Scraping together enough money for a down payment on your first home purchase is tough. But what if you could all that money you’re paying in rent could go towards the down payment?

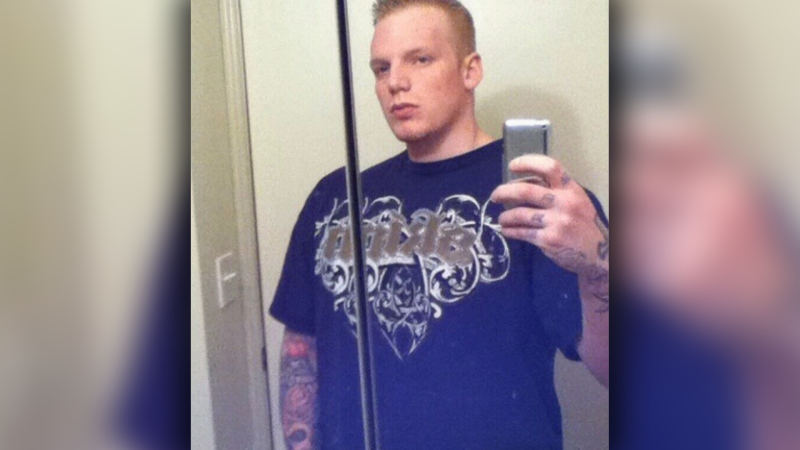

“It's definitely not easy to get into the market and not easy to find a place close to home," said first time homebuyer, Michael Willms.

He’s fortunate to have saved enough money to buy a new condo but not everyone is able to do that.

That’s why the Panatch Group of Richmond is developing a condo complex in Port Moody that will offer 30 one- and two-bedroom units to first-time buyers, under a rent-to-own program.

“They kept feeling by the time they were saving up enough money, the market was running away from them all the time," said company president Kush Panatch.

Rent-to-own programs are a creative way to sell property when the market starts to cool down. However, Panatch felt given the current market it was time to give back.

The group is building 358 condos at 50 Electronic Ave. in Port Moody. Thirty units in the first phase will be offered to first-time buyers and local residents get preference.

[Related: Multimillion-dollar homes in rent-to-own program]

You make your offer, set the price, make a small down payment and in two years when the project is complete you move in and lease for two years before you complete the deal.

“We're going to take all the rent you pay us. We're going to apply that towards the down payment," explained Panatch.

The company has a list of more than 100 people who want to take advantage of the program and says it will work with the City of Port Moody to make sure the selection process is transparent, as well as the details on the lease-to-own contract.

And there’s no guessing what the final product will look like. The Panatch Group has built out two complete units. What you see is what you get, from built out closets, cabinet finishes and countertops to electrical fixtures, including USB enabled plug-ins. No detail has been overlooked.

As the Metro Vancouver real estate market continues to slow down you could see more developers offering creative sales strategies to entice buyers.

However, before you leap into a rent-to-own program you should consider the fine print. Some details you need to consider:

- How much down when you make an offer?

- What happens if you lose your job and don’t qualify for a mortgage when the deal has to close?

- What happens to your earnest money if you don’t complete?

- Can you sell or assign your contract to someone else to take advantage of any increased equity?

Panatch is still working out the details of its rent-to-own program, but expects to charge a $5,000 deposit when the contract is signed and another $5,000 upon occupancy. After two years the money will be applied to the down payment along with all the collected rent.

The company says it's trying to make it as affordable as possible and is not looking to take punitive action if a buyer can't complete the deal at the end of the two years. However, if a customer doesn't complete the purchase, $5000 would be considered a security deposit to cover any damages sustained during the rental period.