You have probably noticed more ads to get you to invest in an RRSP. This time of the year has been called RRSP season.

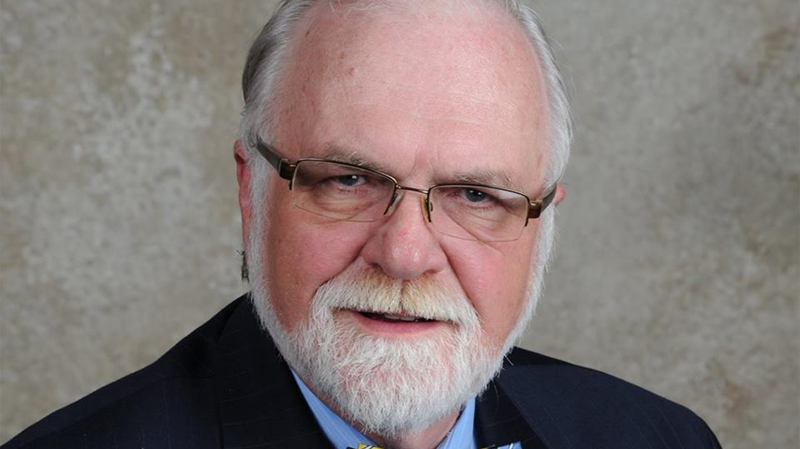

"In the industry RRSP money is referred to as 'sticky money,'" explained Eric Arnold, CEO of Planswell, an online financial planning platform.

He says once banks hook your RRSP money, consumers tend to stay with that firm. That can mean lots of money earned in fees.

But Arnold says beware of offers for RRSP loans.

"I went out personally to a bunch of advisors that I respect that are in my network and I said, 'What's the story on these RRSP loans?' And they said, 'It's garbage.'"

Borrowing to invest takes discipline and he advises against it.

"You can get into a very dangerous debt spiral," said Arnold.

And he says many people may be tempted to spend any potential refund instead of applying the money to the RRSP loan. Some may even spend it on a vacation.

"I want the $5,000 to go on a trip, I feel I deserve a trip, I've been working hard this is what I want to do. And people might deserve the trip and they might be working hard but this is not the way to achieve that," Arnold said.

That doesn't mean you shouldn't invest in an RRSP but that tax sheltered savings tool may not be the first choice for everyone.

Natasha McEwen, 32, of Vancouver says she has money invested in an RRSP but says putting more money into it may not make sense right now. She has one child and another on the way and is only working part time.

"Well we do have some debt with a line of credit that could have been paid down a bit more substantially," McEwen said.

"If you don't have money to contribute to your RRSP, you're probably not in a very liquid situation. Why would you be putting your money into the most illiquid investment vehicle in Canada?" Arnold pointed out.

He says there are some things to consider before investing in an RRSP. He suggests setting up an emergency fund first for unexpected expenses. If you have free cash to invest he recommends putting into a Tax Free Savings Account first. You can grow money tax free and unlike an RRSP it's not taxed if you need to withdraw the money in a pinch.

There has been research indicating nearly 4 out of every 10 Canadians take early withdrawals from their RRSP either for first time home purchases. But once you take money out, you lose that contribution room.

Seeking help from a financial planner can help work out what types of investments are best for your situation. For some people RRSPs make sense. Others may want to carry forward unused contribution limits and top off a registered account when their earnings improve, putting them into a higher tax bracket with more disposable income to invest.

According to a new BMO study the amount of money Canadians are holding in RRSPs has substantially increased and Millennials have seen the highest percentage increase.