VANCOUVER -- Homeowners have started receiving notices of their property's most current assessed value from BC Assessment, and while the number is down for nearly every property in the region, they'll likely be paying more in property taxes anyway.

Both detached homes and strata properties are down as much as 16 per cent throughout Metro Vancouver, with some values holding steady without any change and the prices holding steadier the further a property is from the city of Vancouver.

West Vancouver and the University Endowment Lands saw the biggest drop at 16 per cent for detached homes, while the city of Vancouver is down 10 per cent overall and Surrey's overall residential values are down just four per cent.

"Homes located in Whistler and Pemberton can expect a minimal increase in their assessments whereas the rest of the region will likely experience a reduced assessment value," said BC Assessment Deputy Assessor, Brian Smith, in a press release.

BC Assessment is responsible for determining the value of all properties in the province so that municipalities can determine the share of the property tax burden each owner must pay.

The provincial government is taking credit for the slump in values, insisting their policies are helping make the region more affordable.

"For too long, the previous government sat back and watched housing prices climb well out of the reach of average people," said housing minister Selina Robinson.

"We are encouraged by signs that property values are continuing to stabilize, giving more certainty for those investing in multi-family buildings, more stability for current homeowners and improved opportunity for those entering the market."

But housing analyst and SFU urban planning professor, Andy Yan, believes policy implementations from all levels of government in addition to tougher mortgage requirements are all responsible for the slow and reasonable return to “normal.”

"One has to really note the changes in terms of mortgage reforms as well as local and provincial taxation that really started three years ago and perhaps are coming into full play right now," said Yan.

While property values help determine a home's property taxes, a lower value doesn't mean you'll be paying less in property taxes.

"As noted on your assessment notice, how your assessment changes relative to the average change in your community is what may affect your property taxes," said Smith.

Cities throughout the region finalized their budgets and their property tax rates last month and those budgets don’t change based on the value of their constituents’ properties, so the amount homeowners pay will be recalculated based on relative values. For example, if the home values dropped 10 per cent in your community, but your home dropped by 13 per cent, it’s possible your tax bill could stay the same or even dip a little.

But considering the City of Vancouver alone has approved a seven per cent tax hike for 2020, the likelihood of paying less in property taxes this year is slim.

Homeowners can learn the value of your home without waiting for a mailed assessment by visiting BC Assessment online. They can compare their value to their city or even their neighbourhood with this interactive tool. Appeals can be filed here.

Both BC Assessment and Yan are emphasizing that the assessed value has no bearing on a homeowner’s mortgage, that the impact on resale value is debatable, and that the evaluations should really be seen as a barometer of the housing market – one that’s showing signs of stability after years of volatile growth.

“This is a breather, if you will, a chance for some to consider getting into the market and looking at what they can afford in something of a stable and, dare I say, normal kind of way," said Yan.

“This is really a kind of recalibration to normal."

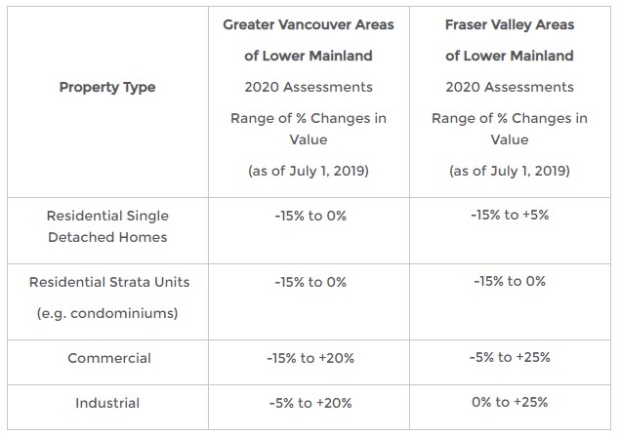

Lower Mainland's estimated range of percentage changes to 2020 assessment values by property type compared to 2019. (BC Assessment)