The federal government is offering a glimmer of hope for investors who say they've been hit with a raft of extra charges for so-called tax-free savings accounts.

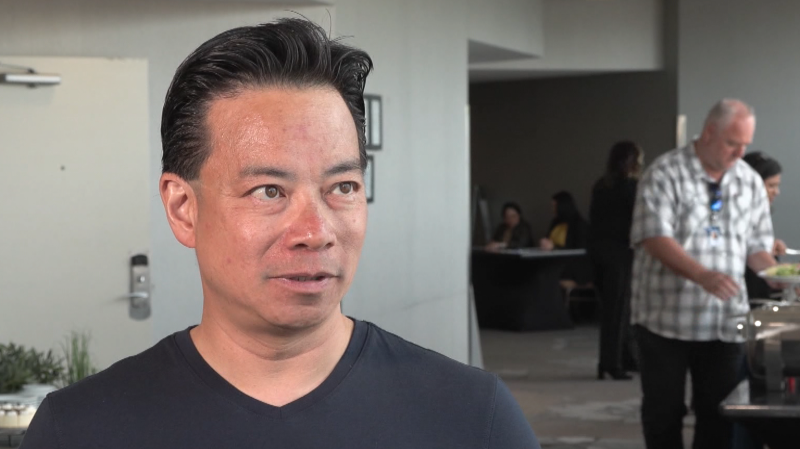

Earlier this week, CTV News spoke with David Doole, who contributed the maximum $5,000 to his account last year. After dipping into it for a short time, he topped it up again.

Months later, he got a bill in the mail.

"I owed them $315," Doole said.

Doole's original $5,000 deposit was the maximum allowable contribution. He withdrew $4,500, but the government won't count it until next year.

So, while his actual balance dropped to $500, his contribution level remained unchanged, and according to federal government math, his total contribution was now $9,500.

He's one of 70,000 Canadians caught by a little-known rule that doesn't count withdrawals like his until next year, creating an artificial over-contribution, even though his account never exceeded $5,000.

"The government, I just don't think made it clear enough to people like us about how it works and they are penalizing us for their poor communication," Doole said.

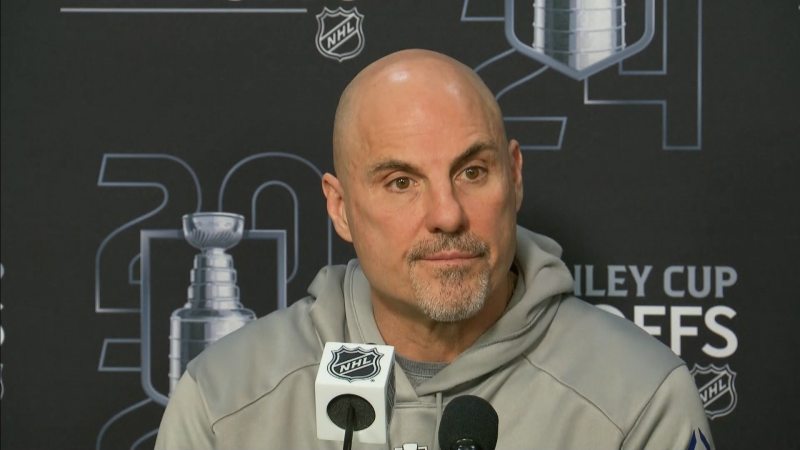

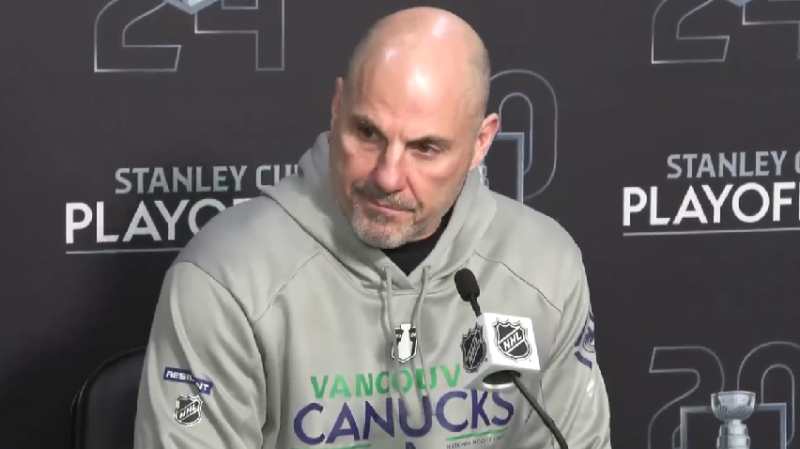

On Friday, CTV News asked Finance Minister Jim Flaherty about the problem, and he had good news.

"We intend to get it fixed, so that people are not penalized for what appears to be an administrative challenge," Flaherty said.

He added that the government doesn't intend to collect on penalties when someone's net contribution has not exceeded the $5,000 limit.

"Of course, they'll have to look to see what people have actually done," he said. "It appears that it was an administrative problem, not someone trying to avoid paying tax."

The federal government has a form that investors can fill out to correct the problem, which is available for download here.

With a report from CTV British Columbia's Chris Olsen