A whopping $7.4 billion was laundered in B.C. in 2018, and about $5 billion of that was in housing, according to a new report.

The government said even that conservative estimate is more than anticipated and shows the scale of B.C.'s money laundering problem.

- Watch a recap of the of Thursday's press conference here

- Full report: Part 2 of Peter German's B.C. money laundering investigation

"These findings are stark evidence of the consequences of an absence of oversight, the weakness of data collection and the total indifference of government until now to this malignant cancer on our economy and our society," Attorney General David Eby told reporters in Victoria Thursday.

The numbers come from a study done by British Columbia’s Expert Panel on Money Laundering in Real Estate. It was just one of two reports released by the provincial government today, the other being "Dirty Money – Part 2" by former RCMP official Peter German.

- Scroll down or click here to see the full reports

According to Eby, German's report found hundreds of examples containing money laundering red flags such as people purchasing millions' worth of real estate without any apparent source of income for doing so. But German also found no agency or police force with both the jurisdiction and resources to adequately pursue these cases.

These included a case where a student purchased 15 condos in the same building for $2.9 million, the attorney general said. In other examples, German's report found a homemaker who had bought five luxury homes over three years for $21 million and a $3.5-million Gulf Island property acquired with funds allegedly embezzled from a $90-million loan fraud in India.

Eby said that even with limited time and resources, German found 494 different properties with between four and 29 mortgages registered and repaid rapid succession, and hundreds more where the owner's listed address is only a law firm or an off-shore financial centre, making it difficult to track down the true owner.

The panel estimates the impact of these kinds of activities on real estate to be a five-per-cent spike in prices.

"And remember, that's an average across the province, so certainly in areas where you would see more money laundering activity and higher prices of housing, you would have seen a higher escalation," said Finance Minister Carole James.

But that isn't the only cost of money laundering.

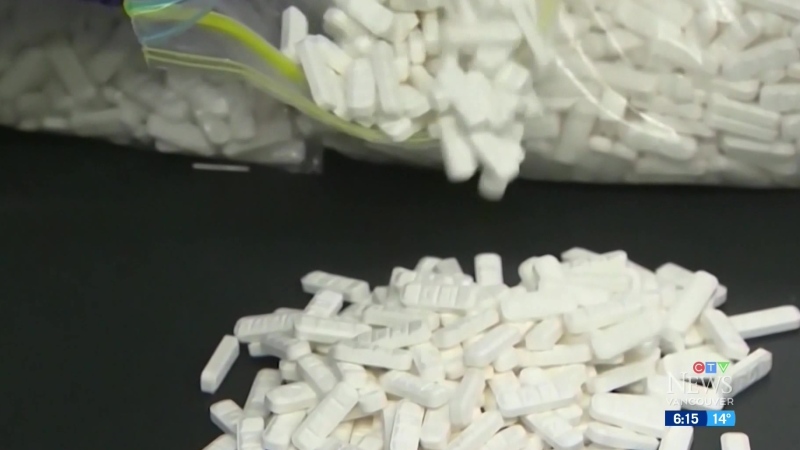

"Wealthy criminals and those looking to evade taxes have had the run of our province for too long, to the point that they are now distorting our economy, hurting families looking for housing an impacting those who have lost loved ones due to opioid overdose, a crisis so severe, it's impacting life expectancy data for British Columbia," Eby said.

The report notes estimating money laundering is different, but says its estimates are conservative. In 2015 the total estimate for B.C. is $6.3 billion growing to $7.4 billion in 2018. In terms of real estate the estimate is $5.3 billion in 2018 alone. Report authors were tasked with finding ways to tighten financial controls to prevent the crime.

Province vows to keep up the fight

B.C.’s beneficial ownership registry is a step in the right direction, noted the report.

A total of 29 recommendations were made, including more transparency, better paper trails and co-ordination with other jurisdictions.

One recommendation is to create Unexplained Wealth Orders which would allow for homes to be confiscated if an owner couldn’t show where the money to pay for it came from.

The German report outlined the red flags associated with real estate money laundering includes straw buyers, cash sales, private lending, unusual interest rates, flipping, quickly discharged mortgages, over and under-valued properties along with those who buy up numerous properties in a real estate shopping spree.

These aren’t necessarily evidence of money laundering, but a clue about what may be happening, according to report authors.

Private mortgage brokers have little visibility in the market according to the report. The report also found that nine per cent of residential properties or 90,000 properties may have private mortgages. Builders’ liens were found to be applied to homes to enforce illegal debts.

Approximately three per cent of straw buyers were students, homemakers or unemployed. 71,000 service addresses were post offices and the owners of $16.12 billion in property values had addresses outside Canada.

On Thursday, both Eby and James said the province will use the findings in its continued fight against money laundering.

"The party is over. It may be spring, but winter is finally coming for those who rely on bulk cash transactions in their businesses model, those hiding their identity from regulators and police while buying homes in our real estate market and those profiting handsomely from the death and misery of the overdose crisis," Eby said.

"Criminal profiteers distorting our provincial economy is not inevitable. While it may be our present, it is not British Columbia's future anymore."

Greens call for public inquiry

The BC Greens say the findings in the two reports reinforce the party's continued calls for a public inquiry into money laundering.

"We saw in German’s report a direct rationale for a public inquiry. Namely, that it would improve public awareness, play a crucial role in fault finding, and would help to develop full recommendations,” party leader Andrew Weaver said in a statement Thursday.

"The B.C. Green caucus has been calling for a public inquiry for months, as have thousands of British Columbians. It is time for this government to start a public inquiry so that the public can get the answers it deserves and B.C. can move forward."

"Dirty Money – Part 2" report also notes realtors are not required to report to FINTRAC, although the federal agency did get suspicious transaction reports from other reporting entities including banks.

Lawyers are vulnerable because they can hold trust funds for clients, and that’s a virtual black hole for police.

Partial releases of the second German report included revelations that no federal RCMP officers are specifically tasked with investigating money laundering, and that criminals were potentially getting tax refunds when using high-end vehicles to clean dirty cash. It also found vulnerabilities in the horse-racing sector but no major issues when it comes to money laundering.

German wasn’t asked to provide recommendations just findings.

The provincial cabinet is considering whether or not to call a public inquiry into money laundering amidst a chorus of voices asking for more answers about how the situation got so bad. Government said once it had the two reports released Thursday, cabinet would make a decision.

Full versions of both reports follow. Vieweing this on our mobile beta site? Tap here to see a compatible version.