Don’t blame us

That’s the message from a lobby group that represents B.C.’s automotive repair sector, who admit their surging prices have been a factor in ICBC’s “dumpster fire” financial crisis.

The Automotive Retailers Association, however, says that the 30 per cent increase in car repair costs over the last two years is out of its members’ control – and they’re not even taking the extra money home.

“Our concern is that our industry might end up being used as a scapegoat, quite frankly, for the escalating costs at ICBC,” said the ARA president, Ken McCormack.

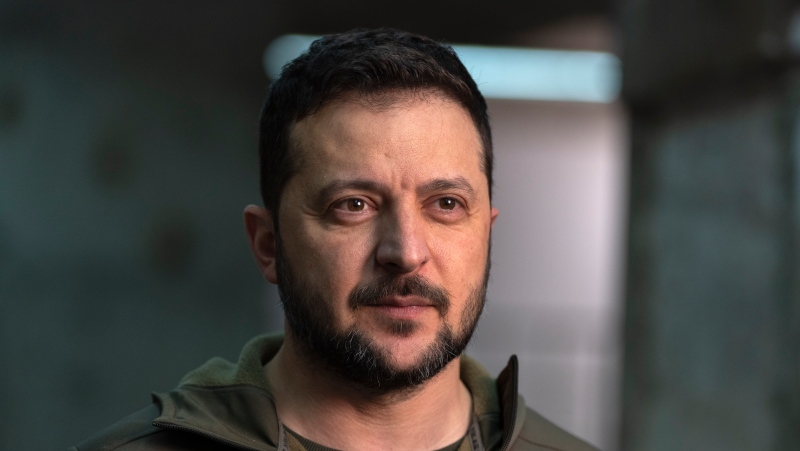

Allegations of overbilling at body shops were one of several factors that the minister responsible for ICBC, David Eby, brought up in a tense news conference on Monday.

Other factors, Eby said, include distracted driving, high legal costs and ICBC mismanagement that he said was abetted by the former Liberal government.

“Years of reckless decisions by the former government have undermined ICBC,” Eby said. “They knew the dumpster was on fire, but they put it behind the building instead of trying to put the fire out.”

The public auto insurer is now projected to lose about $1.3 billion—a loss so huge it may affect the bottom line of the entire provincial government in its upcoming budget.

Eby, however, has promised changes at ICBC that could include caps on injury claims.

A report from Ernst and Young last year found that ICBC spends a quarter of every dollar on legal fees. A CTV analysis discovered that there are an average of 41 new lawsuits involving ICBC each day.

At his auto body shop in North Vancouver, Wade Bartok told CTV News that he’s limited in what he can charge by an automatic billing system called “Mitchell” that determines how much time his workers can bill on specific items.

That time is going up because newer cars have more complicated parts, or are designed differently – such as cars that use crumple zones to protect occupants in the event of a crash.

“There are so many more pieces to repair. That’s where the cost comes in,” Bartok said.

Claim costs are about 30 per cent higher across North America than they were five years ago, said Jim Whittle of the American Insurance Association.

“We’re seeing crashes increase in frequency and severity,” he said.

Whittle said the growing cost of vehicle repairs could be a factor, but added that an economic boom means the average driver is spending more time in their car, increasing their likelihood of being involved in an accident.

The ARA had one suggestion to reduce costs: reverse a 2014 rule change that allowed auto recycling operations to resell ICBC salvage vehicles overseas.

The change has meant that local operations get outbid by those selling out of province, and can’t afford to bring the recycled parts into auto body shops. The percentage of parts that are recycled has dropped from almost 10 per cent in 2011 to just over 7 per cent in 2016.

Reversing that rule might allow more recycled parts back into body shops, which could save about $10 million a year, said McCormack.

But that’s less than 1 per cent of ICBC’s projected $1.3 billion shortfall.

ICBC spokesperson Lindsay Olsen said the agency had not yet received any analysis from the ARA on its proposal.

She said the total annual revenue for salvage sales in 2016 was $73.8 million. About 65 per cent of salvage sales is for parts only.

ICBC spent about $24.6 million in used parts from recyclers to repair customers’ vehicles, which increased about 22 per cent since 2014.