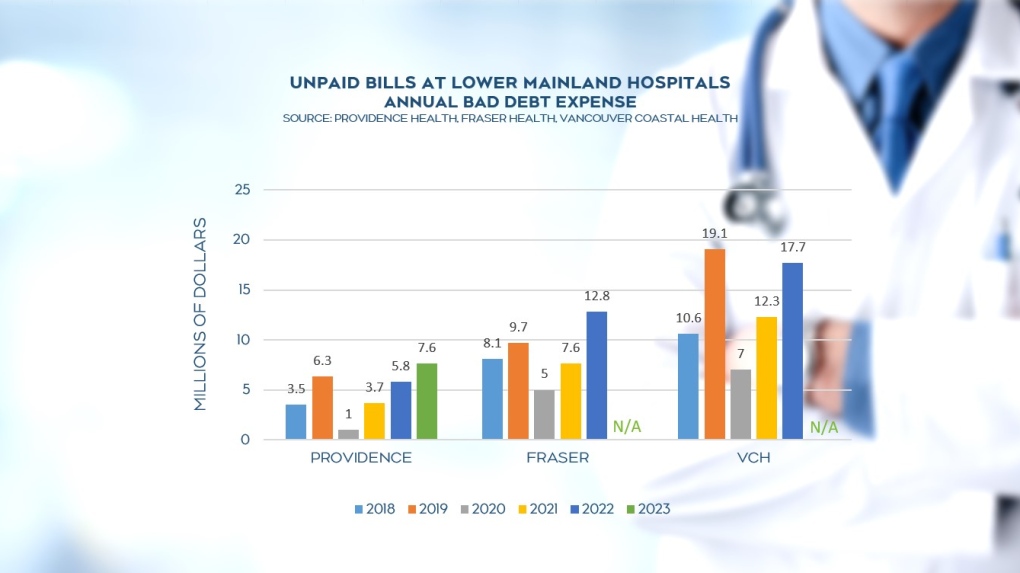

The three B.C. health authorities that operate hospitals in the Lower Mainland have observed a growing number of unpaid hospital bills. In the 2018/19 fiscal year, Providence, Fraser, and Vancouver Coastal Health had $22.2 million outstanding, and in 2022-23 that had ballooned to $36.3 million.

The three B.C. health authorities that operate hospitals in the Lower Mainland have observed a growing number of unpaid hospital bills.

The three B.C. health authorities that operate hospitals in the Lower Mainland have observed a growing number of unpaid hospital bills.

About one third of the invoices issued to “non-residents of Canada” went unpaid across the region; the agencies said they do not keep track of country of origin nor the procedures required.

“They’re going up consistent with population increases and we do everything we can to avoid it, obviously,” said health minister, Adrian Dix, in a one-on-one interview with CTV News.

He emphasized while hospital staff always attempt pre-payment, in medical emergencies that’s not always possible and that given the limited collections options, “we’re not going to be able to totally eliminate that, I think people understand that.”

Until they’re considered “unrecoverable”, the rollover carrying costs of those unpaid bills can be considerable. Fraser Health went from $33 million (in 2018/19 fiscal) to $43 million (2022/23) in its accounts receivable balance, while Providence went from $23 million to $42 million in the same time period.

No one denied care

Dix echoed the health authorities’ statements that no patient would be denied care, particularly emergency medical care, with Providence Health Care stressing, “No one is denied care, and we are proud of that approach. We take this approach seriously.”

In Fraser Health, which has seen a surge compared to pre-pandemic levels, the health authority says that’s “partially attributed to a rise in immigration and the resurgence of travel after years of restrictions.” All health authorities say they provide options for payment and try to work with the patients to find a resolution.

Vancouver Coastal Health was the only health authority of the three to show a decrease in bad debt since before the pandemic began, but is still posting the highest figure with nearly $18 million outstanding in 2022/23.

“VCH will work with people with unpaid hospital bills and their insurance companies to ensure payments, with debt collection agencies and/or court proceedings as a final resort,” wrote a spokesperson. “In some cases, VCH may enter into payment plans with patients to recover the debt owed.”

That health authority includes most of the region’s tourist hotspots and Vancouver General Hospital, the largest in the province. Providence Health oversees just two acute care facilities hospitals, Mount Saint Joseph and St. Paul’s Hospital. The latter is in downtown Vancouver and is the closest to the cruise ship terminal.

Treatment is pricey

Dix pointed out that while people should have travel insurance, that’s not always the case and can lead to hefty bills.

A heart attack, for example, that requires cardiac catheterization and three or four days in intensive care, could easily cost $50,000 for someone without health insurance.

Canadians with medical emergencies in B.C. don’t have to pay since the provinces have mutual compensation agreements.

“Our collections are generally very thoughtful and work with people to pay their debts,” Dix said. “We have to be open, when people come here, to provide particularly emergency medical care just like if Canadians go down to a Seahawks game break a leg, they’d expect care down there. And occasionally, I’m sure Canadians leave debts behind as well.”

CTVNews.ca Top Stories

Can the Governor General do what Pierre Poilievre is asking? This expert says no

A historically difficult week for Prime Minister Justin Trudeau and his Liberal government ended with a renewed push from Conservative Leader Pierre Poilievre to topple this government – this time in the form a letter to the Governor General.

Two U.S. Navy pilots shot down over Red Sea in apparent 'friendly fire' incident, U.S. military says

Two U.S. Navy pilots were shot down Sunday over the Red Sea in an apparent 'friendly fire' incident, the U.S military said, marking the most serious incident to threaten troops in over a year of America targeting Yemen's Houthi rebels.

Ottawa MP Mona Fortier appointed chief government whip

Ottawa-Vanier MP Mona Fortier has been appointed as chief government whip, the latest addition in a major reshuffle of Prime Minister Justin Trudeau's cabinet.

opinion Tom Mulcair: Prime Minister Justin Trudeau's train wreck of a final act

In his latest column for CTVNews.ca, former NDP leader and political analyst Tom Mulcair puts a spotlight on the 'spectacular failure' of Prime Minister Justin Trudeau's final act on the political stage.

B.C. mayor gets calls from across Canada about 'crazy' plan to recruit doctors

A British Columbia community's "out-of-the-box" plan to ease its family doctor shortage by hiring physicians as city employees is sparking interest from across Canada, says Colwood Mayor Doug Kobayashi.

Bluesky finds with growth comes growing pains - and bots

Bluesky has seen its user base soar since the U.S. presidential election, boosted by people seeking refuge from Elon Musk's X, which they view as increasingly leaning too far to the right given its owner's support of U.S. president-elect Donald Trump, or wanting an alternative to Meta's Threads and its algorithms.

'There’s no support': Domestic abuse survivor shares difficulties leaving her relationship

An Edmonton woman who tried to flee an abusive relationship ended up back where she started in part due to a lack of shelter space.

opinion King Charles' Christmas: Who's in and who's out this year?

Christmas 2024 is set to be a Christmas like no other for the Royal Family, says royal commentator Afua Hagan. King Charles III has initiated the most important and significant transformation of royal Christmas celebrations in decades.

OPP find wanted man by chance in eastern Ontario home, seize $50K worth of drugs

A wanted eastern Ontario man was found with $50,000 worth of drugs and cash on him in a home in Bancroft, Ont. on Friday morning, according to the Ontario Provincial Police (OPP).