***Story originally aired Feb. 4, 2014***

With the average seasonally adjusted price of a home in Vancouver sitting at $825,000, many Vancouverites are turning away from the dream of home ownership and choosing to rent instead.

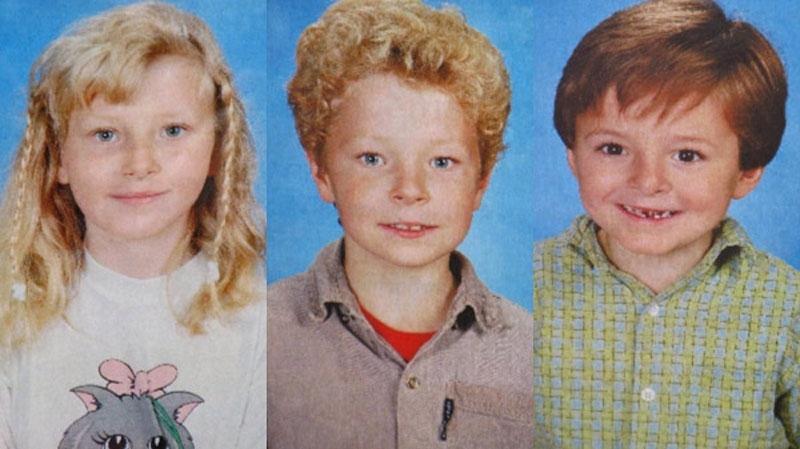

The Black family used to own an 860-square-foot condo in North Vancouver, but moved after they had their second child and the space became too small.

"Once the two kids come along and you know, people living above and below you, no outdoor space, we even have two cats, and it was evident they were finding the place too small," said Kristy Black.

A bigger family home cost too much money, so the Blacks decided to rent their dream home with a yard for the kids instead.

“Once we looked into renting then we saw that it was just about the same as what we're paying in mortgage. Sure, we're paying someone else's mortgage, but at the same time it allows us to have what we need right now for our family," she said.

The Blacks are in good company. Tom Davidoff, an economist at the University of B.C., did the same thing. He sold his Vancouver home and rented a property, and invested the equity in the stock market.

"I think the safer play is perhaps not necessarily own the home. It's a single asset and the one thing your mother also told you is don't put all your eggs in one basket," said Davidoff.

Davidoff says the money tied up in a home is not earning the interest it could be and renting means you don’t have to pay property taxes, maintenance fees or costly home repairs.

The challenge for many people, is finding a suitable rental in an area you want to live in. There are some websites that can help, like padmapper.com. There are also new rental properties being developed, like the three rental towers the Aquilinis are planning to build in downtown Vancouver.

Should you wait?

Many would-be home buyers are hoping the housing bubble is about to burst, but they could be waiting for a long time.

Davidoff says while it is possible that the city could see a 20 per cent decline in housing prices, the more likely scenario is a soft landing followed by a long period of low appreciation.

President of Century 21 In Town Realty Michael La Prairie agrees. His advice to young buyers, who have a job and a healthy savings account, is to get into the market now, but temper your expectations.

"You're not buying your Mercedes when you first come out of school, and you're not buying your Prada purses if you got the big student loans. You have to kind of calm it down, grow up, and this is what you can afford to buy," said La Prairie.