The group spearheading the fight against the Harmonized Sales Tax in B.C. has launched a constitutional challenge against it.

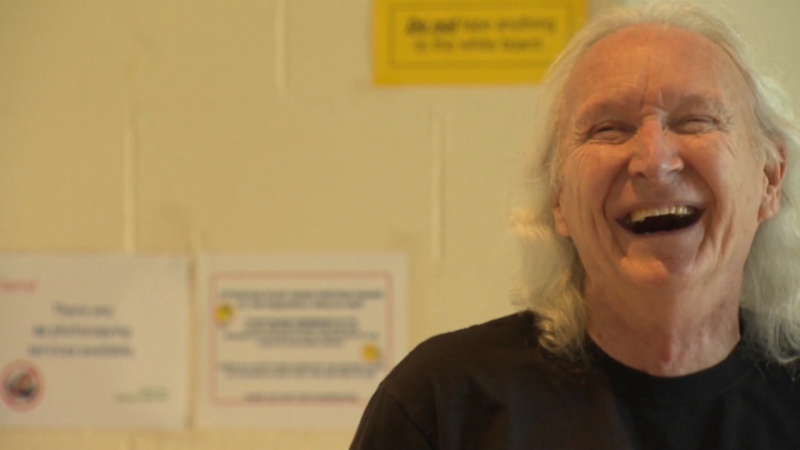

Fight-HST's leader and former B.C. premier, Bill Vander Zalm, announced the motion at B.C. Supreme Court Monday morning, calling the much-maligned tax "invalid."

Vander Zalm says the tax violates the principle of no taxation without representation because members of the B.C. legislature voted only to repeal the provincial sales tax, not to implement the HST.

Fight-HST said it decided to accelerate its legal challenge after a coalition of business groups filed an action last week aimed at having a judge review the draft legislation behind the anti-HST petition.

The HST, which combines the five percent GST with the seven percent provincial sales tax, took effect in B.C. and Ontario on July 1.

B.C. Premier Gordon Campbell maintains the tax will create jobs and attract billions of investment dollars into the province.

Critics hold the HST takes money out of consumers' pockets by charging them on items that used to be PST-free.

More than 700,000 B.C. residents signed an anti-HST petition against the tax.