The refusal by a downtown Vancouver casino to accept money from a popular Canadian rapper – something that sparked an extraordinary online backlash – was because the casino was following the letter of B.C.’s new anti-money laundering rules, sources tell CTV News.

Drake was able to gamble for a short time at Parq casino early Saturday morning, but ran up against rules that force cash-carrying customers to declare the source of their funds if they try and spend $10,000 or more in a visit.

Attorney General David Eby oversees the application of the new rules, which have been in effect since January. He told reporters in Victoria that he was not going to comment on Drake’s case specifically because of privacy, but referred to the rules repeatedly.

“The new rules that we have in B.C. are meant to apply universally. Every person that goes into one is subject to the same rules and they apply without exception,” Eby said.

The money laundering rules were put in place after a report by lawyer and former RCMP executive Peter German revealed that millions of dollars were laundered through B.C. casinos by organized criminals.

An earlier audit revealed that about $13.5 million in $20 bills was accepted at Great Canadian’s River Rock Casino in July 2015.

Now, casinos must ask for the source of any cash transaction of $10,000 or more. Eby said the new rules have resulted in a decline of suspicious cash transactions by 99 per cent.

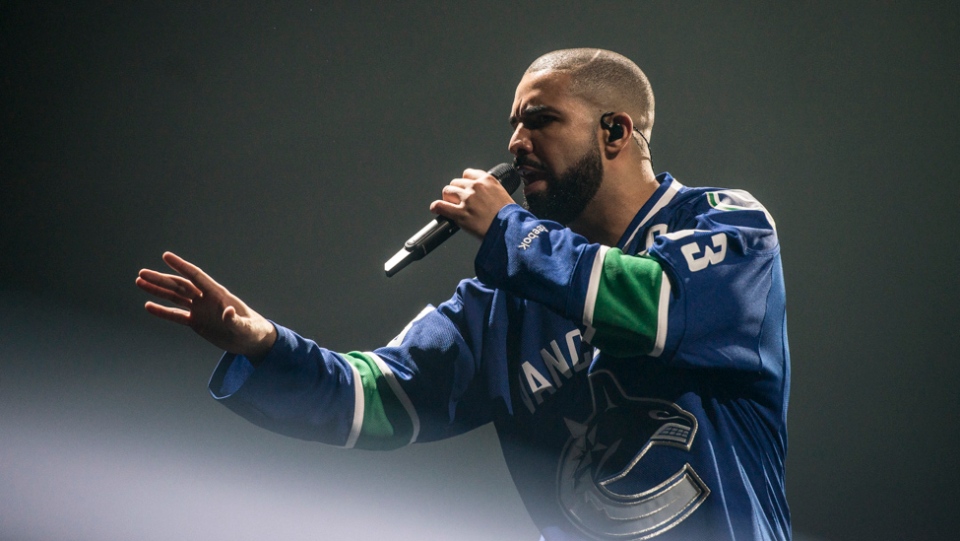

That appears to be the rule that Drake, whose full name is Aubrey Graham, ran afoul of early Saturday morning. After leaving the casino, he posted to Instagram, “Parq Casino is the worst run business I have ever witnessed…profiling me and not allowing me to gamble when I had everything they originally asked for.”

Fans swarmed Parq’s reviews on sites like Yelp, prompting an “unusual activity alert” and disabled posts. Over on Instagram, Parq’s page mysteriously went down on Sunday before resurfacing Monday.

A Reddit post circulating by someone who claimed to be an employee of Parq, confirmed by one source to CTV News, claimed that “the minute Drake walked in, everyone knew exactly who he was.”

The author says Drake gambled first with just under $10,000 cash, which would have been the maximum the casino could have accepted to avoid any disclosure requirements.

Then he used money sent to him through a wire transfer, which was also accepted as the casino could see the source of those funds.

But on his third trip to the cashier, he tried cash again, which put him over the $10,000 threshold and he was refused.

Another source told CTV News that the pattern of showing up with cash, spending it, and returning with more is a pattern of those using loan sharks.

And just because Drake is wealthy is not an acceptable demonstration of the source of that particular cash, which needs to be documented, another source said.

The source of funds declaration form used by any casino licensed by BCLC requires identification, an explanation of where the money came from, the name of the financial institution, the branch and account number, as well as a receipt.

That has been onerous for some clients, sources say.

But reducing the requirements is not something the casino industry is looking to do, said Paul Burns, the CEO of the Canadian Gaming Association.

“The rules on source of funds are the toughest in North America,” said Burns. “The reality is they follow the rules. The rules on source of funds are stringent in particular.”

The casino has apologized to Drake and promised an investigation into what happened.