What the federal leaders are promising about British Columbians' top election issues – climate change, housing and taxes

Liberal Leader Justin Trudeau, Conservative Leader Erin O'Toole, New Democratic Party Leader Jagmeet Singh and Green leader Annammie Paul are shown. (Photos from THE CANADIAN PRESS / Sean Kilpatrick during the federal election French-language leaders debate, Wednesday, September 8, 2021 in Gatineau, Que.)

Liberal Leader Justin Trudeau, Conservative Leader Erin O'Toole, New Democratic Party Leader Jagmeet Singh and Green leader Annammie Paul are shown. (Photos from THE CANADIAN PRESS / Sean Kilpatrick during the federal election French-language leaders debate, Wednesday, September 8, 2021 in Gatineau, Que.)

B.C. voters say climate change, affordable housing and the amount of taxes they pay are their top concerns in the Sept. 20 federal election.

A recent Angus Reid survey* asked respondents what they were thinking about before heading to the polls, and found three topics most important to B.C. voters.

CTV News tracked down the promises made by the major federal parties with candidates running in B.C.

The parties whose platforms were examined in this article were determined based on the qualifying criteria established by the Leaders’ Debates Commission to take part in September’s federal election debates.

Here’s where each of them stands on the issues that British Columbians care about.

CLIMATE CHANGE

Liberals: The Liberals list “a cleaner, greener future” as one of the top six priorities in their platform.

They propose pushing the oil and gas industry and the entire country to net zero emissions by 2050, ending plastic waste by the end of the decade, phasing out public financing for fossil fuels and creating a $2-billion fund for economic diversification in resource-dependent provinces.

Conservatives: The Conservatives promise a four-pillar approach to environmental issues. It includes implementing carbon border tariffs on China and other major polluters, increasing the adoption of zero-emission vehicles and introducing a retail “loyalty” card-like “carbon savings account” for Canadians who purchase fuel.

The party also pledges to invest a billion dollars in building out electric vehicle manufacturing in Canada.

NDP: The New Democrats would aim for a reduction of emissions by at least 50 per cent from 2005 levels by 2030 and would set a target of net carbon-free electricity by 2030, moving to 100 per cent non-emitting electricity by 2040.

The party also vows to end all federal subsidies for oil, gas and pipeline projects, retrofit all buildings in Canada by 2050, strengthen environmental protections and establish an independent office to monitor federal climate progress.

Greens: The Greens pledge to ensure a reduction in greenhouse gas emissions of 60 per cent from 2005 levels by 2030 with clear enforceable targets and timelines in place by 2023.

The party would also phase out existing oil and gas operations, cancel all new pipeline projects and ban fracking.

AFFORDABLE HOUSING

Liberals: The Liberal party platform promises $2.7 billion in increased funding for the National Housing Co-Investment Fund, and would provide tax credits for families looking to build a second unit in their home for a loved one. The party also pledges to help renters become homeowners through $1 billion in loans and grants.

Conservatives: The Conservatives pledge to build one million new homes over the next three years, encourage a new market in seven- to 10-year mortgages and impose a ban on new foreign ownership for the next two years.

NDP: The NDP plan includes 500,000 affordable housing units in the next 10 years. The party also pledges to reintroduce a 30-year term on CMHC-insured mortgages on entry-level homes for first-time buyers.

Greens: The Greens pledge to establish a national moratorium on evictions, create national standards to establish rent and vacancy controls and to build and acquire a minimum of 300,000 of affordable, non-market, co-op and non-profit housing over a decade.

TAXES

Liberals: The Liberals' plan includes raising corporate income taxes on banks and insurance companies that make more than $1 billion a year from 15 to 18 per cent.

It would also create a minimum tax rule so people in the highest tax bracket pay at least 15 per cent each year, removing their ability to “artificially pay no tax through excessive use of deductions and credits.”

Conservatives: The Conservative platform includes a one-month GST “holiday” at retail stores, which would mean consumers pay no federal tax on purchases during that time.

The party says it would also order the Competition Bureau to investigate bank fees and require more transparency for investment management fees. It has said previously it would also complete an extensive review with tax reform in mind, if elected.

NDP: The New Democrats would implement a temporary COVID-19 "excess" profit tax that would mean corporations that made huge profits during the pandemic would pay an additional 15 per cent. The NDP would also put a one per cent tax on households with fortunes topping $10 million and boost the top marginal tax rate two points to 35 per cent for the highest tax bracket.

Greens: The Greens would impose a one per cent tax on net family wealth above $20 million as well as charge a five per cent surtax on commercial bank profits.

Their plan includes increasing the federal corporate tax rate from 15 to 21 per cent to bring it into line with the federal rate in the United States and an exemption for new and used electric and zero-emission vehicles from federal sales tax.

*The survey used in this article was conducted by the Angus Reid Institute online between Aug. 20 and 23. A randomized sample of 1,692 adults were questioned. Results of the survey are considered accurate within 2.5 percentage points, 19 times out of 20.

CTVNews.ca Top Stories

Budget 2024 prioritizes housing while taxing highest earners, deficit projected at $39.8B

In an effort to level the playing field for young people, in the 2024 federal budget, the government is targeting Canada's highest earners with new taxes in order to help offset billions in new spending to enhance the country's housing supply and social supports.

BUDGET 2024 Feds cutting 5,000 public service jobs, looking to turn underused buildings into housing

Five thousand public service jobs will be cut over the next four years, while underused federal office buildings, Canada Post properties and the National Defence Medical Centre in Ottawa could be turned into new housing units, as the federal government looks to find billions of dollars in savings and boost the country's housing portfolio.

Some of the winners and losers in the 2024 federal budget

With a variety of fiscal and policy measures announced in the federal budget, winners include small businesses and fintech companies while losers include the tobacco industry and Canadian pension funds.

From housing initiatives to a disability benefit, how the federal budget impacts you

From plans to boost new housing stock, encourage small businesses, and increase taxes on Canada’s top-earners, CTVNews.ca has sifted through the 416-page budget to find out what will make the biggest difference to your pocketbook.

Toronto police arrest several people at rail line protest

Several people have been arrested at a pro-Palestinian demonstration in the city’s west end that blocked rail lines for hours Tuesday.

500 Newfoundlanders wound up on the same cruise and it turned into a rocking kitchen party

A Celebrity Apex cruise to the Caribbean this month turned into a rocking Newfoundland kitchen party when hundreds of people from Canada's easternmost province happened to be booked on the same ship.

Teen hockey players arrested for sexual assault following hazing incident: Manitoba RCMP

Three teenagers were arrested in connection with a pair of alleged hazing incidents on a Manitoba hockey team, police say.

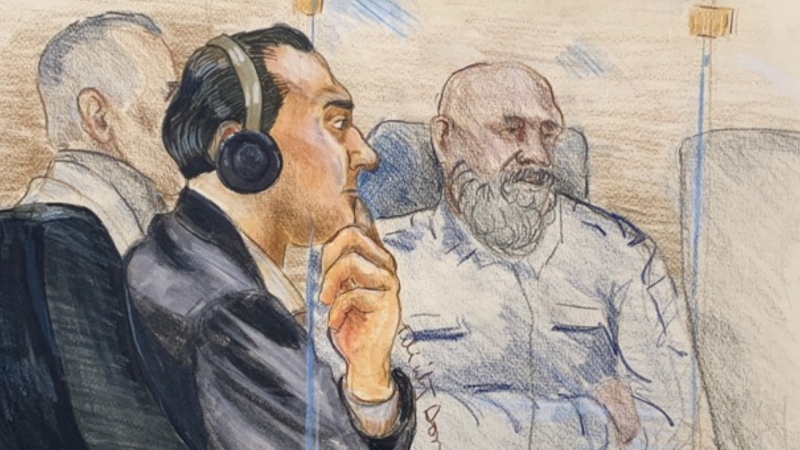

B.C. killer seeks to attend sentencing by video as lawyer cites safety concerns

A defence lawyer for Ibrahim Ali, who was convicted of first-degree murder of a 13-year-old girl in Burnaby, B.C., says the man wants to appear at his sentencing hearing by video over fear for his safety.

Lululemon unveils first summer kit for Canada's Olympic and Paralympic teams

Lululemon showed off its collection for the Summer Olympics and Paralympics on Tuesday at the Liberty Grand entertainment complex. Athletes sported a variety of selections during a fashion show that featured garments to be worn on the podium, during opening and closing ceremonies, media interviews and daily life on the ground in France.