There are two things in life you can count on: death and taxes. You don’t know when death is going to strike but taxes shouldn’t come as a surprise. However, you might be caught off guard by taxes hiding in unexpected places.

When you shop, you pay provincial sales tax and GST, both based on the purchase price, and it’s clearly displayed on your receipt. But that’s not the case for everything we buy.

There’s double taxation hiding in plain sight and it only becomes clear when you do the math.

Did you know that when you park in Metro Vancouver you’re paying tax on top of tax? You wouldn’t be able to easily tell by looking at the receipt.

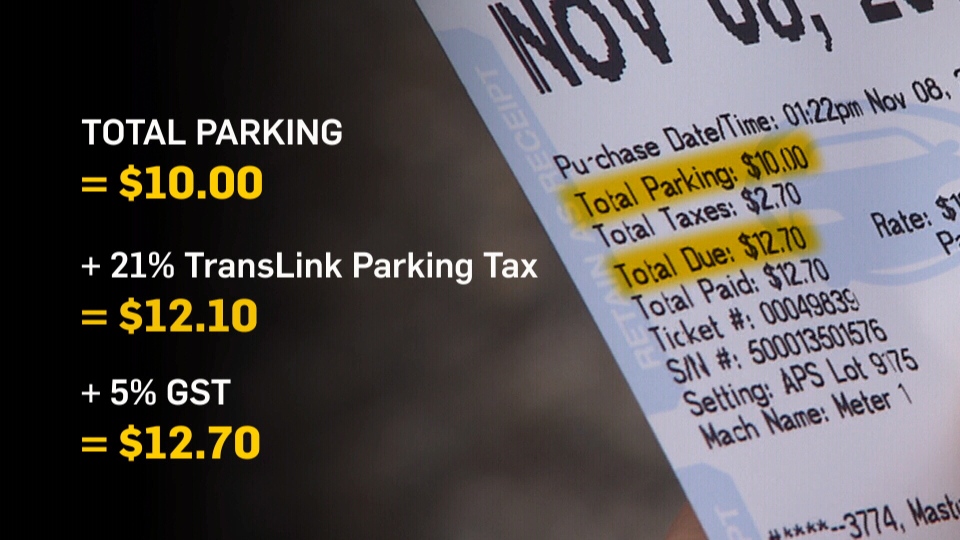

CTV News paid for $10 worth of time at a local parking lot in downtown Vancouver. The receipt listed the total taxes paid at $2.70. That’s 27 per cent - bringing the total bill to $12.70.

We had to do a bit of math to figure out we were being charged tax on tax. TransLink charges a 21 per cent parking tax, that’s based on the parking fee, the 5 per cent GST is then calculated on that total amount. Rather than adding the two taxes together, the tax is compounded.

Consumers we talked to were surprised.

“That’s not very right,” said Jen.

"Oh boy, good eye, good eye," said Bonnie, another woman who had stopped to look at the receipt.

It may be nickels and dimes at a time, but last year TransLink says the parking tax brought in $70 million. GST calculated, on just the tax alone, generated an extra $3.5 million for the federal government.

"Tax on tax is fundamentally unfair and people shouldn't put up with it," said Kris Sims of the Canadian Taxpayers Federation.

But it happens all the time. Every time you fill up at the pump in B.C., you pay about $0.43 cents in taxes added to the base price/litre. The GST is calculated on the resulting total.

You also pay tax on tax on alcohol, tobacco and nowdo so for cannabis. And the GST will also be calculated on top of the carbon tax that we’re all going to have to pay on things like utilities.

The feds say most of the carbon tax revenue will be go back to the provinces but you can bet the GST charged on the carbon tax will go straight into federal coffers.

"It would be hundreds of millions of dollars, easily. Easily," said Sims.

A 2017 analysis by the Library of Parliament puts it at $280 million in B.C. and Alberta alone. And the Canadian Taxpayers Federation did an analysis of the extra GST collected on gas and diesel taxes and determined that Canadians are paying an extra $1.764 billion a year.

The Canada Revenue Agency administers the GST and when CTV news asked why there’s tax on tax for something as simple as parking, we were told it’s because legislation hasn’t been written to address it.

The Canadian Taxpayers Federation has a simple solution - no tax on tax. It says if consumers don’t like feeling the tax pinch, they need to complain and lobby their politicians.

"No matter how mad you are or how hopeless it seems, push back," said Sims.