Inflation down across Canada, up slightly in British Columbia

Inflation may be cooling across most of Canada, but people are still feeling the pinch of higher prices, especially in B.C. where the cost of goods increased slightly in July, according to Statistics Canada.

The agency said year-over-year, inflation across the country was 7.6 per cent in July, that's lower than June when it was 8.1 per cent. Most of the decrease is driven by lower gas prices.

At the same time, some groceries are costing a lot more. Compared to this time last year -- eggs, fresh fruit and baked goods cost consumers more than 10 per cent more.

According to the Statistics Canada report, B.C. was the only province where inflation increased. The rate going from 7.9 percent in June to eight percent in July. The agency said travel accommodations, car insurance, and gas prices -- notoriously the highest in the country - are the biggest factors.

The province sets rent increases based on July's inflation number. This year, the cap will be lower.

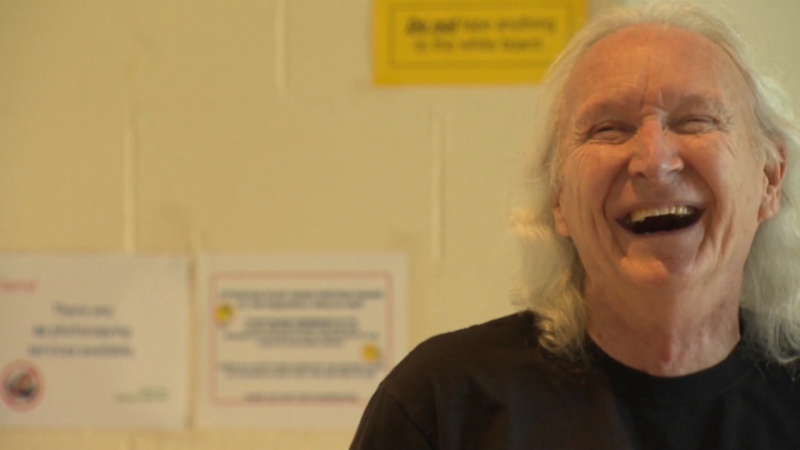

Housing Minister Murray Rankin told CTV News in a statement that the particulars are still being ironed out.

"As many renters are barely hanging on and cannot afford a change in their rent at current rates of inflation, we will be capping the annual allowable rent increase for 2023 below the rate of inflation," he wrote

"We are finalizing the details of what the rent cap will be, and will have more to say in the coming weeks.'

Homeowners may also be on the hook for higher mortgage payments. While the head of the Bank of Canada thinks inflation may have peaked -- it's still much higher than its target of two percent.

CTVNews.ca Top Stories

Outdated cancer screening guidelines jeopardizing early detection, doctors say

A group of doctors say Canadian cancer screening guidelines set by a national task force are out-of-date and putting people at risk because their cancers aren't detected early enough.

Lululemon unveils first summer kit for Canada's Olympic and Paralympic teams

Lululemon says it is combining function and fashion in its first-ever summer kit for Canada's Olympians and Paralympians.

'I just started crying': Blue Jays player signs jersey for man in hospital

An Ontario woman says she never expected to be gifted a Blue Jays jersey for her ailing husband when she sat alone at the team’s home opener next to a couple of kind strangers.

Mussolini's wartime bunker opens to the public in Rome

After its last closure in 2021, it has now reopened for guided tours of the air raid shelter and the bunker. The complex now includes a multimedia exhibition about Rome during World War II, air raid systems for civilians, and the series of 51 Allied bombings that pummeled the city between July 1943 and May 1944.

LIVE @ 4 EDT Freeland to present 2024 federal budget, promising billions in new spending

Canadians will learn Tuesday the entirety of the federal Liberal government's new spending plans, and how they intend to pay for them, when Deputy Prime Minister and Finance Minister Chrystia Freeland tables the 2024 federal budget.

B.C. woman facing steep medical bills, uncertain future after Thailand crash

The family of a Victoria, B.C., woman who was seriously injured in an accident in Thailand is pleading for help as medical bills pile up.

Step inside 'The Brain': Northern education tool aims to promote drug safety

An immersive experience inside a massive dome coined 'The Brain' is helping youth learn about brain function and addiction

WATCH Half of Canadians living paycheque-to-paycheque: Equifax

As Canadians deal with a crushing housing shortage, high rental prices and inflationary price pressures, now Equifax Canada is warning that Canadian consumers are increasingly under stress"from the surging cost of living.

Ontario woman charged almost $7,000 for 20-minute taxi ride abroad

An Ontario woman was shocked to find she’d been charged nearly $7,000 after unknowingly using an unauthorized taxi company while on vacation in January.