VANCOUVER -- This year has been a wake-up call as we navigate the difficulties of the pandemic. For many, the financial impact has been difficult to grasp. With markets bouncing around and many Canadians uncertain about job security, there is also fear about the future.

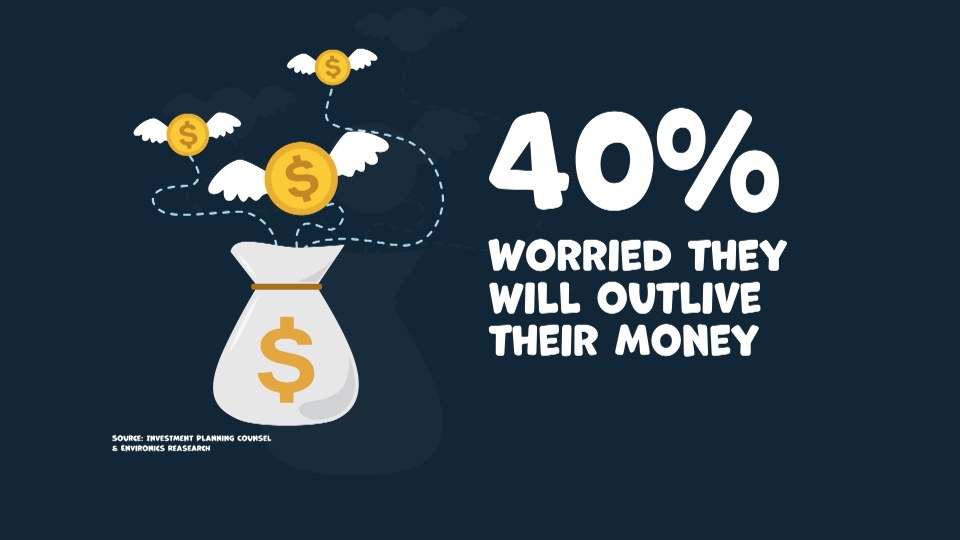

A new survey shows 40 per cent of Canadians are afraid they will blow through their savings and outlive their money in retirement, and that has them rethinking their investment strategies.

Ron Kubara, of Surrey, had a successful career bringing photo labs to retailers and retired early. He was overseas when the pandemic hit, living out his retirement dream when the markets started to fall. He watched as his investments dropped by as much as 35 per cent.

“It’s a feeling in the chest and it’s strong and it goes, ‘Oh my goodness, am I going to have enough money to live through to retirement?’” Kubara told CTV News Vancouver.

A survey released by Investment Planning Counsel, conducted by Environics Research, shows how the pandemic has impacted Canadians’ financial priorities. Forty per cent are placing more importance on job stability than six months ago, and 80 per cent are re-evaluating their priorities.

For Kubara, it is not necessarily about outliving his money, but more about living the type of retirement he had envisioned, and he is not alone.

“It’s made people re-look at everything,” said Chris Reynolds, CEO of the Investment Planning Counsel.

Kubara had an investment advisor to lean on, and the survey showed 93 per cent believe such support is more important now than ever before.

“When they feel unsafe and there’s some uncertainty in their future, they want that stability. They want to go back to somebody and say, ‘Am I going to be OK?’” said Reynolds.

However, there are indications that many Canadians are trying to handle things themselves. The organization that regulates investment dealers, the Investment Industry Regulatory Organization of Canada (IIROC), noticed a big change during the first six months of this year. There was a significant uptick in do-it-yourself trading accounts, with 1.2 million Canadians opening up self-directed accounts, possibly trying to cash in on a down market.

"It's natural that people think they will make money off a particular product, but more often than not they have to ask themselves, ‘What can I afford to lose?’” said Lucy Becker of IIROC.

Some common mistakes made by DIY investors include: investing in complicated products and trading strategies; borrowing from lines of credit; letting fees eat away at investments and betting the farm and losing.

“It’s this time where they really need advice,” said Reynolds.

He says there are many major financial life decisions that can be difficult to navigate. Those include understanding when to shift investment strategies, how to get the most tax savings out of retirement investments, dealing with kids and college education, estate planning and much more.

Kubara said he was glad he had someone he could rely on during the tougher periods.

“We felt we were in good shape because we were staying in good communication with our financial planner as he’s reassuring us it will bounce back,” he said.

“Everything is so dynamic. We find we’re communicating on a very regular basis. In fact, almost monthly, we’re providing some form of information to our clients,” added Reynolds. “Much, much, more communication than probably in the history of our organization.”

There are also many online tools to help you with self-directed investment accounts, including robo-advisors, which can automatically rebalance portfolios based on risk tolerance. Usually, such services involve exchange traded funds – or ETFs – and have lower fees. However, when it comes to navigating bigger life issues, many Canadians like to lean on the professionals who can help guide them on a secure road to retirement.

“Where an advisor comes in handy is all those life decisions, and there’s going to be tons of them,” said Reynolds.