VANCOUVER -- It’s something Dana Johl says she’s done for years, with no issues: electronically transfer money online, through an Interac e-transfer.

But last month, a transfer she sent didn’t end up where it was supposed to go.

“I’m going to have to go into debt a little bit for a little while. I mean, it’s not great timing,” she said.

Johl said she transferred just over $1,700 from her TD bank account to another account she has at Scotiabank on May 19. She received an email confirmation, which she showed to CTV News, but the money never materialized.

"Looked completely normal, until I went to pay the payment that I was transferring the money to make...and I saw that it wasn't in my account," Johl said.“I called TD. TD said oh yeah, it was accepted, it was accepted by a TD account and they told me the person’s name."

It was a name Johl didn’t know. She said she was referred to the bank’s fraud department. Recently, she received a letter from the bank dated May 28 saying her claim of a disputed transaction had been declined.

- You can now sign up to CTV News' Nightly Briefing newsletter, our evening reading recommendation. You can sign up here to receive it each weekday night.

In part, the letter read: “Our investigation found that in order to complete the disputed transactions, the individual responsible had access to financial information that you are responsible for protecting.”

Johl has appealed the bank’s decision.

"One of my key questions was, what financial information? And can you see where, if I did something wrong, it went awry because I have my bank card. No one has my online banking,” Johl said. “My second question to the bank, which they haven’t answered me on, was if you know who this person is then can’t you contact them and say there’s been some mistake?”

In an email to CTV News, TD’s manager of corporate and public affairs Ryan-Sang Lee said “we look forward to working with her to address this matter through our regular review process.”

“In the interim, we appreciate her coming forward with her story to help educate your viewers on how they can protect themselves when sending money,” Lee added, and said this includes providing an accurate email address for the recipient and a security question and answer that isn’t easy to guess.

Lee said customers can also set up an e-transfer autodeposit, which allows for an immediate deposit without a password.

“Since these funds are deposited automatically, they cannot be intercepted by a third party,” Lee said.

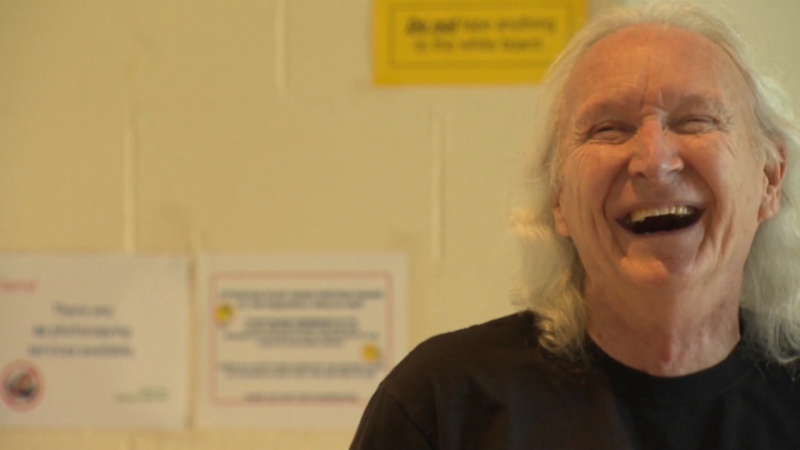

Cybersecurity expert and author of The Canadian Cyberfraud Handbook Claudiu Popa said when someone gains access to your online banking, they can surreptitiously change email addresses attached to your regular transfers.

‘It’s fairly easy for someone who has stolen access to your account to simply change all of those recipients to their own email address,” Popa said. “Whenever you have a financial process that is very convenient you can expect it to get exploited by malicious individuals.”

Popa said it’s a good idea to check those addresses on a regular basis, and delete anything that looks sketchy. He also recommends seeing if your bank offers a two-step authentication for accessing online banking, where a code is sent to another device such as a phone.

“That means if your password is stolen, they would still need your phone to access your account, and that is huge,” he said.

He recommended making sure anti-virus software is up to date, and not having too many apps on your phone.

Popa also encouraged people to report these types of experiences to the Canadian Anti-Fraud Centre.

Johl said even if she doesn’t end up getting her money back, she wants people to know how they can be sure their funds are going to be safe.

In the meantime, she’s not sure about using e-transfer again.

“I think I would say if it’s a particularly large amount of money, and somewhat risky, I would try and find another way,” she said. “At least until we can get some of these answers or some guarantees the bank is either going to be protect us through some kind of insurance or come up with a system that isn’t hackable.”