As tax time rolls around it's time to start thinking not only about your finances, but also about your future and how to protect what you own. But you may be surprised by just how many people don’t have a will, which can be a costly mistake.

When Chris King’s 38-year old twin brother Cameron was diagnosed with liver cancer, he wasn’t prepared at all.

“We thought we had time and everything moved really quickly,” said King.

Within weeks, his brother had died. He didn’t have a will.

Then just four months later King’s family was struck with another tragic blow. Their father Peter was diagnosed with colon cancer at 69 years old.

“Going into the hospital for his operation he didn't update his will or anything like that because he didn't think anything would happen,” explained King.

But Peter didn’t make it either, leaving King, and his wife Jody, to deal with the estates of both his brother and father.

"We were just so overwhelmed. I feel like we've just been in this tumble cycle of paperwork and meetings, not being able to properly grieve," he said.

A recent study shows 62 per cent of Canadians don't have a will, and of those who do, 12 per cent have wills that are out of date.

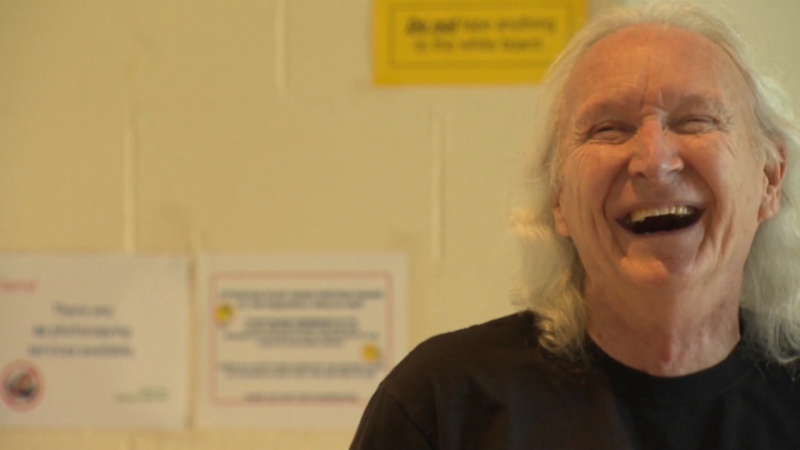

Richard Bell is a lawyer at Bell Alliance who specializes in will and estate planning. He says he sees this scenario all too often, but reminds people that it’s never too late to put together a will.

“It's important to be ready to protect the ones you leave behind. Many lawyers and notaries are happy to get to the hospital as fast as possible we do this on a fairly regular basis," said Bell.

King did end up finding a recent will for his father, but it wasn’t signed. He found another that was signed but was from 1978.

“There’s a lot of stuff in this will that just is irrelevant now,” he explained.

Bell says you need to update a will regularly. Have a power of attorney ready to go and a representation agreement in place to deal with medical issues.

And there are other things to consider, like setting up trusts.

"We've seen a situation, $2 million was inherited by a 19-year-old. As I describe it, lots of new friends, lots of good times but potentially a path that's not what we'd like to see happen to anybody," said Bell.

Having a will also ensures that important questions for parents are answered, like who will raise your young children if both parents die.

The cost of putting together a will depends on the complexity of your estate. You can ask a lawyer or notary for an estimate and if it’s too expensive, you may be able to write you own will use a will kit.

However, Bell cautions against trying to do it yourself because there may be issues or questions you may not have considered and that’s where professional legal advice can pay off.