***originally aired June 22***

With 32 domestic banks in Canada, finding the right bank can be a tedious task. But there are online services out there to help narrow it down and find the right bank to fit your needs and budget.

According to industry research the average Canadian spends up to $220 per year on bank fees, but only 17 per cent have switched to a different financial institution in the past three years. The majority of those surveyed showed loyalty to one bank.

“All my corporate accounts and personal accounts are at the same bank. I couldn't comparison shop if I tried," one woman told Ross McLaughlin.

“I find it frustrating to even do the process because it takes so much work to change everything," said another woman.

But RateHub, known for its mortgage rate comparison tool, is trying to shake things up, offering a new tool to compare bank and credit union accounts.

“We're really passionate about making sure Canadians save money by making smarter and more informed decisions," explained RateHub’s Nicole Laoutaris. “You just go to RateHub.ca, and you can click on the type of product that you're looking for."

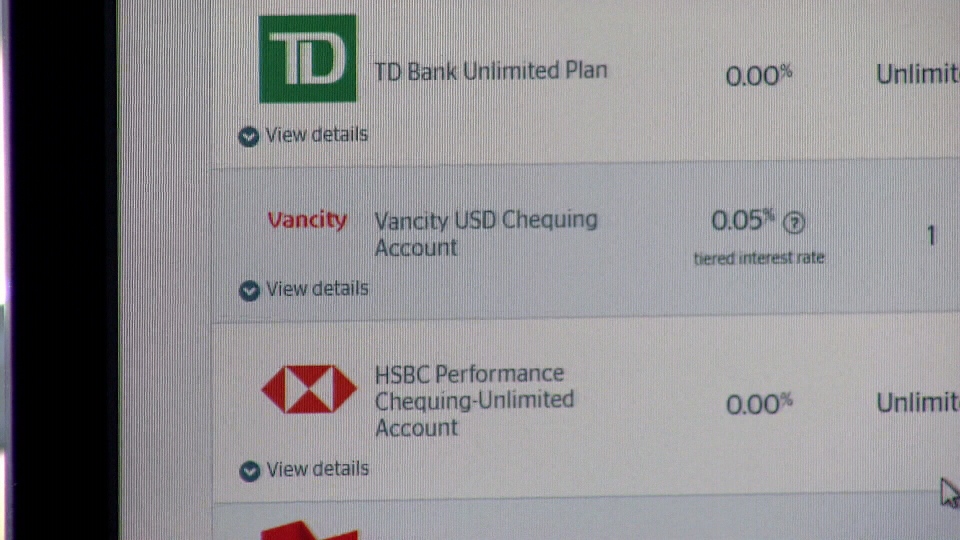

Whether its chequing, savings, mortgages or investments, the site breaks it down for you so you can see who's offering the best deal for your needs.

Right now, RateHub compares 17 financial institutions, including credit unions, with more being added all the time. But it's not the only game in town.

There are other comparison sites like RateSupermarket.ca which offers similar information. And No Fee Banking Canada, which provides information about the best no fee accounts.

“There's so much competition out there so looking for banks to see what they can offer, you might as well take advantage of what they can kind of do for you," said one man to McLaughlin.

But no matter what information you find on these sites you will always want to verify it with the bank you are considering.

“This has all the information in one place, so you can do it a little bit more quickly and efficiently. And maybe see a product that you didn't think was out there and may be more appropriate for you,” said Laoutaris.

McLaughlin on Your Side hasn’t independently verified the information provided on these websites. RateHub says it has a team constantly reviewing bank offers and changes to update the site, but again, it pays to verify that with your bank.