VANCOUVER -- The Better Business Bureau of Mainland B.C. is warning consumers to be on guard when using peer-to-peer payment apps.

“With these specific peer-to-peer platforms it’s really supposed to be used for transactions between people in your network, people you know and people you know personally,” said Karla Lair, the organization’s local spokesperson. They should only be used with people you trust.

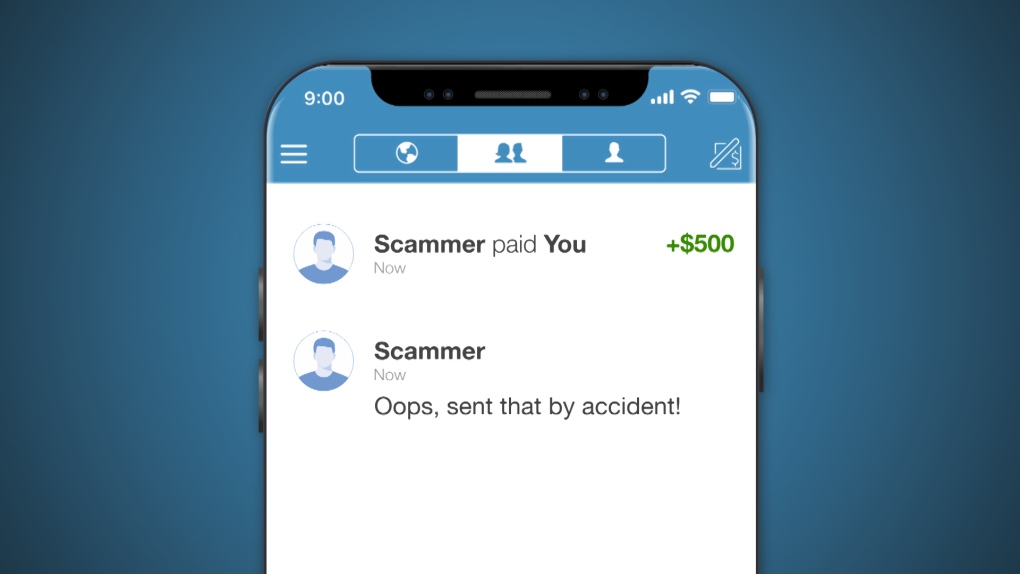

Laird says the BBB has received five complaints from consumers who were victimized when someone “accidentally” sent them money through the peer-to-peer payment apps.

The consumers each received hundreds of dollars in their accounts, according to the BBB, then got a message saying it had been sent in error. After the consumers sent the money back, they discovered that they had been the victims of fraud.

The BBB says culprits are using stolen credit cards to send the money and that it can take a while before the transaction is determined to be fraudulent, leaving consumers on the hook for the money they send back.

If you get money “mistakenly” sent to you through any peer-to-peer payment app and the person who sent it asks for it back, just tell the sender to ask the vendor to cancel the transaction. If the sender puts up a fuss and refuses, the best thing you can do is just leave the money in your account.

If it was truly an error, the vendor can get the transaction reversed. If it’s fraud, the vendor will reverse the transaction and take the money back, deducting it from your account.

Here are some of the BBB’s tips to protect yourself from fraud when using pay peer-to-peer pay apps:

- Only send to trusted contacts and double check the credentials before hitting send.

- Don’t use peer-to-peer pay apps to receive money for items you’re selling online. Try selling your items on platforms like Etsy, eBay and Amazon that offer payment methods like PayPal, with protections when things go wrong.

- Avoid linking directly to a bank account to make payments. A credit card offers more protections.

- Don’t let a stranger borrow your mobile phone. They could fake a call then say the party is not picking up and ask to send a text, all while launching your peer-to-peer pay app and sending money out.

- Enable digital security settings, such a multi-factor authentication, requiring a fingerprint or PIN to complete the transaction.