Short-term rental website Airbnb will be responsible for collecting taxes from B.C. homeowners as part of an agreement between the company and the province.

Finance Minister Carole James announced Wednesday that provincial sales and local tourism taxes will be collected through Airbnb's platform.

Once regulations are in place, Airbnb will collect 8 per cent PST and up to 3 per cent municipal and regional district sales tax on all accommodations rented out through its site.

The province estimated there are approximately 18,500 Airbnb listings in B.C., which could have brought in about $18 million in sales taxes had the legislation been in place last year.

"Through global offices and online transactions, these companies have taken root outside our tax system," James said.

"We need to ensure that businesses and those taking part in the sharing economy are paying their share in taxes."

The province plans to use some of the tax dollars collected by Airbnb to help fund affordable housing initiatives across the province.

About $16 million in PST will go to the province for housing, while approximately $5 million in tourism taxes will go to local governments.

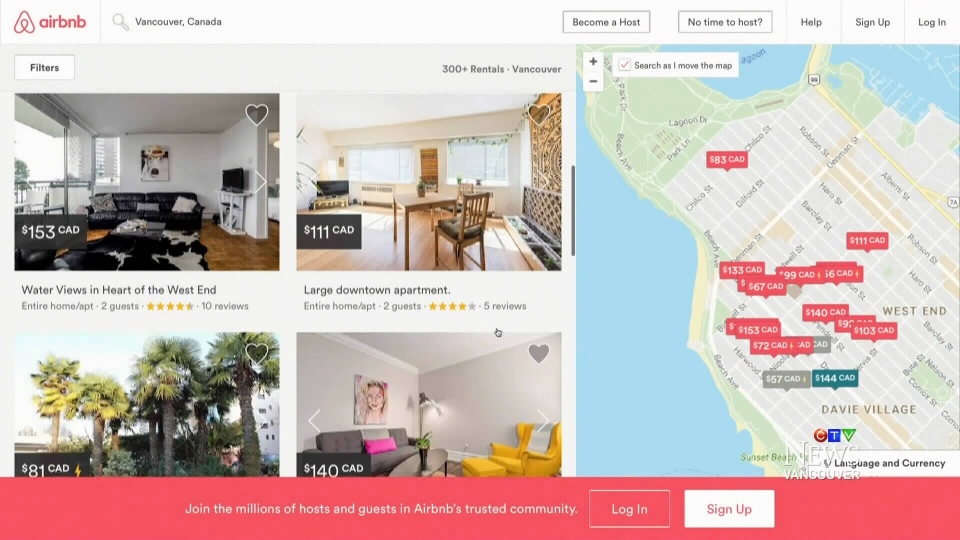

Airbnb has been controversial in cities like Vancouver, where some owners are using their suites like hotel rooms rather long-term housing for renters.

Vancouver City Council voted in November to legalize rentals like the 6,000 in the city listed on Airbnb, but under a series of restrictions including that they can only be in principal residences.

The decision was meant to encourage owners to open up vacant properties to long-term renters struggling to find housing in a market with a vacancy rate of less than 1 per cent.

Under Vancouver's new rules, homeowners will have to pay $49 per year for a licence, and the licence will have to be displayed on their online listing.

Airbnb's Canadian manager of public policy called the move a "defining moment."

"This is about modernizing laws to adjust to the sharing economy," Alex Dagg said.

A similar system is in place in Quebec, where the company is responsible for collecting a 3.5 per cent tax on lodging in that province.

Airbnb also collects taxes in jurisdictions including France, India, and some U.S. states, B.C. officials said.

In the future, the province will look to make similar arrangements with other short-term rental sites.

But some housing advocates say more needs to be done to prevent guests from displacing the people who could live in those suites long-term.

"Eliminate whole unit rentals to free up housing suites," suggested Octavian Cadabeshi of the Fairbnb Coalition, a national group of homeowners, tenants, businesses and labour organizations.

Others have taken action against Airbnb in an attempt to block homeowners from listing their places on the site.

Vancouver resident and lawyer Polina Furtula said her building had a problem with unruly Airbnb visitors even though the strata forbids short-term rentals.

"We tried going after the individual owners or tenants renting out the apartments in our building and found that it was very difficult to even figure out which unit was involved," she said.

"Finally what we decided to do is send a demand letter to Airbnb… demanding they take down all of the listings in our building and threatening to take legal action against them."

A short time later, all the listings were removed. Some came back up, but the overall number was reduced.

Furtula said other strata corporations she's represented have had similar success.

"Essentially, I think they're the ones running a hotel that involves units in our building, so they should be responsible."

With reports from CTV Vancouver's Jon Woodward