The trip and been bought and paid for, but two weeks before Eva Hall was to depart for Mexico she was in a major collision.

She suffered a concussion and back injuries.

"And I couldn’t walk on my foot and I thought oh my God this is getting worse and worse and worse," she said. "My daughter and granddaughter went on the trip."

And she was left behind dealing with her injuries and with Tugo Travel Insurance to get reimbursed for her portion of the trip.

“I wasn’t stressed as much from the accident as I was when I had to deal with all this paperwork,” she said.

Coverage wasn’t the issue. Trip cancellation because of her unforeseen accident was covered.

There was an essential piece of paperwork that she couldn't get. It was the original receipt from WestJet Vacations for the $6,000 that has been spent for the three travellers. Without it, Eva couldn’t get her claim processed.

"So make sure you keep all your receipts from your trip. You have to provide original receipts as part of the claims package at the time of claim," said Mike Starko, Tugo Travel Insurance's Chief Claims Officer.

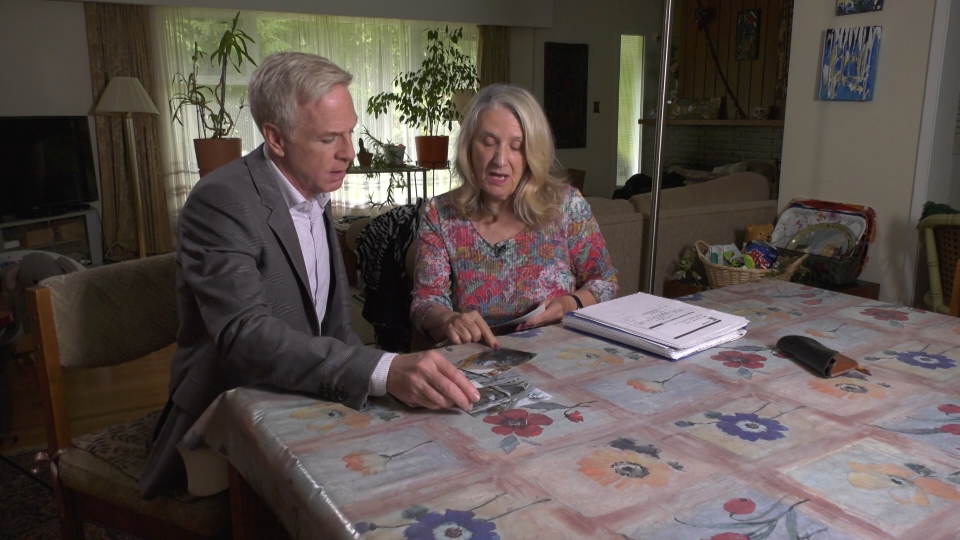

Hall says she called WestJet several times and got passed around. After several months she gave up and contacted CTV Vancouver’s McLaughlin On Your Side for help.

CTV News Vancouver contacted WestJet and the company spokesperson, Morgan Bell, responded immediately confirming that WestJet Vacations sent Tugo the original receipt.

He apologized for the delays that had been caused, writing "I hope that Eva is able to swiftly resolve the matter."

She wasn’t. When we followed up with her, she was even more frustrated because she says a Tugo customer service representative had told her that her claim may not get processed because too much time had passed.

“When somebody says to you, you only got 60 days,” she said, “That guy at Tugo really hurt me.”

There had been some kind of miscommunication.

“Typically what we advise is try to get your forms in within 60 days,” said Starko, “You have one full year to process your claim and to submit it.”

Filing a travel insurance claim can be complicated because it involves doctors, medical reports, other possible insurance you may have that could help pay and it can take time to get documentation from abroad.

Tugo sent Eva a personal letter apologizing for the lack of support and assistance from the agent, stating, and "Our goal is to make the claim process as easy as possible."

Tugo told CTV News it has since reviewed the telephone conversations Eva had with the company and says none of them mentioned a 60 day timeline. Tugo suggested she must have misunderstood.

Regardless, the company immediately resolved her claim and a cheque was sent in the amount of $2,426.26 to cover her portion of the trip that she couldn’t take.

“What I was trying to do in three months you did in two days. Thank you,” Hall said.

Tugo says 95 per cent of claims that it receives are processed without any issues.

“When a claim isn’t paid and that comes down to what the terms and conditions of the policy are and how travel insurance works,” said Starko.

He says to clearly read your policy, get your paperwork in order before you need to file a claim, keep it in a safe place and when you start the claim process it's important to fully complete all the forms that are requested.

If you do run into problems there is a process that you can follow to make sure you are treated fairly. Tugo is a member of the Travel Health Insurance Association and its members are bound to follow the Travel Insurance Bill of Rights and Responsibilities to offer confidence to Canadians who buy travel insurance.