VANCOUVER -- COVID-19 has grounded travellers all over the world, and many who bought annual insurance policies for medical emergencies are wondering how to get their money back or secure an extension.

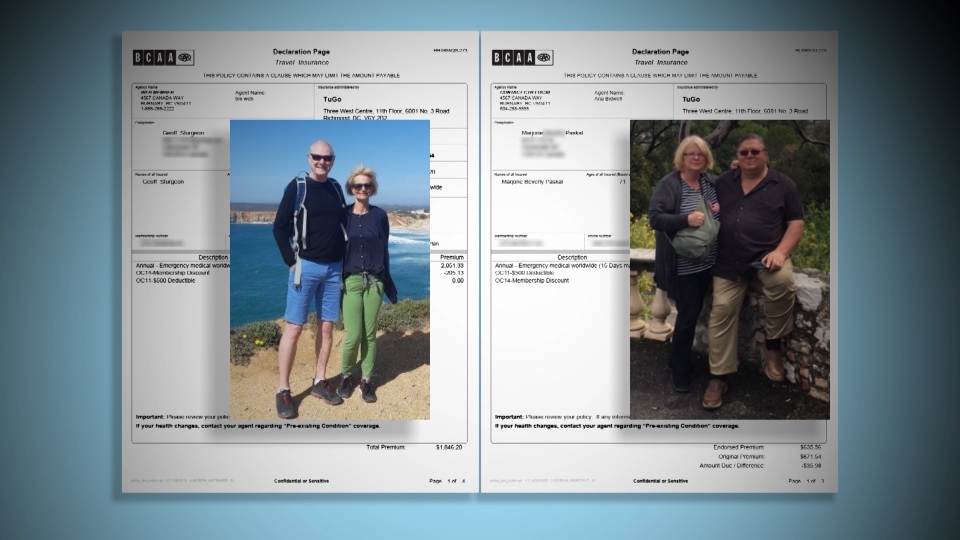

Vancouver's Geoff Sturgeon and his wife spent $2,157 on a year-long medical emergency health insurance plan that covers them for up to 60 days at a time on multiple trips outside the country. In March, because of the pandemic, they cut short a European vacation and returned home. Now, they’re grounded with nowhere to go.

"What we were looking for is an extension on our next year's policy," Sturgeon told CTV News Vancouver.

Another couple, Marjorie Paskal and her husband, paid $1,139 for an annual policy to cover them for trips up to 15 days at a time. It expires Jan. 1, 2021 but now they can't take the European river cruise they had planned for this summer and aren't sure when travel restrictions will be lifted.

"It's not just me that's involved here," said Paskal. "It's a lot of people that have paid for their health insurance for the year and can't go anywhere because of the virus."

Both couples purchased policies through BCAA and both are dministered by a Richmond company, Tugo.

But when they asked for a refund, the Paskals told CTV News they were not happy with the response from BCAA.

"They said no. Just bluntly — no," Paskal said. "I would expect insurance companies to be a little more considerate of people's situations. Viking Cruises, who we booked with this year for a really nice cruise, they gave us all our money back without a problem."

Sturgeon said: "I think it's just basic fairness."

Will McAleer of the Travel Health Insurance Association of Canada said problems with these annual medical emergency polices are now being addressed by insurers.

"We've seen a wide range of movement amongst the members to allow for some flexibility on those policies," he said.

CTV News Vancouver reached out to BCAA and Tugo about this issue.

Tugo responded in an email, explaining consumers could get refunds or vouchers for single-trip emergency coverage for trips that hadn't occurred. Alternatively, if they came home early from a trip, travellers could get a voucher or refund for the unused portion of the coverage as long as no claims were going to be made.

As for those annual emergency medical plans, the company said if the consumer had travelled on the policy, there would be no refunds.

BCAA says the 90-day window to cancel the policy had passed for the Paskals because they had been waiting for the final word from the cruise line on their trip.

After an email exchange between CTV News and the agencies, the situation was reassessed. The insurer recognized the Paskals' unique situation.

"We were working with Tugo, our travel underwriter, and are really happy to report we totally understand her perspective and wanted to provide her a refund in this situation," said Meghan Hill, a senior manager with BCAA customer service.

"That would be great," said Paskal, "but why did they have to wait until [CTV News] called them to do that?"

BCAA said they had been working on it since last week when Paskal first asked that her case to be escalated.

The Sturgeons' situation was a bit different, since the couple had already travelled on their policy. BCAA says the value of the coverage for that trip was significant but still recognizes that the couple may not be able to take the trips they had planned for this year and has offered to be flexible.

"Geoff [Sturgeon] still has plans upcoming, and so we left the door open that if he's not able to go on those trips and is looking for an accommodation to be made, we certainly are happy to do that for him," said Hill.

The Travel Health Insurance Association of Canada says these are unique circumstances and recommends that consumers contact their insurers to work things out.

"We certainly encourage a traveller to call in to that provider and to talk about the circumstances around that to see what type of credit they can get," McAleer said.

To be fair, many insurance companies like Tugo did adjust early in the crisis and did extend policies and coverage to help people get home while still covered. But there are bound to be lingering issues that come up as the dust settles around the impact of the pandemic.

More detail from Tugo on cancellations and refunds:

For TuGo® Travel Insurance:

• If a traveller decided not to go on their trip and the policy has not gone into effect, a full refund, or a voucher for the full refund amount may be available to them.

• Single Trip Emergency Medical: If they returned early from the trip, a voucher or refund is available for the unused number of days on the emergency medical policy, as long as the traveller didn’t claim or have any intention of claiming on the policy.

• Annual Emergency Medical Plan: If they have travelled on an annual policy, refunds are not available. However, if they bought an extension to a Multi Trip Annual policy (for example, added an extra week to your 10-day annual policy trip length), they may be able to get a refund or voucher.

• If the traveller chooses the voucher option over a refund, they’ll receive a minimum of 10% more days added to their future travel policy.