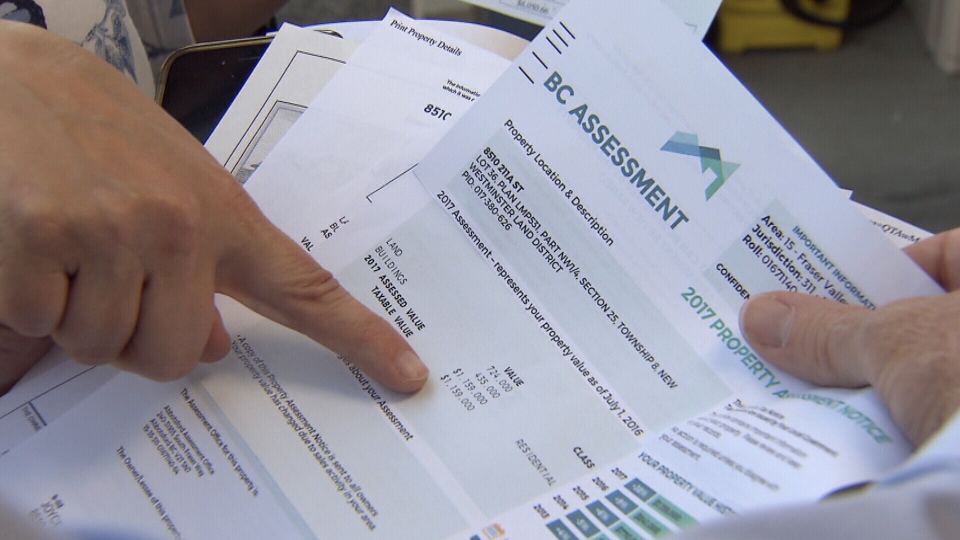

When McLaughlin on Your Side interviewed Lori Sowerby last August, she was fuming over the taxes her late mother had paid on her Walnut Grove home for nearly 20 years.

The home’s property assessment had included a finished basement, which didn’t actually exist. That simple error meant Sowerby’s mom, Joyce, had overpaid thousands of dollars taxes to the Township of Langley and Lori wanted that money back.

When the CTV story aired, an employee in the Township of Langley saw the report, which sparked an internal review.

“They're tough situations when somebody finds out, as in this case for 19 years, they've been paying for taxes on a property that had a finished basement when it didn't have a finished basement," said Karen Sinclair, director of finance at the Township of Langley. “"In this particular case, one of the employees saw it on the news, the report on the news, and heard Walnut Grove and thought, 'That's one of our properties.'"

Homeowners should always check their property’s description online, but Soweby’s mom wasn’t computer savvy and although the problem was corrected, the assessor can only address the current year’s taxes.

After the township launched its internal review, Sowerby was sent a cheque for $959.80, three years worth of overpaid taxes. The municipality has a policy that it can only go back three years to fix tax mistakes.

"It came into being in 1999 and it's in place just to deal with situations like this," explained Sinclair.

Even though it’s not all of the overpayment, Sowerby is happy with the results.

“It’s mind blowing, and that is just really uplifting,” she said, “We’re just really, really happy with the outcome.”

The township says when it gets a report of an error on the property description it does an audit to see if other homes in the same area may have been affected. But it's still up to you to spot mistakes.

The municipality says mistakes like this don’t occur very often. Over the last decade there have been 22 square footage errors, and last year 22 homeowners who should have been paying half the school tax because they were in the agriculture land reserve were paying the full amount. That was also corrected.